Bonds, Bullion, Banks, & Bitcoin Battered As "Good News Is Bad News" Again After Powell

Image Source: Unsplash

Hotter than expected Services surveys - with a big jump in prices - was just the good news the market did not want to hear. Though no ZeroHedge reader should be surprised by this resurgence in economi 'animal spirits' - it is merely the lagged response of an economy that was fed a massive loosening of financial conditions late last year...

Source: Bloomberg

As we saw a lot of last year: bad news is good and good news is bad, at least when it comes to trading a soft landing and the odds of rate-cuts in the short-term tumbled...

Source: Bloomberg

Unsurprisingly, this morning's data, Chair Powell's comments, along with the strong payrolls report, generally strong macro data points, and largely constructive earnings reports we have seen recently, are all combining in a step higher in 10-year UST yield, breaking out decidedly above 4.00%...

Source: Bloomberg

The entire curve was higher by 11-15bps today...

Source: Bloomberg

And higher rates hammered stocks...until they didn't. Stocks initially puked, only to revert dramatically higher (with Nasdaq getting back into green). Small Caps were clubbed like a baby seal today, as was The Dow, while Nasdaq couldn't quite hold green into the close...

...thanks to a notable short-squeeze off the initial dump lows...

Source: Bloomberg

Interestingly, 0-DTE traders tried twice to fade the gains in stocks...

Regional bank stocks closed red again with NYCB hammered...

NVDA extended its insanely vertical recent rise after Goldman upgraded the AI giant. This pushed the RSI to massively overbought at 85...

Source: Bloomberg

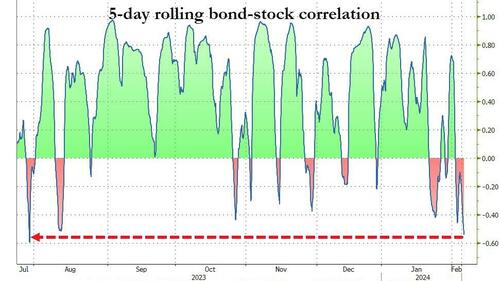

Recently, bonds and stocks have been moving very differently. Today saw bond yields and stocks close at their highs of the day...

Source: Bloomberg

Here's why...

The higher 10Y yields go, the more demand for AI chips so bank ChatGPT algos can explain to idiot retail why soaring rates are great for you https://t.co/9zsRMvXxEE

— zerohedge (@zerohedge) February 5, 2024

With bond-stock correlation crashing to its lowest level in months...

Source: Bloomberg

The dollar extended gains today, rallying up to its 100DMA to its highest in 3 months (after bouncing off its 50DMA and breaking thru its 200DMA)...

Source: Bloomberg

Gold slipped to one week lows, but spot found support at $2020...

Source: Bloomberg

After falling back into January's range, oil managed small gains today with WTI testing above $73 briefly...

Source: Bloomberg

Bitcoin surged overnight, back above $43,500 before plunging back to earth after headlines about bankrupt crypto-lender Genesis Trading filed a motion to liquidate over $1.6 billion in crypto...

Source: Bloomberg

Ethereum outperformed Bitcoin today, trading up to $2300...

Source: Bloomberg

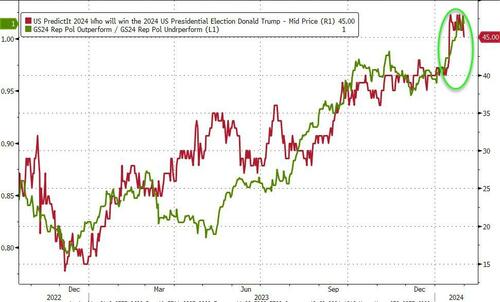

Finally, is the market pricing in a Trump victory?

Source: Bloomberg

Based on Goldman's Republican winners vs losers basket performance, it appears stocks are moving in sync with Trump's odds.

More By This Author:

Key Events This Week: CPI Revisions, ISM, And SLOOSISM Services Accelerates, But Prices Surge Most In 11 Years

Forget AI Bubble. A New One Emerges As Space Firms Prepare For IPO Launchpad

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more