WTI Holds Gains After API Reports Crude/Cushing Builds, Distillates Draw

Image Source: Unsplash

Oil prices managed gains today as MidEast risks trumped hawkish sentiment (and may even have been helped by a rise in rate-cut expectations as banking crisis fears reawakened).

The EIA report - saying oil inventories will fall and so will US production - also supported price action today.

Prices pared gains and even briefly declined after Qatari Prime Minister Sheikh Mohammed Bin Abdulrahman Al Thani said at a news conference that Hamas’s response in negotiations over a ceasefire with Israel has been “positive.”

But, as we note below, trading was very choppy today.

API

-

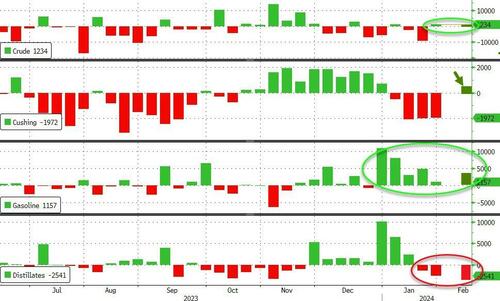

Crude +674k (+1.3mm exp)

-

Cushing +492k

-

Gasoline +3.65mm (+300k exp)

-

Distillates -3.7mm (-2.0mm exp)

Crude inventories rose very modestly for the second week in a row. Cushing saw stockpiles rise after 4 weeks of draws. Gasoline stocks built for the 6th straight week and distillates drew-down for the 3rd week...

Source: Bloomberg

WTI was trading around $73.50 ahead of the print and was basically unchanged after...

As the chart below shows, the day-session trading was extremely choppy as trend-following algos took control

“Current price action is instead consistent with CTA buying activity across both WTI and Brent crudes, as rangebound trading activity whipsaws trend signals once again,” Daniel Ghali, a commodity strategist at TD Securities, wrote in a note to clients.

In its influential monthly Short-Term Energy Outlook, the EIA said it sees inventories dropping by 0.8-million barrels per day during the current quarter, supporting prices. As well, it sees US oil production dropping off a record.

"We forecast production will return to almost 13.3 million b/d in February but then decrease slightly through the middle of 2024 and will not exceed the December 2023 record until February 2025," the outlook noted.

More By This Author:

Standard Chartered Sees Ether HItting $4,000 By May, When Ethereum ETF Is Approved

Bonds, Bullion, Banks, & Bitcoin Battered As "Good News Is Bad News" Again After Powell

Key Events This Week: CPI Revisions, ISM, And SLOOS

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more