What Are The Real Sources Of Inflation In The West?

For more than a year now, the famous debate about the origins of inflation has resurfaced. Attached to their ideologies and interests, two groups are distinguishing themselves as they did in the past. On the one hand, the more "Keynesian" consider that it is exclusively linked to supply: a combination of the energy crisis and the disorganization of value chains. On the other hand, the neo-monetarists believe that it is due to the excess of money creation during the health crisis. To compare their ideas, these two groups do not hesitate to use isolated cases and events from previous eras as examples. Thus forgetting that economics is an inexact science... and that the current period cannot be compared in any way. But this ideological battle seems above all inept, because the sources of the price increase are certainly a mixture of their respective arguments.

Back to the roots

The inflationary spiral we are experiencing today began in March 2021.

A year earlier, governments instituted their first lockdown measures to deal with the spread of the Coronavirus. At that time, the economy came to a halt. Households were isolated in their homes and businesses were closed. Logistical disruptions began to appear and the economic fabric was weakened. The perverse effects of successive relocations became apparent, and interdependence was pointed out. Consumption and production were at their lowest. Demand fell, the price of a barrel of oil collapsed. Inflation was close to 0% and deflation was narrowly avoided.

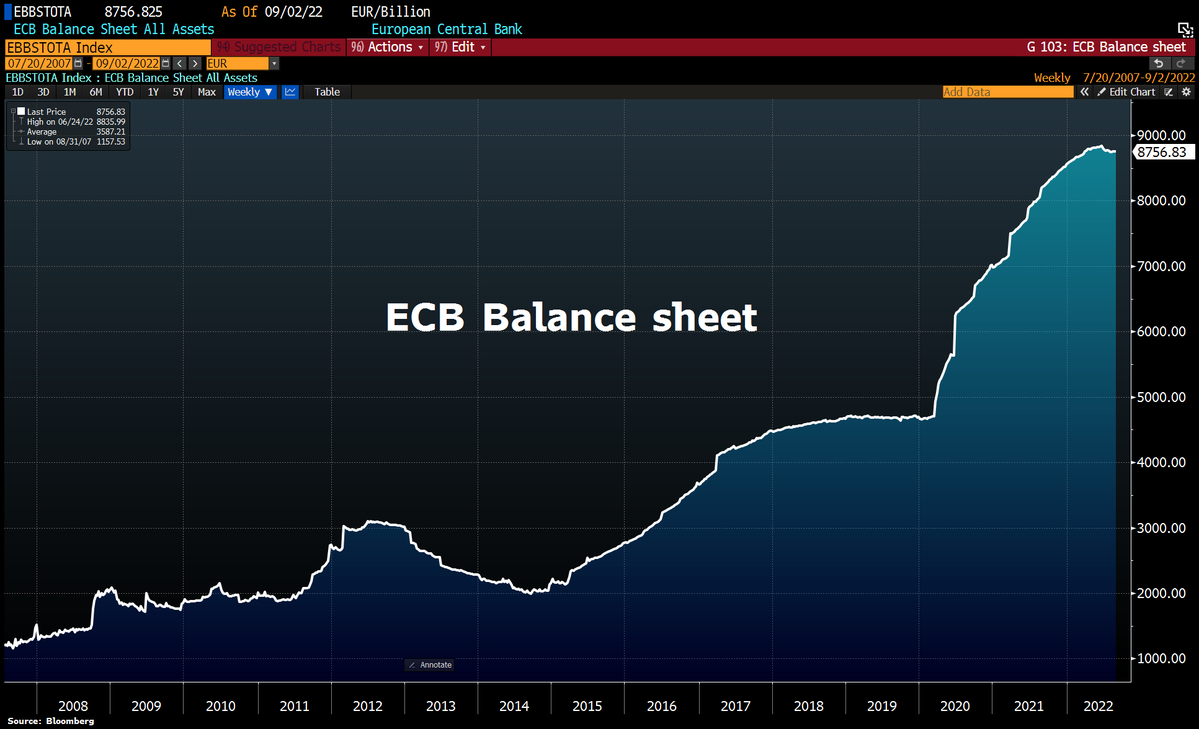

The world entered a historic recession. The GDP of the United States contracted by 31% in the second quarter of 2020, and that of the eurozone by 12%. The financial markets then began to fall, only a few months after the repo crisis (liquidity crisis on the interbank market). Given the size of the financial bubble inflated in the aftermath of the subprime crisis, the banking system required considerable support - much more than in 2008 - to avoid collapse. In the panic, central banks acted massively with billions of dollars, as shown by the disproportionate increase in their balance sheets. In addition, in order to encourage the use of credit, they kept their key interest rates at 0%.

The effects were quickly felt. Markets recover, all financial assets are up: stocks, bonds, crypto-currencies, real estate, commodities... Since money doesn't cost much anymore, or rather it costs even less, companies benefit: the number of M&A, SPACs, IPOs, share buybacks, and dividends, reach records.

European Central Bank (ECB) balance sheet (trillions of euros)

US Federal Reserve (Fed) balance sheet (trillions of euros)

But these interventions, which consist of buying up public and private debt securities on the secondary market, do not simply serve to support the financial system in a crisis. By increasing bank reserves, they mechanically reduce the cost of borrowing for governments, allowing them to carry out large-scale stimulus plans. At the beginning of 2021, the major powers decided to implement substantial programs to support the economy as a whole. The United States declares the introduction of a plan of $ 4 trillion in total, the European Union, €750 billion.

New trillions are thus created, before being repurchased by central banks to continue to support the governments and the markets (in the eurozone, since 2020, the ECB has repurchased more than 80% of the public debt issued). Companies, still closed, receive state-guaranteed loans, or take on debt themselves at historically low rates.

At the same time, faced with a 70% drop in the price of a barrel of oil between March and April 2020, and the dawn of the peak of non-conventional oil, the OPEC+ countries, of which Russia is a member, have decided on a 20% reduction in their production during 2020 to maintain prices.

Post-covid economic recovery

Little by little, the health crisis calmed down and measures were relaxed. Central banks introduced massive and continuous asset repurchase programs, and governments continued their support measures. In Western societies, where household confidence is high and the savings rate relatively low, consumption was strong. (1) Despite the fragility of the economic fabric, the economy quickly took off again.

OPEC+ then takes advantage of this economic rebound to continue to reduce its production by more than 10-15% (from pre-covid levels) throughout 2021. Given that the organization produces most of the world's oil, but more importantly that energy drives the economy, this intervention accentuates the large imbalance between supply and demand.

Oil wells@lesoleilnumérique

In addition, given the intensity of the economic recovery, supply chains began to break down. Many production sites, particularly in Asia, remained closed. In China, the country's "zero covid" strategy severely restricted the quantity of goods produced. As the "world's factory" encountered major difficulties, international trade slowed down.

Shortages appeared and multiplied as a result of climatic shocks. Western countries, especially Europe and the United States, were being hit hard by the shortage of semi-conductors and raw materials. Global value chains were deeply disrupted.

As during the Great War, an imbalance is created between the money supply and the level of production. This supply shock combined with strong demand can only put upward pressure on prices. In the United States, where the amount of the stimulus package is the most substantial compared to the size of the country's population, inflation, as measured by the consumer price index (CPI), will reach 5.3% over one year in August 2021. In the same period, it is 3% in the eurozone, 3.2% in the UK and 4.1% in Canada. Now above the central banks' target of 2%, is price inflation already out of control?

Rather than tightening their monetary policy to curb price increases, monetary institutions chose to continue their policy of buying up debt securities and keeping their rates extremely low. This choice is fueled by the idea that inflation is exclusively linked to logistical problems and that these will be resolved over time. In reality, central banks faced a dilemma from which they could not escape: maintain an accommodating monetary policy at the risk of allowing inflation to continue and seeing confidence erode, or intervene to slow down the rise in prices, at the risk of triggering an economic and financial crisis. Finally, the first solution was adopted.

Inflation is on the rise

As the inflationary spiral seems to be truly launched, uncertainty grows, especially on the markets. Investors take massive refuge in assets deemed liquid and of high quality, first and foremost gold and the dollar - the reserve and exchange currency par excellence. This "flight to quality", which is well known to the markets, de facto depreciates most currencies against the US dollar.

While this depreciation is, at first sight, desirable because it strengthens the competitiveness of countries, it nevertheless increases the price of products quoted in dollars, i.e. most traded products. The price of raw materials, already at very high levels due to logistical problems, climatic shocks and persistent speculation, is rising even more. Countries outside the United States will thus suffer a double inflationary shock: the first linked to the economic recovery, and the second linked to the depreciation of their currency against the dollar.

In December 2021, faced with the continuing increase in consumer prices, the central banks made their confessions and recognized that the rise in prices was finally here to stay. U.S. Federal Reserve Chairman Jerome Powell declares that "inflation is not transitory." As the appeal of the U.S. currency grows, the U.S. continues to export inflation around the world. At that time, price inflation reached 7% in the United States (the highest level since 1982), 5.3% in the eurozone (a record since the creation of the indicator in 1997), and 5.4% in the UK (the highest since 1992).

Three months later, on 24 February 2022, Putin declared war on Ukraine.

This geostrategic conflict, linked to the expansion of NATO, Russia's de-dollarization policy, and the energy war between the United States and OPEC+, in turn leads to inflationary pressure. Since a large share of raw materials, especially agricultural products, comes from Russia and Ukraine, this war is creating new shortages. At the same time, the embargo on Russian gas by Western countries is causing energy prices to rise, accentuated by speculation.

The United Kingdom, like other European countries, is suffering the adverse effects of its weak energy transition measures and its dependence on Russian energy. Their trade balances are collapsing, inflation is rising. At 7.5% in March 2022, price increases will soon be higher in the Old Continent than in the United States (then at 8.5%). In the UK, the political crisis added to the economic difficulties: inflation reached 7%.

(Graph showing the euro/dollar rate)

In this context, central banks are tightening monetary policy, in particular by gradually raising key interest rates. However, disparities remain due to diverging interests. While the Fed is acting quickly to strengthen confidence in the dollar, the ECB, faced with the challenge of a single interest rate for nineteen different countries, is choosing to maintain its rates at 0% to avoid a run on the debts of southern countries. It was not until July 27 that the Frankfurt institution made its first increase of 0.5%, which was then increased by 0.75% on September 14. From now on, the Fed's key rate is between 3% and 3.25%, while the Bank of England's is 2.25%, and the ECB's is 1.25%.

These differences are causing significant movements in exchange rates and inflationary pressures. Apart from this fact, these interventions seem to be ineffective if we believe the argument often repeated by central bankers: the rise in prices is linked to logistical problems. When central banks are forecasting a reduction in inflation in 2023 and a return to around 2% in 2024, why do they decide to increase key rates?

The inflationary spiral, now anchored in the real economy, cannot be stopped without triggering a recession. Faced with their own dilemma, the top officials of the monetary institutions are now considering this sad fact. Recently, the governor of the U.S. central bank publicly stated, "We need a somewhat higher unemployment rate to fight inflation."

Central banks are thus trying to keep household confidence, before it eventually slips away from them, and the Japanese case is familiar...

(1) A side note on the Japanese case is in order here. Why is inflation rising only slightly in Japan, while the Bank of Japan is pursuing the same monetary policy? Firstly, the volume of asset purchases during the health crisis increased much less as a proportion of its balance sheet than that of the Fed, the ECB or the Bank of England. In addition, there are structural factors at work. Japan began this quantitative easing policy in the early 1990s following the country's financial crash, and then gradually fell into a liquidity trap: when the interest rate falls below a certain level, households prefer to hold money rather than debt. Moreover, Japan has been hit by an aging population and a falling birth rate for many years. As domestic consumption remains extremely low, inflation - currently at 2.8% year-on-year in August - is rising only slightly. With the Bank of Japan's balance sheet at nearly 140% of GDP, and the country's public debt at 250% of GDP, Japan is at risk of having to create a new central bank.

More By This Author:

The Bond Crash And The Soaring Dollar Pose A Systemic Risk On The Financial Markets

The Evolution Of The Monetary System Since The 19th Century

The Chinese Economic Model At The End Of Its Breath

Disclosure: GoldBroker.com, all rights reserved.