Crypto Bid, Crude Skids, Stocks & Bonds Sluggish As CPI Looms

Image Source: Pixabay

Somehow, Small Business Optimism rose in June (for the third straight month) to its highest since Dec 2023 despite aggregate economic data collapsing dramatically, PMIs plunging, and even The Fed admitting the labor market is tightening. Doe this look normal? We saw a decoupling of this sort in June 2021 after which small business optimism collapsed to fresh cycle lows...

Source: Bloomberg

Powell was his ubiquitously neutral self with maybe a slight dovish tilt lifted rate-cut expectations rising modestly on the day...

Source: Bloomberg

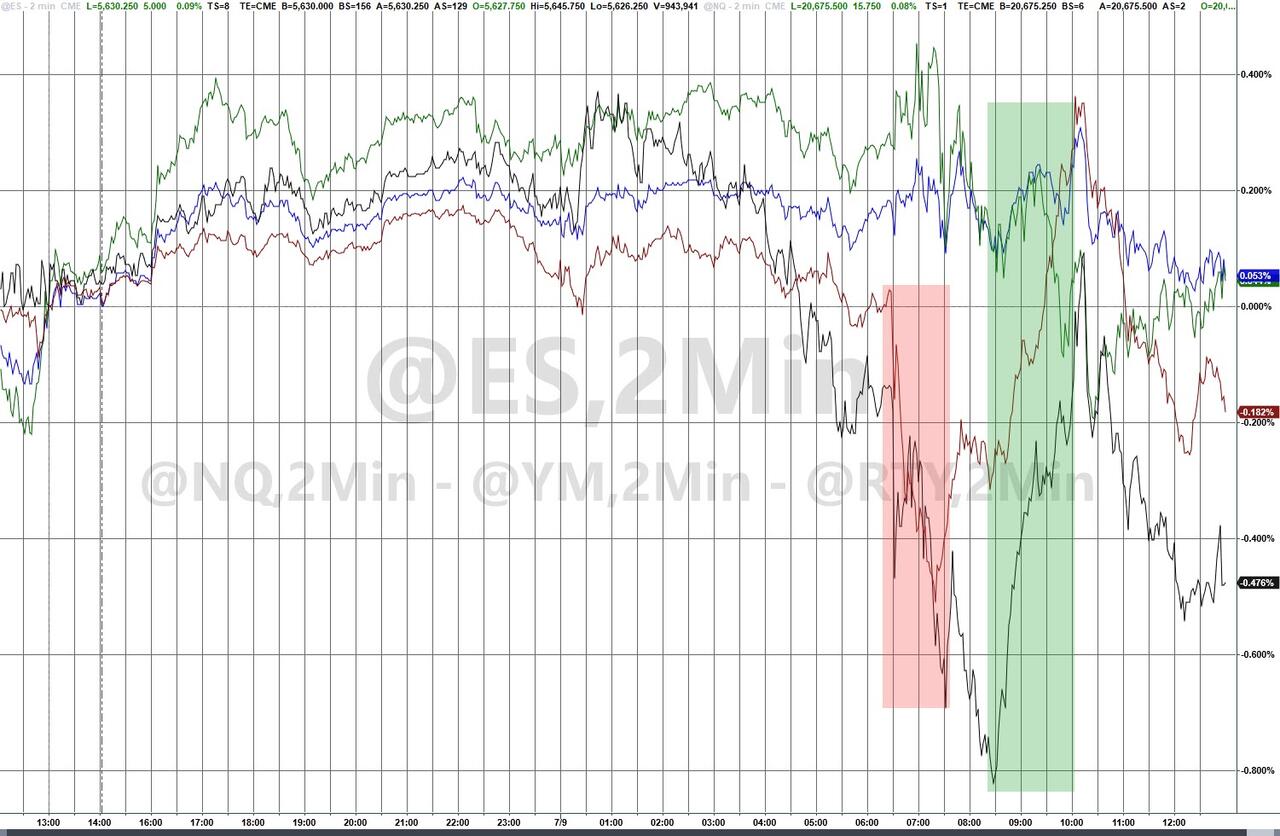

Small Caps lagged on the day with The Dow also sliding into the red. Some very choppy trading intraday - with the new normal intraday reversion of trend (very long gamma). The Nasdaq and S&P were basically unchanged...

Goldman Sachs trading floor notes that overall volumes were down (-11% vs the 20dma) nothing this is a function of:

1) little micro news flow,

2) non-existent index volatility (see VIX hovering near multi year lows),

3) and investors prepping for earnings.

Traders noted investors tracking slightly better to buy (+39bps) with both HF’s and LO’s leading the way, though volume feels relatively light tracking down -115 vs the 20dma. Top of book stands out for the second day in a row, tracking +46% vs the trailing 20days.

-

Both LOs & HF’s are active on the buyside in Tech, + Cons Discretionary.

-

HFs are better for sale across Fins and Industrials.

-

Lots of focus on Software… Client activity relatively quiet today across the space & dispersion of performance relatively low… possibly suggesting top-down pressure on the space vs. aggressive selling of single stocks.

But 1-month implied correlation remains dramatically low...

Source: Bloomberg

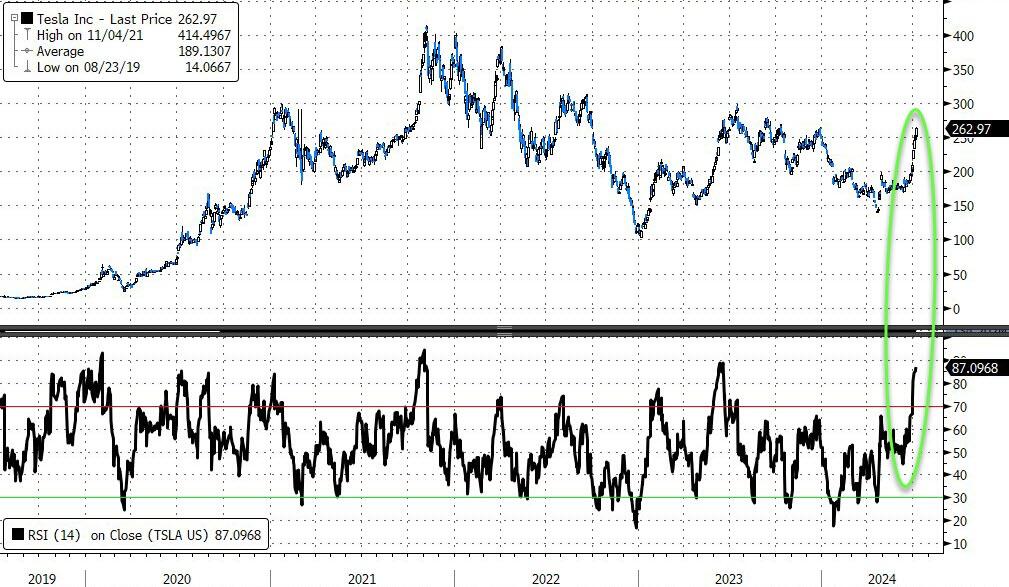

Tesla (TSLA) keeps soaring/squeezing higher with an RSI of 87 now...

Source: Bloomberg

Treasury yields basically trod water again today with the long-end very modestly underperforming (30Y +3bps, 2Y unch). This pulled the entire curve higher on the week - though very marginally...

Source: Bloomberg

Bitcoin surged back above $58,000 today after yesterday's large ETF inflows...

Source: Bloomberg

The dollar limped higher today but again in a narrow range...

Source: Bloomberg

Gold did the same as the dollar, inching higher in a narrow range...

Source: Bloomberg

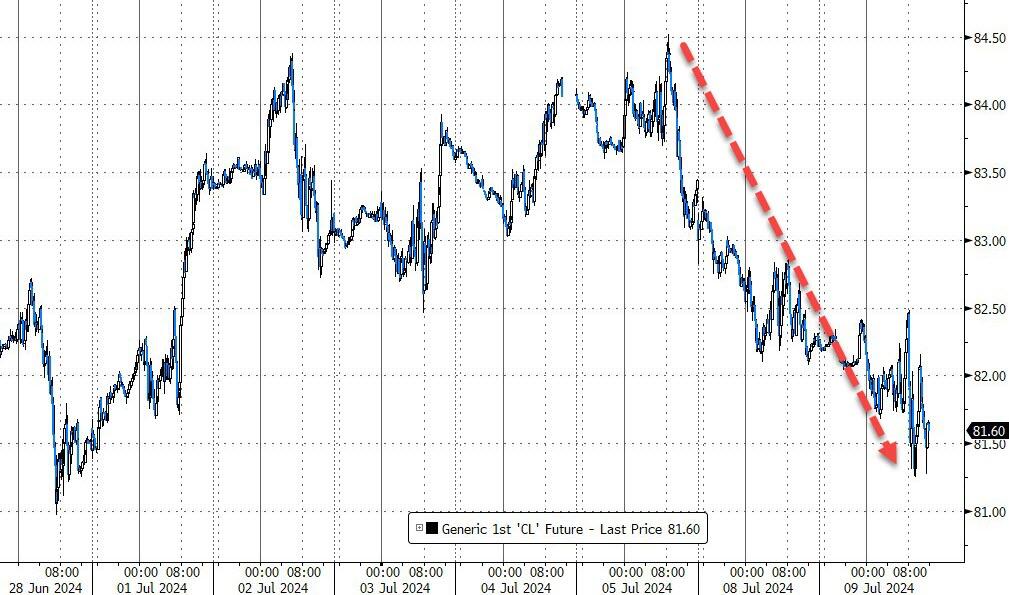

Crude prices slipped to one week lows...

Source: Bloomberg

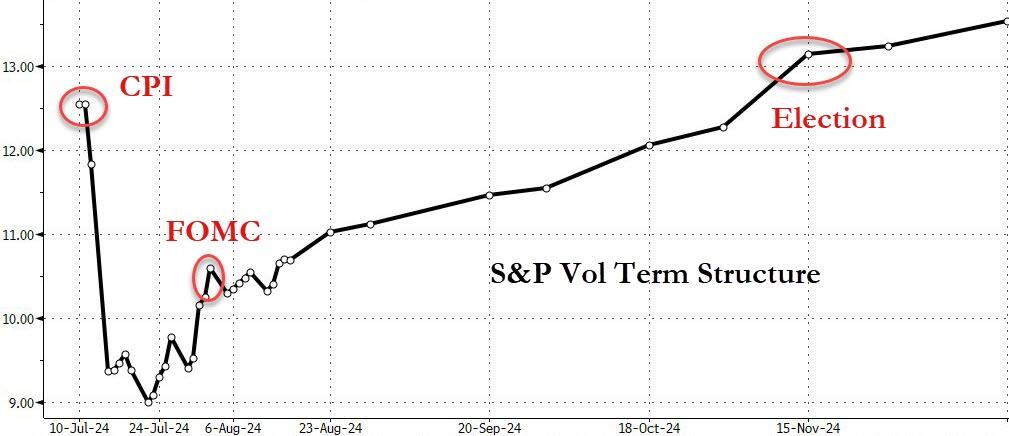

Finally, the options market is pricing in some actual volatility in the next couple of days as Powell speaks and CPI strikes on Thursday. After that, traders expect everything to calm down again until the July FOMC...

Source: Bloomberg

Will CPI satisfy Biden's needs?

More By This Author:

Robusta Rockets To 16-Year High After Major Grower Vietnam Records Export PlungeUS Farmers Hoard Corn Like It's 1988

Tesla's Furious Rally Is Another Massive Short Squeeze

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more