Bitcoin: Summer Pullback Incoming – Dip Buying Opportunity Ahead?

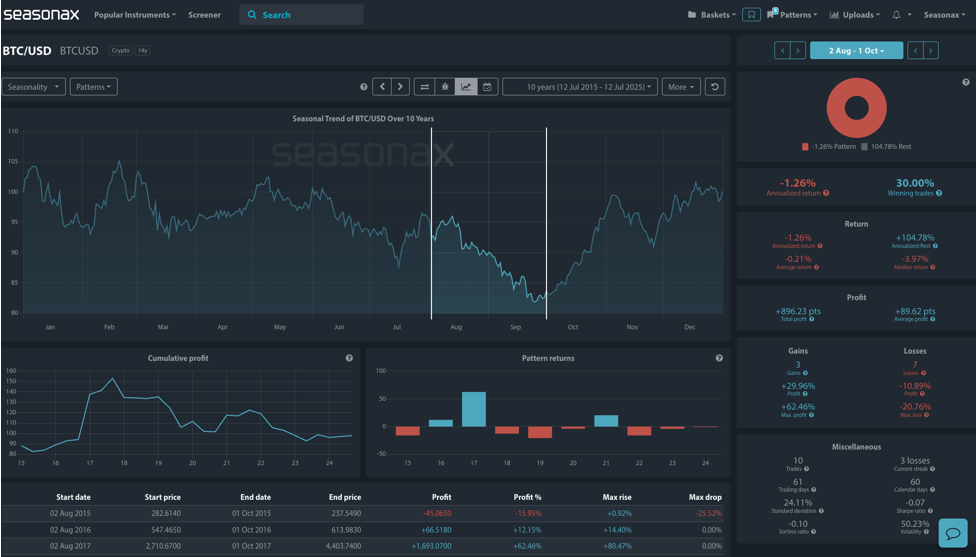

- Instrument: BTC/USD

- Timeframe: August 2 – October 1 (10 years)

- Average Pattern Move: –0.21%

- Winning Percentage: 30.00%

You may not realize it, but Bitcoin tends to underperform during late summer, with the pattern from August 2 to October 1 showing a –0.21% average return and only a 30% win rate over the last 10 years. Despite the broader uptrend, this window has produced a –1.26% annualized return – and a median loss of nearly –4%.

Even during strong years, like 2017 (+62.46%) and 2016 (+12.15%), this period often came with significant volatility or mid-cycle consolidations. With Bitcoin up over 30% year-to-date and recently clearing $120,000, could a seasonal breather be ahead?

Why It Matters Now: Summer Euphoria vs. Historical Gravity

Bitcoin recently broke above $123,000 after weeks of coiling around the $100K mark. Optimism has surged on multiple fronts:

- ETF inflows exceeded $2.7 billion last week, pushing total AUM above $150 billion.

- Open interest in Bitcoin futures hit a record $86.3 billion, indicating extreme positioning.

And yet… seasonal flows suggest caution. Only 3 out of the last 10 years posted positive returns in this window – and the average drawdown exceeded 10% in the losers.

Technical & Sentiment Watch

- Bitcoin has cleared $120K, and the $112K level marked below is a key support area. While a dip below could trigger a re-test of $100K dip buyers may be inclined to test the water on a dip back towards $110

With open interest and sentiment stretched, a tactical retracement could offer a healthy reset.

(Click on image to enlarge)

Trade Risks

- Dips may be shallow or short-lived given strong institutional flows and macro tailwinds (e.g., dovish Fed, fiscal expansion). Crypto volatility remains high — shorting seasonality without structural catalysts is risky

Video Length: 00:01:57

More By This Author:

Intel: Layoffs Loom Large As Seasonal Weakness Approaches - Watch Post‑Earnings RiskSilver: A Seasonal Pop Incoming As Hedge Fund Positioning Peaks?

GBP/USD: CPI Miss Could Trigger Familiar Summer Slide

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more