WTI Lifts Off One-Week Lows After API Reports Bigger Than Expected Crude Draw

Image Source: Unsplash

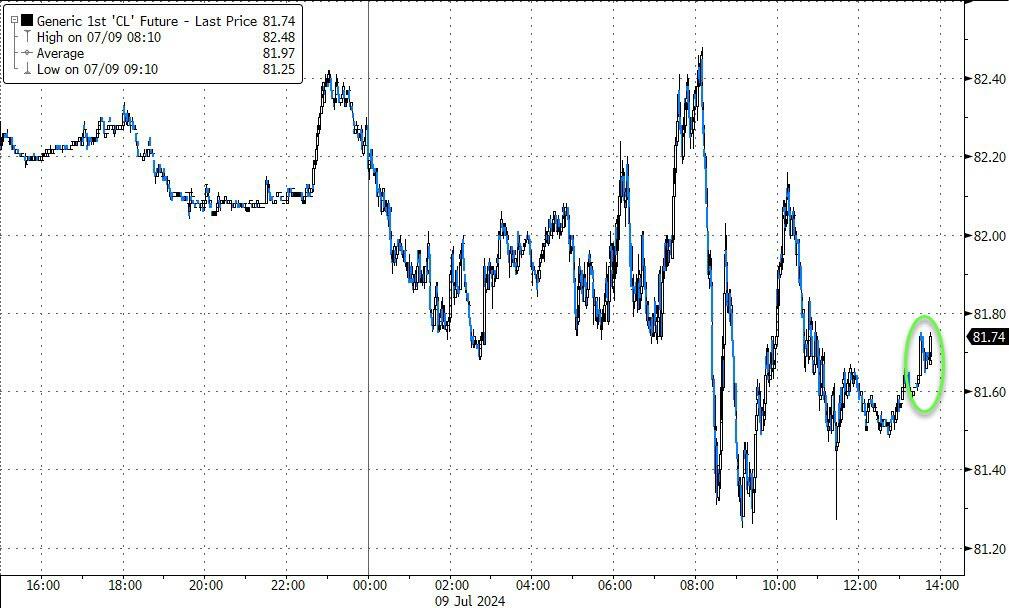

Oil prices dropped today as traders hung on every word from Fed Chair Powell prompting some wild intraday swings.

Earlier, prices traded above $82 a barrel after Powell said the labor market has “cooled considerably,” but further comments that avoided sending signals about imminent rate cuts caused markets to give up previous gains.

Crude markets are in a “nervous trade”, said Dennis Kissler, senior vice president for trading at BOK Financial Securities, ahead of Thursday's CPI data.

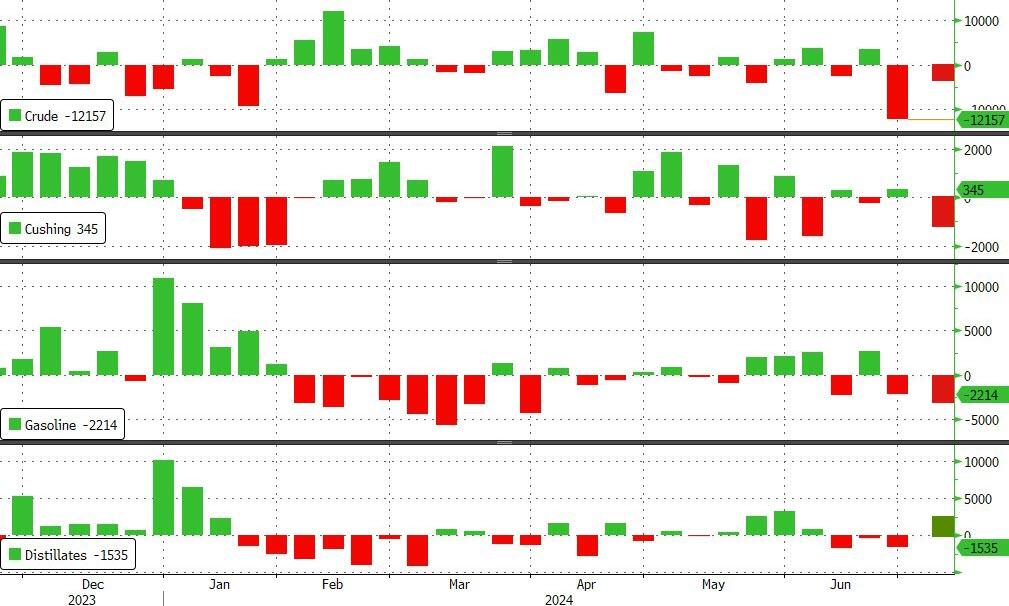

API

-

Crude -1.9mm (-1.3mm exp)

-

Cushing-1.2mm

-

Gasoline -3.0mm

-

Distillates +2.3mm

Crude stocks fell more than expected last week according to API and gasoline inventories also fell for the second straight week...

Source: Bloomberg

WTI rebounded off one-week lows after the bigger than expected crude draw (but remains lower on the day for now)...

Adding to bearish sentiment, the oil hub of Houston made it through the worst of storm Beryl and reported progress on recovery efforts.

On the bullish side, Russia’s crude exports in the week to July 7 slumped the most since before the 2022 invasion of Ukraine, according to vessel-tracking data compiled by Bloomberg.

There was no clear reason for the sudden weekly drop, but shipments fell from the major ports.

Forecasts for higher fuel consumption throughout the Northern Hemisphere’s summer have supported prices, though slumping supertanker earnings are a reminder of ongoing concerns about Chinese consumption.

More By This Author:

Crypto Bid, Crude Skids, Stocks & Bonds Sluggish As CPI Looms

Robusta Rockets To 16-Year High After Major Grower Vietnam Records Export Plunge

US Farmers Hoard Corn Like It's 1988

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more