WiMi: Valuing A Company Diversified In Many Industries

WiMi Hologram Cloud Inc. (WIMI) is an Augmented Reality (AR) company based in Beijing, China. The company specializes in holographic content designed to enhance reality in 3-D. WiMi started with its AR advertising and AR entertainment segment when it went public on April 1st, 2020. According to Frost & Sullivan, the holographic AR application platform that WiMi currently operates covers the broadest types of holographic AR offerings in China.

Shortly after the company became public on the Nasdaq, it acquired a semiconductor business. This segment seems completely different from its main business. However, WiMi began to develop its semiconductor business and explore the relevant applications of holographic 3D vision in the semiconductor industry starting July 2020.

The company is highly diversified in many industries including advertising, entertainment, and semiconductors. These industries make WiMi a diversified company, even though its main activities are based on AR technology. Therefore, WiMi has different growth rates and gross margins for each segment. For the purpose of this valuation, each industry has been analyzed.

Currently, advertising is the biggest consumer of AR.

The advertisement industry is not going away anytime soon. The United States is thriving in this industry and so is China. Through holographic vision presentation, holographic interactive software development, holographic online, offline advertising, and holographic payment, WiMi has become a leader of AR advertising in China. China has a large number of Internet users and mobile Internet users, making AR advertisements very attractive to advertisers. In addition, stores offering AR experiences are penetrating rapidly into China’s shopping malls. Consumers can enjoy the AR experience at a low cost, which has promoted consumers’ acceptance of AR. Sponsored filters inside social network apps will also rise due to the boom of short video apps in China.

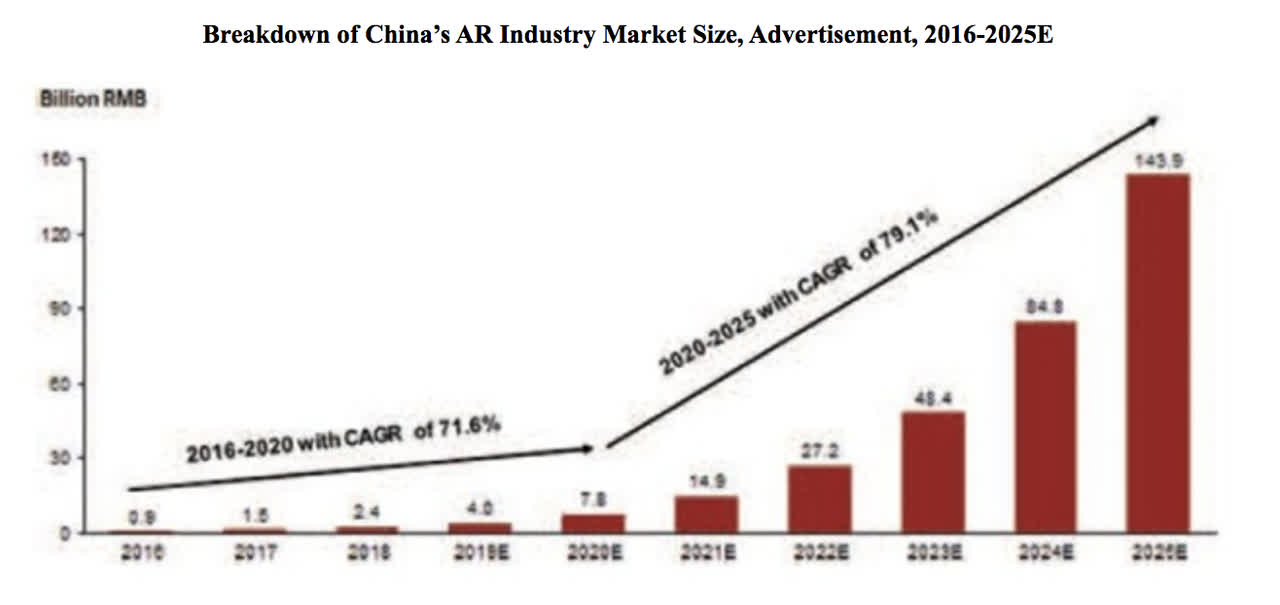

According to Frost & Sullivan, the market size of AR advertisement was estimated with a compound annual growth rate of 71.6% (see exhibit 1), much higher than the growth of the total online advertising market. As AR technology keeps evolving to satisfy the advertisers’ growing need, AR is expected to be largely used in most advertisements. According to Frost & Sullivan, the market will be valued at RMB 143.9 billion (USD 22.1 billion) in 2025 with a CAGR of 79.1% (see exhibit 1), indicating a larger market share in the total online advertising market in the next five years. Also, digital ad spending will overtake traditional ad spending by 2021, which may give the opportunity to AR companies to develop their ad products throughout the smartphones and TV networks.

Exhibit 1 (Source: Frost & Sullivan)

The AR advertisement segment revenues from WiMi increased by 47.6% from 2018 to 2019 and by 14.9% from 2019 to 2020. Even if the growth slowed down in 2020, I expect the company to draw revenues from a higher demand from advertisers this year. WiMi’s gross margin on its AR advertisement segment was 47.4% in 2019 and 31.2% in 2020.

AR Entertainment will soon surpass the AR Advertising industry

Entertainment, including gaming and video, takes a huge share of the AR sector as well. It is expected to have a higher growth rate than the AR advertising segment in the future. Driven by the availability of AR, improvement in smart phone performance, and the prospect of the gaming industry, AR entertainment is expected to have a promising future. China’s per capita expenditure on education, culture and recreation is predicted to grow at a CAGR of 8.2% from 2018 to 2023. This will bring more customers wanting to achieve a higher quality for video games and AR in gaming will move towards interactive games involving multi-players. Holography will be applied in more live shows, from PC games in the arena to concerts.

According to Frost & Sullivan, the market size is expected to be RMB 180 billion (USD 27.6 billion) by 2025, indicating a CAGR of 92.6% (see exhibit 2), and surpassing advertisement to be the biggest application scenario of AR.

Exhibit 2 (Source: Frost & Sullivan)

Last year did not live up to the expectations of this segment. WiMi reported a -42.4% loss in revenues from the AR entertainment segment, whereas, from 2018 to 2019, WiMi's AR entertainment segment grew by more than 17.3%. This segment mainly relies on consumer spending and “acceptance” of AR in video games and movies. Even if the pandemic led to the decline in this segment, I expect holographic content to be a worldwide innovation in the coming new entertainment products. Also, this segment has a gross margin advantage. It was 89.4%, both in 2019 and 2020. Even if sales are not up to the expectations, the margins made on this segment is an asset to WiMi.

Semiconductors is the main revenue source for WiMi

From 2019 to 2020, WiMi’s revenue increased from RMB 319.1 million (USD 45.8 million) to RMB 766.0 million (USD 117.4 million). This is a 140% growth over the period, thanks to the semiconductor segment. In 2019, the company's revenues came from the AR advertising branch with 83.8% of revenues compared to the AR entertainment branch bringing 16.2% of revenues. In 2020, the company's revenues mainly came from the semiconductor branch with 56.0% of revenues compared to 40.1% for AR advertising and only 3.9% for AR entertainment. WiMi believes that the application demand for holographic 3D vision in the semiconductor industry is growing rapidly and represents promising market potentials.

The company is very vague on the application of this segment and the place it has for its business. Nevertheless, it seems like during a low supply of semiconductors, being involved in this segment is an opportunity. It also means that WiMi integrated vertically to produce its own semiconductors without being dependent on suppliers.

In 2020, the semiconductor segment represented 56.0% of the revenue and it had a 10.9% gross margin. The gross margin is not as high as the other two segments but potential is definitely laying in this segment. With a limited supply and a high demand, prices may go higher in the next few years and will increase the margin.

The future AR applications for WiMi may also add industry diversification

The application of AR is broader than what most people think. Application scenes include holographic cinemas, holographic education, holographic exhibition and display, holographic retail, holographic high-end home applications, holographic communication, holography in robots and artificial intelligence, NFTs and so on. The expected 2025 Chinese AR distribution market of RMB 454.8 billion (USD 69.0 billion), as seen on exhibit 3, will be composed of 39.6% towards entertainment, 31.6% towards advertisement and 14.8% towards education. The other market segments include household services with 5.3%, travel with 3.0%, and retailing with 5.0%.

Exhibit 3 (Source: WiMi)

Other segments are not taken into consideration in this valuation because WiMi is not involved in businesses involving other industries yet. However, investors need to keep an eye on the optionality and product developments into multiple other promising industries. AR can be utilized in many different industries that each have different expected growth and margins.

Sales Franchise Share Valuation

Even if WiMi made some profit in 2019, the company reported a negative net income in 2020 (exhibit 4). Without meaningful profit in sight and since WiMi is a relatively new company, it is not realistic to value WiMi’s shares with earnings or cash flow estimates.

Exhibit 4 (Source: Bloomberg)

Based on the relative importance of sales growth over margin, I decided to use a sales-based model as follows:

Revenue growth is expected to fluctuate widely year to year, depending on consumer spending and acceptance of AR. With a consensus of a 68.77% growth in 2021 and a 15.00% growth in 2022, a margin of error needs to be taken into consideration (see exhibit 5). This is why I selected a different revenue growth for each segment to determine an average for the share price. The revenue growth is in the 38%-46% range for the AR advertising segment, 40%-48% range for the AR entertainment segment, and 32%-40% range for the semiconductor segment.

Exhibit 5 (Source: Bloomberg)

The discount rate has been set at 11%. The gross margin estimates for the AR advertising segment has a range of 38%-44%, the gross margin for the AR entertainment segment has been set at 82%-88%, while the gross margin for the semiconductor segment is 18%-24%. These estimates of the future gross margins are reflecting the current trend in margins for each segment.

Exhibit 6, 7, & 8 (Source: Author’s Calculations)

Given the various forecasts and by adding up each segment, the fair value P* for WiMi ranges, theoretically, from $9.2 to $10.8. If you agree with my estimates, the SFV valuation model computes a fair value average of $10, which makes WiMi shares undervalued at the moment.

Takeaways

With a lot of industry diversification, WiMi presents an opportunity to invest in a Chinese growth company. The AR industry is a futuristic technology worth catching investor’s interests. The acceptance of AR is key for the future growth of the company and the development into potential new industries would add diversification to the company. WiMi may be undervalued with a valuation range of $9.2-$10.8.

I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.

My first response did not consider any hostilities or any government affecting the business. Certainly those would alter the curve, possibly a lot. In addition the recent unlisting action will make some changes that may be unfortunate.

So certainly what is coming next will be interesting.

We will need to watch this closely. I will definitely write another piece in case of a significant event like this.

Good article, BUT that projected very strong growth of the AR Segment looks way to much like typical "CEO SUNSHINE", the sort that CEOs are paid to produce. So the slope may well stay shallow, especially if this plague does not die out. So while this company looks good, the predicted growth includes the whole realm, not just tthis one company. Clever indeed, but deliberately misleading.

I can see your point but I would worry more about the global (mainly led by US) move against China. COVID will go away but the attacking China just started.

Thank you for bringing this company to our attention. I would say that it is hard to value the stock because it is difficult to know how the company is actually performing. Who are their competitors in China? What are their market entry barriers? Since this is a Chinese company, who are their major shareholders? It would be interesting to know if they have plans to take their technology and market expertise outside of China. Looking at their stock chart we see that the stock is where it was about 15 months ago, though it flirted briefly with $16, it is trading back in the $5 range. As a young company selling technology in a new and growing market, it should be worth at least twice its current price. Still, as with many Chinese companies, the lack of true transparency makes doing such valuations difficult.

Thank you for the read and comment. Although the lack of transparency makes this valuation difficult, WiMi is known to be the leader of AR in China. This year is going to be very important for the company. I would do another valuation piece if their sales become international. As for the stock, it is not receiving enough attention in my opinion. This technology is growing fast and a specialized company like WiMi is hard to find.

A really well done article, although I think WIMI's fair value should be higher than $10 to worth the China risk.

I agree, the China risk is elevated. However, the diversification of the company in multiple industries helped this valuation to be around the $10 level. Thank you for the read and comment Dr. Ma!

I can see your argument. But for a young high growth company, is diversification investors are looking for (to buy the stock)? I like @Edward Simon's questions a lot. You should have answers for most of his questions.

Thank you for the advice and I agree with you. Investors are not specifically looking for WiMi's diversification but for its sales growth potential, technology advances, and the position it has developed in the Chinese AR industry.

Interesting, thanks for the share.

Thank you for the read and comment!