Why Canadian Mortgage Rates Are About To Fall

Yesterday, when RBC Royal Bank announced that it was lowering its five-year fixed mortgage rate it came as no surprise to industry insiders. The combination of falling bond yields and weakening mortgage demand have teamed up to put considerable pressure on all aspects of the Canadian mortgage market. Granted the drop in RBC’s posted rate was just 15 basis points, from 3.89 % to 3.74 %, nonetheless, it does signal that the recent rate hikes by the Bank of Canada are not been transmitted into higher rates across the yield curve; in fact, just the opposite as the yield has flattened.

So much of the reporting in the financial press erroneously touted that mortgage rates were going to continue to rise and that borrowers should be preparing for difficulties in re-financing or borrowing anew. The bond market never bought into this storyline. Ever since the Bank of Canada starting raising its bank rate in July 2018, the yields on the 5-year bond, the one most influential in determining mortgage rates, started to fall and now resides at less than 1.9 %. The wholesale cost of money to the banks dropped sufficiently that the banks could drop mortgage rates and still maintain required net margins.

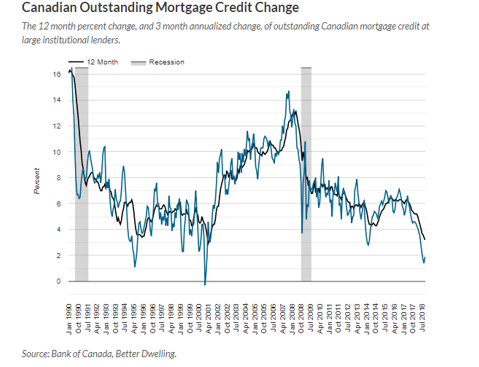

When it comes to the housing market, governments should be careful what they wish for. About a year ago, the Canadian government expressed real concern over the steady rise in housing prices, especially in the large metropolitan areas and instituted a series of measures to cool mortgage demand. These measures were aimed at fending off any systematic risks by making it more difficult to obtain high loan-to-value mortgages and also to weed out high loan-to-income borrowers. As the accompanying chart demonstrates, the negative impact on mortgage demand was relatively swift.

(Click on image to enlarge)

Part and parcel of the slump in mortgage loan demand was the significant fall off in housing starts. Annualized, housing starts in Canada dropped by 5 % in December compared to November. As new homes purchases declined, developers became ever more cautious about starting new projects.

The mortgage industry in North America is undergoing major shifts in its supply chain. The U.S. major banks are shying away from mortgage lending in response to the high cost of providing residential loans. In the United States, alternative lenders are online mortgage originators that are becoming more of a force in the industry. Alternative mortgage lenders now account for half of all home loans, according to Federal Reserve, the largest share in 20 years. These originators are transforming the mortgage loan process with faster approvals plus online application and a minimum of paper documentation.

The Canadian market for alternative lending is not as nearly well-developed, yet the Big Six banks are starting to take notice of the changing Canadian landscape. Industry analysts expect that the alternative lenders, currently estimated to be 10 % of the total market, will grow rapidly as more non-bank financial institution compete. Schedule B banks, credit unions, insurance companies and a huge host of private lenders are starting to offer competitive rates and terms. These entities are driven in part by government policy and advances in information technology.