When Will The Wars Finally End?

Image Source: Pixabay

You may not be directly affected by the conflicts in Ukraine or the Middle East and you too are most likely hoping that the conflicts will soon be resolved. However, the discussions about rearmament have probably not gone unnoticed by you, nor have thoughts about post-war reconstruction. Fortunately, new conflicts are not started every year, even if it sometimes feels that way. The supposed stock market winners of the war, and those who could potentially profit from a subsequent reconstruction, are mentioned again and again in the media.

But is it really the case that these stocks follow the conflicts, or do they have a life of their own andonly marginally related to current events?

We have examined two of these repeatedly mentioned stocks and discovered some interesting facts. Rheinmetall shares are generally regarded as war winners and Heidelberg Materials is often cited as a rebuilder. Both stocks show interesting movement patterns over the course of the year that cannot be linked to current events. However, they could also potentially benefit from the current conflict.

Rheinmetall, the armaments group with many other business areas

Anyone who insists that Rheinmetall is based solely on armaments would be proven wrong. In addition to its core business, the Group is also active in industrial manufacturing technologies, civil vehicle technology, electronic systems and, last but not least, e-mobility and hydrogen mobility.

The course of the annual cycle thus shows that the current turmoil of war has hardly any influence on development. There are two distinct periods that you can take advantage of. From mid-May to the end of November, there is a tendency towards a negative phase, which at first glance looks balanced with 14 to 16 positive to negative years. In the negative years, however, a considerable 26% is lost on average during this period. The 14 positive years, on the other hand, could only show a gain of 17%.

However, the period from the beginning of December to mid-May is much more interesting. Here you can benefit from a rare ratio of 27 to 4 years. In the 4 negative years, the average loss is just under 13%, but this is mainly due to a single year. The 27 positive years, on the other hand, generate an average gain of 36 %. Although the focus here is on the last 4 years, they are also quite respectable before that.

This shows that the course of the year is divided into two parts and is not necessarily related to current armed conflicts.

(Click on image to enlarge)

Seasonal Trend of Rheinmetall AG over a 31-year span; Source: Seasonax

When the war is over, it’s time to rebuild

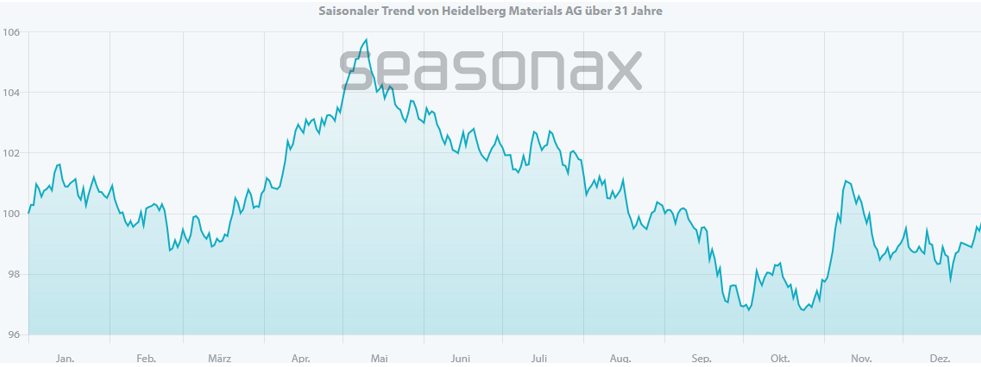

It is almost impossible to predict whether Heidelberg Materials will actually have an impact on business in Ukraine or Gaza. However, the share is repeatedly mentioned when it comes to reconstruction in the devastated areas. As with Rheinmetall, two periods are particularly striking for Heidelberg Materials. From mid-May to the beginning of October, the situation is not particularly positive (even if this is not the case this year). In 19 years during this period, an average loss of 17% is generated. Only 11 years perform positively during this period and generate a profit of around 16%.

(Click on image to enlarge)

Seasonal Trend of Heidelberg AG over a 31-year span; Source: Seasonax

As with Rheinmetall, the second conspicuous period is the more interesting one. Even though it is shorter than the periods described so far, an extraordinary performance can be achieved here. From mid-March to the beginning of May, a remarkable 10%average return was achieved in 27 years for this short period. Even if you exclude the particularly good year 2009, a respectable 8% average still remains. Furthermore, only 4 losses were recorded during this period which resulted in an average loss of 7% which, once again, is also mainly attributable to one year. If this is excluded, the average loss is only 4.6%.

Everyone dreams of peace, but share performance doesn’t care

Of course, we all hope that the wars in the world will soon come to an end. This article serves to show that in order to make money on the market, it is obviously not worth following the constant stream of half rumours or announcements. It is obviously much more important to pay attention to the seasonal effects of shares, as can be seen from the example of Rheinmetall and Heidelberg Materials.

More By This Author:

Triple Witching Effect: A Quick Guide To Market Chaos

Apple’s August Advantage: Can Earnings And Tariff News Supercharge The Trend?

Bitcoin: Summer Pullback Incoming – Dip Buying Opportunity Ahead?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more