Housing In Recession: Interest Rates Or Policy Uncertainty

Image Source: Pixabay

Treasury Secretary Bessent says housing is in recession because of high interest rates. Might not high policy uncertainty have some effect?

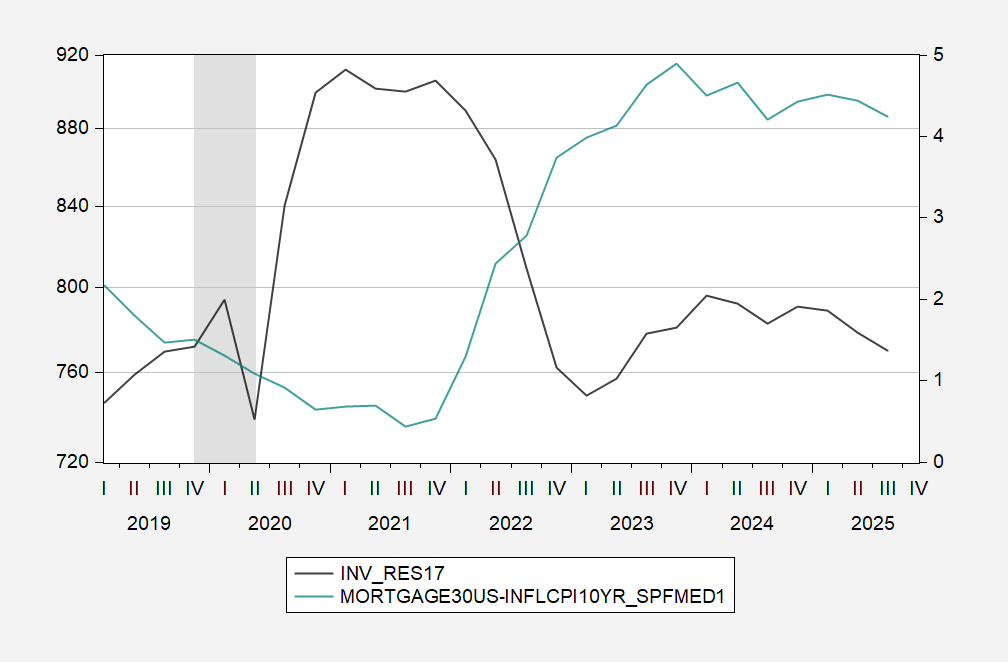

First, the 30yr mortgage adjusted by expected 10yr inflation:

Figure 1: Real residential investment, in bn.Ch.2017$ SAAR (black, left scale), 30 year mortgage rate adjusted by 10 yr SPF median inflation, in % (blue, right scale). 2005-2012 data is in Ch.2012$, rescaled into Ch.2017$. Q3 real residential investment is nowcast from GDPNow. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Fannie Mae via FRED, Philadelphia Fed, NBER, and author’s calculations.

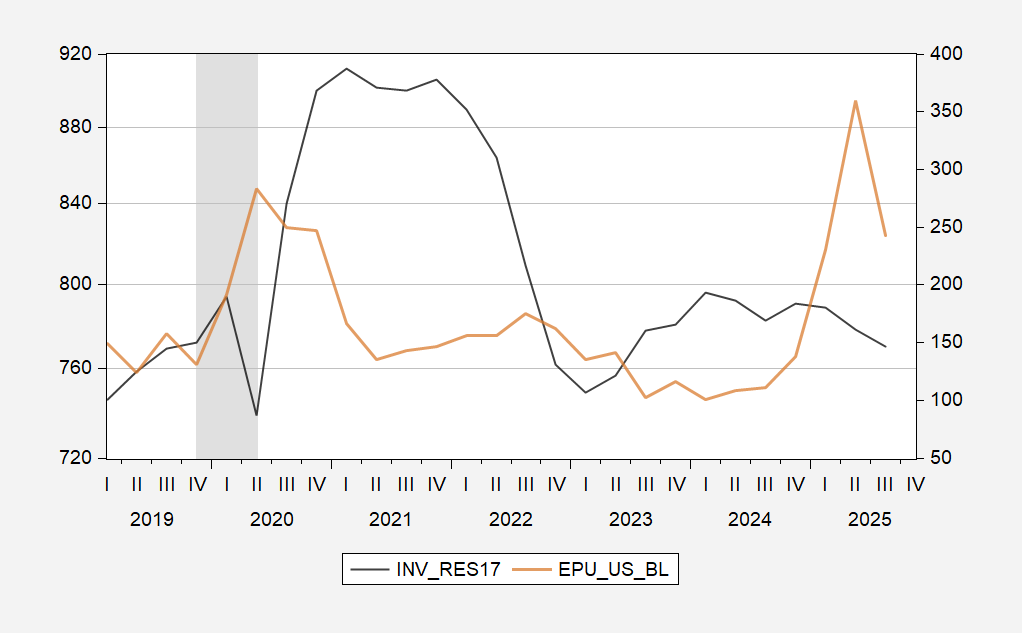

Now compare against Economic Policy Uncertainty (baseline):

Figure 2: Real residential investment, in bn.Ch.2017$ SAAR (black, left scale), Economic Policy Uncertainty, legacy series (tan, right scale). 2002-2012 data is in Ch.2012$, rescaled into Ch.2017$. Q3 real residential investment is nowcast from GDPNow. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Fannie Mae via FRED, Philadelphia Fed, NBER, policyuncertainty.com, and author’s calculations.

Seems to me that policy uncertainty is at least as plausible as an explanation for the decrease in residential investment as high interest rates.

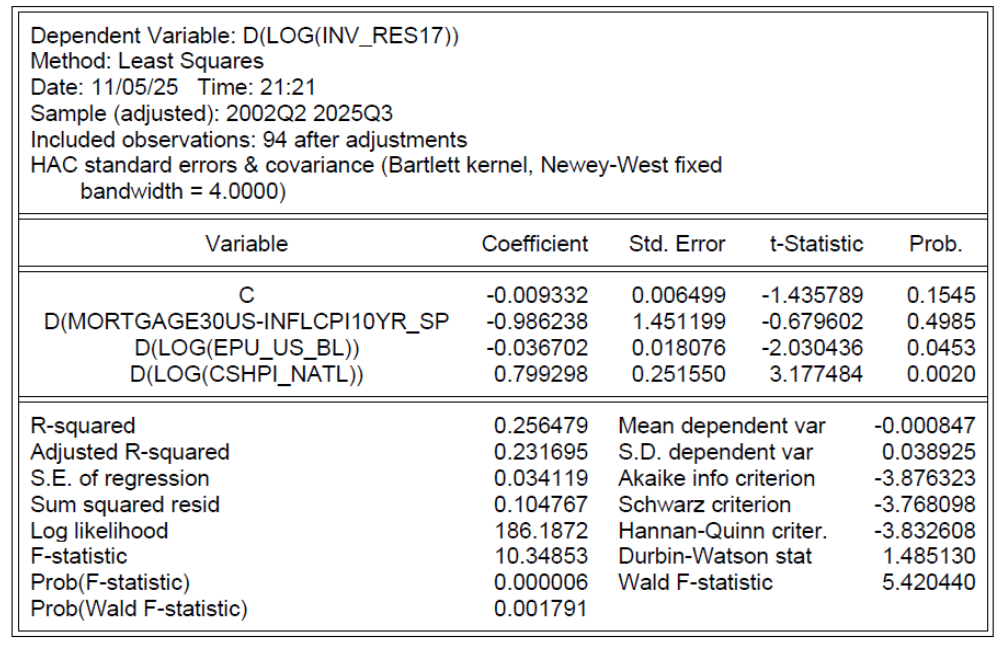

To verify this, I estimate a regression over the 2005-2025 period, in first differences, relating growth in real residential investment to changes in the real interest rate and EPU, and appreciation in house prices (from Case-Shiller national house price index).

I estimate the relationship in first differences because residential investment and house prices are unit root processes.

How to assess the relative importance of real interest rates vs. policy uncertainty? I refer to standardized coefficients, aka “beta” coefficients. The coefficent for policy uncertainty is twice the magnitude of that for the real interest rate (although the largest coefficient is for price appreciation): -0.08 vs -0.17 vs. 0.46. To the extent that house price appreciation depends on interest rates, the real interest rate effect could be larger.

More By This Author:

ADP Private NFP And Implied BLS NFPLabor Market Indicators Amidst The Shutdown

CA, NY, And The Nation: GDP Vs. Employment