Will Russian Gas Flow Back To Europe? Peace Talks Spark Speculation

Image Source: Unsplash

The possibility of a peace agreement between Russia and Ukraine has led to increased optimism and discussions regarding the potential return of Russian gas supplies to Europe.

“While it is not our base case, a partial restart of flows could drastically change the outlook for the European gas market,” Warren Patterson, head of commodities strategies at ING Group, said in a report.

Despite discussions about restarting Russian pipeline gas to Europe as part of a Russia-Ukraine peace deal, significant obstacles remain.

Recent difficulties in getting Russia and Ukraine to negotiate, even for a temporary ceasefire, mean a US-brokered ceasefire is unlikely.

Their demands are far apart, and Russia’s offer to halt attacks on Ukrainian energy infrastructure for only 30 days highlights this. Russian pipeline flows won’t return without a permanent peace deal, according to ING’s report.

Europe’s goal to end its dependency on Russian fossil fuels by 2027 conflicts with the potential benefit of lower energy prices from increased Russian pipeline flows.

US President Donald Trump wants to end the Ukraine war but may not want to restart Russian gas flows to Europe.

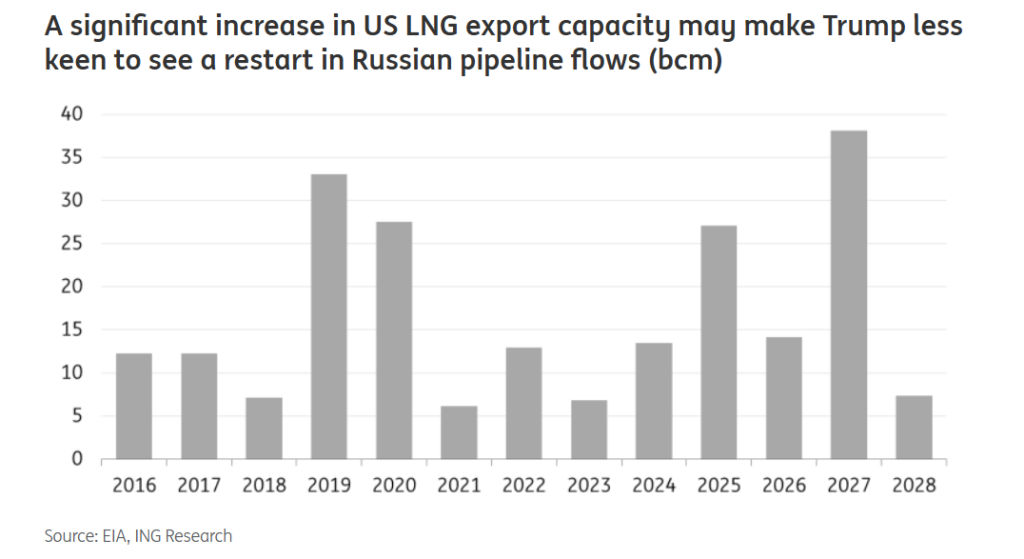

The US has a lot of new LNG capacity coming online, and much of it is based on Europe being a major buyer.

If Russia starts supplying gas again, US LNG exporters will have to find other customers, especially with Qatar also increasing LNG exports.

(Click on image to enlarge)

Source: ING Research

Scenarios

The initial scenario focuses on the easing of US sanctions on three currently sanctioned Russian LNG plants, without any increase in Russian pipeline flows, Patterson said.

This scenario specifically involves the relief of Russian LNG sanctions.

In the second scenario, ING assumes that Russian pipeline flows return to 2024 levels, including a resumption of transit flows through Ukraine at 2024 levels. Additionally, the US lifts sanctions on LNG.

Finally, the third scenario involves Europe significantly increasing its reliance on Russian pipeline gas, leading to a partial recovery of supplies, although still below pre-2022 levels.

This would also require the US to lift sanctions on sanctioned Russian LNG projects.

Patterson said:

In our base case, we do not see a resumption of Russian pipeline flows to Europe, as achieving a peace deal remains challenging, and EU members are reluctant to increase their reliance on Russian energy.

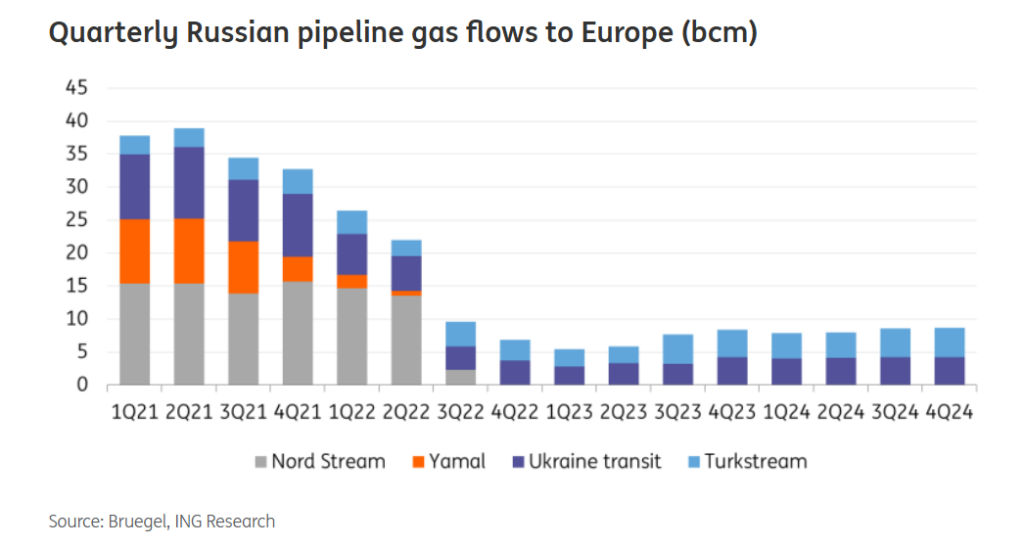

The remaining pipeline flows from Russia will only amount to about 15 billion cubic metres per year via the TurkStream pipeline.

Russian LNG sanction relief

The US appears more open to negotiating with Russia to end the war, while Europe remains skeptical of a peace deal.

This could lead to Europe maintaining its goal of reducing reliance on Russian fossil fuels by 2027, and refusing to increase its dependence on Russian pipeline gas, according to Patterson.

In this scenario, Europe would continue to purchase Russian LNG, and only gas flows through the TurkStream pipeline would continue.

European imports of Russian LNG could even increase if the US were to relax sanctions against the Arctic 2 LNG project.

The Arctic 2 LNG project is not yet operational due to sanctions.

Lifting sanctions could increase supply by 9 billion cubic metres, improving the global LNG market this year.

However, this won’t ease supply concerns or significantly affect TTF prices.

“Therefore, European prices will still need to remain elevated in order to ensure adequate LNG supply is brought in ahead of the 2025/26 winter,” Patterson said.

(Click on image to enlarge)

Source: ING Research

Russian pipeline flows return to 2024 levels

The resumption of the approximately 15 bcm of Russian supply that transited Ukraine in 2024, returning to the 2024 pipeline flows, would ease some of the supply concerns and make the EU’s storage target of 90% by 1 November more achievable ahead of the 2025/26 winter.

However, the timing of a restart of these flows is uncertain.

In order to help the EU balance, it would need to happen in 2025. A 2026 restart does little to help with tightness concerns ahead of the 2025-26 winter.

Additionally, this scenario includes the US lifting sanctions on Arctic 2 LNG, which would result in an extra 9bcm of supply per year, Patterson said.

TTF will likely trade down into a €30-40/MWh range, as European hub prices will be weighed on by a restart of flows through Ukraine.

Europe restarts imports

Although it is the least likely scenario, a peace agreement between Russia and Ukraine could result in a partial resumption of pipeline gas to Europe, despite some European opposition.

This scenario assumes that only two additional routes for Russian pipeline gas into Europe are viable, according to ING.

Gas flows from Russia to Ukraine have restarted and could reach 40bcm, matching the 2021-24 contract volumes, despite being lower since the war began.

The Yamal-Europe pipeline, with a capacity of 33bcm, could see a return of flows.

However, a restart may take time due to potential maintenance work.

Europe will gain an additional 73bcm of annual supply, equivalent to about 22% of the EU’s 2024 consumption.

Combined with the 15bcm of flows already received through the TurkStream pipeline, total Russian pipeline flows to the EU would reach approximately 88bcm per year.

Source: ING Research

This may also lead to Russia once again becoming the EU’s primary gas supplier (including LNG), a development that will likely be met with concern.

Nord Stream 1 is unlikely to return due to severe damage from the 2022 sabotage attack.

Nord Stream 2, though partially damaged, could potentially supply 27.5bcm but remains uncertified and has never been in commercial operation.

“The uncertainties around this scenario are what pipeline routes will be used and also the timing. A restart that only takes place in 2026 would obviously be of little help to the European market for the 2025/26 winter,” Patterson said.

More By This Author:

Shopify Stock Price Giant Megaphone Points To A Strong Surge

Canada’s Inflation Hits 2.6%, Raising Fears Of Economic Strain

How China Is Quietly Slowing India’s Manufacturing Growth

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more