Zenith Bank Continues To Perform Well

This article serves as an update to my article late last year on Zenith Bank (NL: ZENITHB, LSE: ZENB). The stock price is up by more than 80% since the publication of the article and exceeded the targeted return of 35%, excluding the dividend, by a substantial margin. The question if there is still more value in this bank therefore almost invariably arises.

In essence I still consider Zenith to be amongst the best Nigerian Banks and a good longer-term investment. I am, however, somewhat more cautious about its share price performance for 2018 and have a target price of NGN 28.65.

Asset Quality and Capital

The bank’s NPL ratio increased by 188 basis-point YoY to reach 4.2%. This remains well below the average NPL ratio for the Nigerian banking sector as a whole of around 12%. The 188-basis point increase, however, came in above the 150-basis point increase in NPLs I had factored into my previous analysis.

Its aggressive NPL recognition in the First Half of 2017 should nevertheless reduce the risk of a substantial increase in NPLs in 2018. It may also be to early to conclude that the worst of the asset quality issues for Nigerian banks has passed but NPL formations certainly showed signs of slowing in the Third Quarter. Zenith’s NPL ratio in fact declined by 10-basis points QoQ in the Third Quarter which was the first decline in its NPL ratio since the onset of the Nigerian Economic crisis.

Its NPL coverage ratio at 110.3% is also reasonable in addition to the fact that it requires customers in the oil and gas sector with loan balances outstanding to hedge against price risks. These hedges have assisted these clients to maintain profitability whilst also protecting Zenith from some of the adverse effects of lower oil prices.

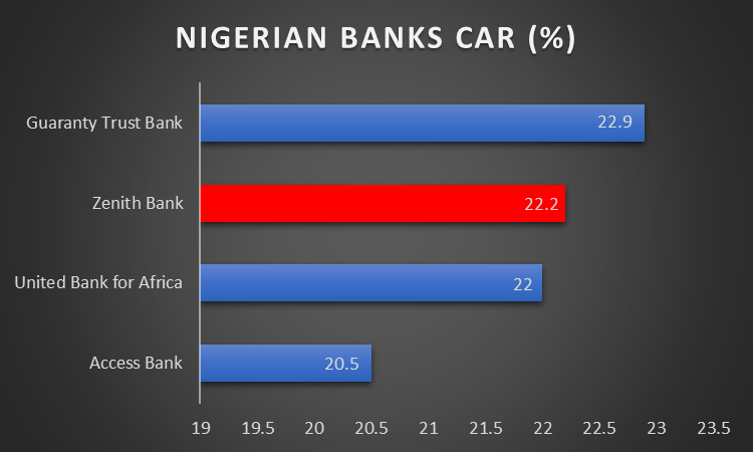

Zenith’s Capital Adequacy Ratio (CAR) at 22.2% also remains amongst the highest in the Nigerian Banking sector. It is also comfortably above the regulatory minimum required CAR of 15% for domestically systemic important banks and banks with international authorisation. Strong capital levels reduce the risk of a dilutive equity raise. The bank will, however, continue to retain a large portion of earnings in order to strengthen its capital position whilst its expanding rapidly across the African continent.

(Source: Company Fillings)

Despite increasing its retained earnings, the bank is expected to deliver a dividend yield of 9.5% for the full year. Investors should not, however, be lured in by the dividend yield alone as an investment in a Nigerian bank is certainly riskier than most other stocks dividend investors ordinarily invest in.

Earnings and NIM

Zenith reported a 37.5% YoY increase in total revenue for the first nine months of 2017 which was strongly supported by a 53.45% increase in fees & commission income and a 398.53% increase in trading income. The substantial increase in trading income came about largely as a result of increased FX liquidity available in Nigeria and more interest in investing in treasuries by the bank’s customer base. Growth in this area of the bank is likely to be much more modest in 2018.

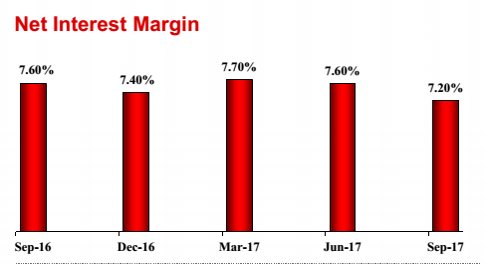

A 115% increase in loan loss provision charges had a negative impact on the bank earnings but loan loss provisions should moderate going into 2018. All in all, Net Profit after tax increased by around 35% YoY for the first nine months of 2017. The bank’s Net Interest Margin (NIM) declined by around 40-basis points YoY which was broadly in line with expectations. Its NIM could possibly decline further in the last quarter of the year but will likely stabilise towards the middle of 2018 as Nigeria’s economic prospects have improved.

(Source: Zenith Bank Investor Presentation)

The Reserve Requirement Ratio (RRR), the proportion of deposits that the bank must hold as cash on hand, remains at 22.5%. The Nigerian banks are unlikely to see a reduction in the RRR as long as inflation remains elevated. If the recent more positive economic trends should, however, persist it is possible that the banks could see a reduction in the RRR towards the end of 2018 or the beginning of 2019. A reduction in the RRR, and the resulting liquidity boost, could have a substantial impact on the bank’s NIM. The bank is currently more focused on asset quality, however, and would be unlikely to utilise any benefit from a reduced RRR in the unlikely event that such a reduction arises earlier than expected.

Valuation and Conclusion

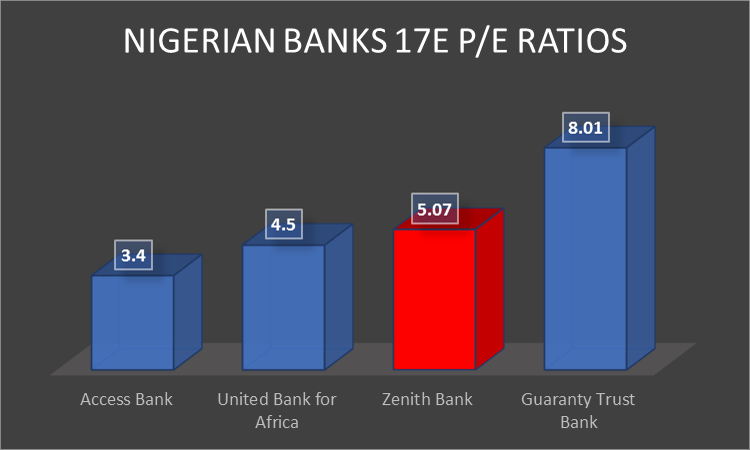

Zenith is trading at 5.07 times expected earnings for the full year which is below its 5-year average of around 6. It is, however, the second highest of the four major Nigerian banks considered in the charts below.

(Source: Reuters)

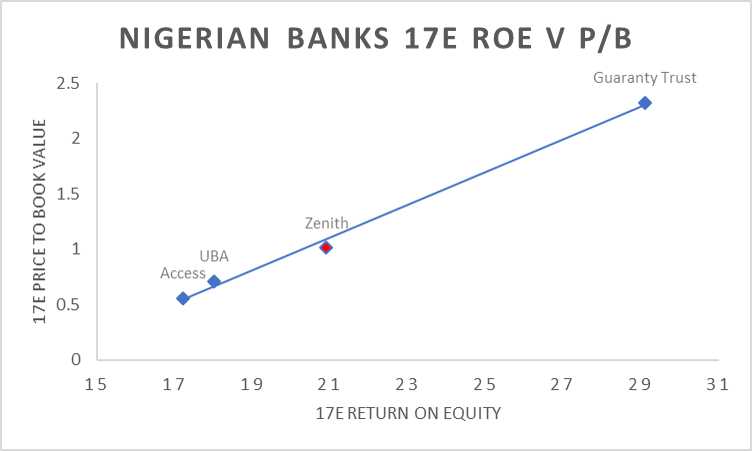

If, however, comparing Zenith’s Return on Equity (ROE) to its price to book value (P/B) relative to that of its peers it becomes apparent that the stock is not trading at a premium to that of its peers.

A P/E ratio of about 5 also seems massively cheap in comparison to other banking stocks in the US for example and even South Africa. The increased risk in the Nigerian market, however, warrants a certain discount and it cannot therefore be expected that its share price should trade near that of its US or South African counterparts. The bank also remains a good long-term investment, in my view, though the substantial increase in its share price over the course of 2017 will likely limit short term upside potential.

Louis, this is an interesting find although not without risk. Did the price pop so much because there was some financial uncertainty about its viability before?

Thank you for the feedback. I certainly agree that an investment in a Nigerian bank carries higher than normal risk. The concern over viability in 2016 was not related to Zenith per se but rather to the Nigerian banking sector as a whole. What drew my attention at Zenith in 2016 was its strong asset quality at a time when the Nigerian banking sector saw NPLs reach 11%. As noted, I am less optomistic about its share price performance for 2018.