The Evolution Of The Monetary System Since The 19th Century

The history of money is several thousand years old. But do we know its evolution? How was it created? How does it work? Its influence?

The questions that revolve around this social link are of little interest to the average person. Yet money structures our economic and political models.

In the classical sense of the term, it is an instrument of payment in force in a given place and time. According to Aristotle, it is a unit of account, a store of value, and an intermediary for exchanges. Beyond these three functions, it is composed of a single aspect: trust. Money relies only on the trust of its users. In a market economy, this is a fundamental element in the proper conduct of politics in the broad sense. To paraphrase Michel Aglietta - an illustrious 21st-century economist - trust in money is the alpha and omega of society. The fact that the many inflationary and financial crises in history have been followed by large-scale reforms is therefore not surprising... Confidence was lost, and it had to be restored.

So why are the recent financial crashes an exception? What were the reforms of previous centuries? What were the dominant schools of economic thought? A brief look at the evolution of the monetary system, especially since the 19th century, will give us some answers.

Money: 3,000 Years of History

The first currency (in the current sense) was born in 687 BC, when the king of Lydia, Gyges, replaced the barter system with electrum (natural alloys of gold and silver), allowing the trade of all products. This historical transition signed the passage from a barter economy to a market economy. Only one element is preserved: debt. Advances of foodstuffs became advances of metallic currencies, then accounting entries today. To this debt, interest is added, which later becomes interest rates.

Photos of electrum in 600 BC

The advent of metallic money marks a major societal change. "Struck" by the public power, symbol of the strength embodied by the city, this new tool serves to vivify the local retail trade and is accepted to pay taxes. In a period of emancipation of thought, its introduction allows an improvement of citizenship and an increased development of science. Moreover, it is a real economic and social innovation.

However, the fall of the Roman Empire and the appearance of the Middle Ages changed the status quo. The establishment of feudal systems restricted freedom and limited the accessibility of money. In order for the greatest number of people to continue to exchange, bartering resurfaced and new systems such as the counting stick and the bill of exchange were introduced.

Counting stick used in the Middle Ages

In the 10th century, the intensification of trade accelerated the need for a practical means of exchange for all. Bi-metallic (gold/silver) and even tri-metallic (gold/silver/bronze) systems in the Muslim world were used for the crusades and for the expansion of trade. Under different names, multiple national currencies appeared - with the common characteristic of referring to a metal weight.

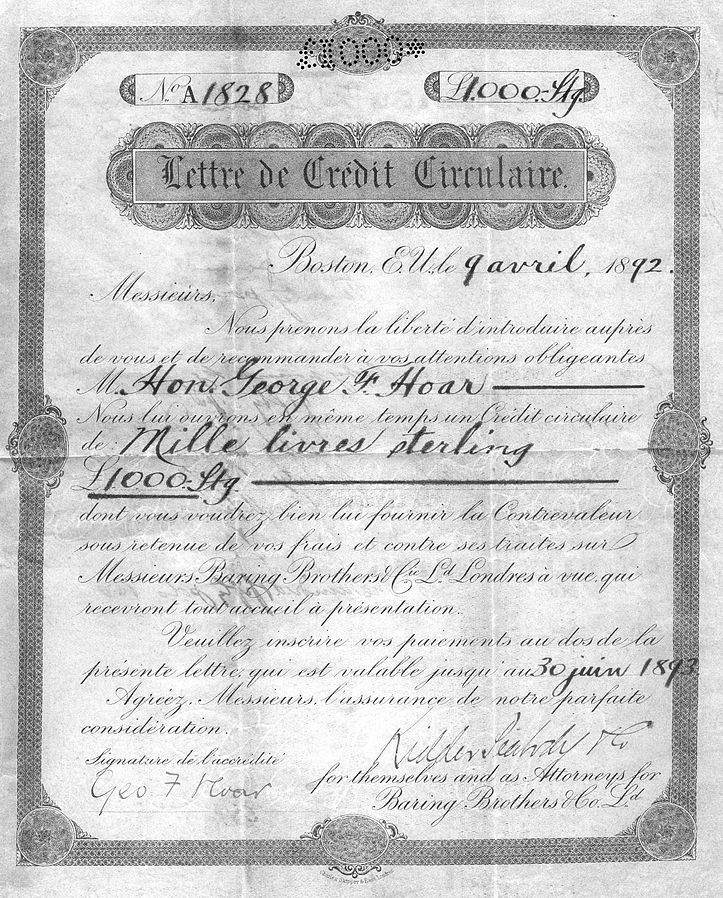

Bill of exchange, also called "circular letter of credit"

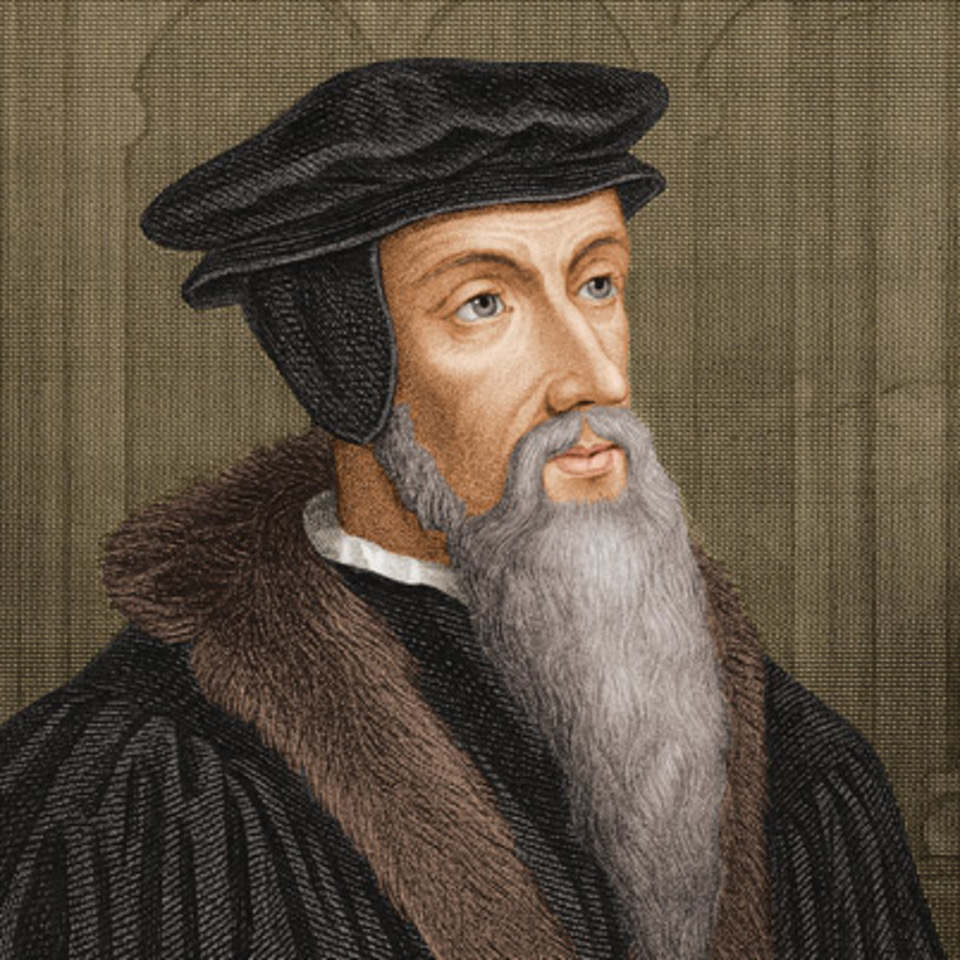

The 16th century marked a new turning point. During the Renaissance, the relationship between man and faith - and between man and money - was considered in a new light. In this period, marked by the development of the humanist movement, the intensification of religious reforms led to the politicization of money and the appearance of mercantilist conceptions. After the birth of Protestantism in 1517, interest-based lending became widespread under the impetus of John Calvin. In his book "Lettre sur l'usure" (Letter on usury), published in 1545, the French theologian challenged the thinking of the Church, which believed that one should "lend without expecting anything in return" (a precept found in Muslim practices). He believes that lending at interest can be tolerated "as long as it is productive". Unconsciously, by legitimizing this act, Calvin had just laid the foundations of modern capitalism.

John Calvin (1509 – 1564)

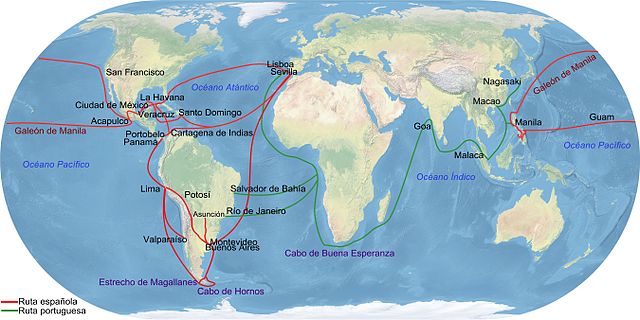

This period was also marked by the appearance of new economic cycles whose effects agitated public debate. The discovery of America and its large quantities of metals - at a time when metallic currencies were still the main means of payment - generated a period of high inflation in Western Europe and China. Although the origins of this price increase are unclear, there is a consensus in philosophical discourse that the influx of metals from the New World stimulated demand and thus increased prices. Copernicus then declared: "money depreciates when it becomes too abundant". Jean Bodin - a French economist and philosopher - continued and developed this close link between the volume of money in circulation and the general rise in prices in his "Réponse à M. de Malestroit". John Locke and Thomas Gresham abound in this sense.

Flow of metals in the 16th and 17th centuries

If this theory was unanimously accepted in the 16th century, the financial changes of the following two centuries were to overturn the ideals. Due to the creation of deposit banks (represented by goldsmiths), the birth of central banks - then under private status -, the development of banknotes and the creation of the first international currency - the thaler (ancestor of the dollar) -, the monetary system became more bankable. Under the name of "tulipomania", the first financial crisis linked to the rise in the price of the tulip occurred in 1636 in Holland.

New schools of economic thought took hold, but two in particular stood out when the Bank of England's suspension of the gold convertibility of banknotes in 1797 was followed by historic inflation two years later, and then an economic crisis in 1810.

Represented by David Ricardo, the proponents of the currency school defended the idea that money should be issued on the sole condition that the central bank hold the equivalent in gold and silver. This monetary policy would not only make it possible to control inflation (and thus the loss of value of money), but also to create the conditions for a prosperous economy. In contrast, the proponents of the banking school - founded by the British economist Thomas Tooke - believe that the quantity of money in circulation should be decoupled from the holding of gold and silver and should refer only to economic circumstances. Bank loans can be issued in unlimited quantities, depending on the demand of economic agents.

Birth of the Gold Standard

In 1844, following the numerous financial crises of the early 19th century, the currency school prevailed when the last version of the Bank Charter Act was passed in England. Twenty years after Ricardo's death, the gold standard was adopted in the country. The quantity of banknotes issued by the central bank then became dependent on the gold reserves it held in its vaults and the power of creation of banknotes by commercial banks was reduced.

David Ricardo (1772 – 1823)

Against the backdrop of a constantly growing globalization, the international community decided to ratify this unique monetary system. Most of the Western countries introduced it in 1873. India, Argentina and Russia did the same a few years later. The money supply and the exchange rate of each country were henceforth linked to gold movements. This means that their wealth is conditioned, to a lesser degree, to the distribution of yellow metal in the world.

Inegalitarian in nature, this system is also highly unstable. As more and more countries join the system, the decline in gold production feeds hoarding and leads to deflationary cycles. The most affected countries are experiencing significant increases in unemployment and a fall in productivity.

Moreover, the United Kingdom - the country that made the decision to adopt this regime - exerts a particular influence within the system. With its industrial and financial strength, as well as its energy power due to the many coal mines in the country, the country managed to impose the British pound as the international reserve currency. Thanks to the use of its key interest rate - particularly during periods when gold was scarce - the Bank of England was able to direct foreign capital and play ipso facto a determining role in the economic activity of competing nations. This status helped to maintain the United Kingdom's position as the world's leading power for several decades.

Bank of England circa 1840

When the First World War broke out, the unsustainability of this system reached its peak. The financing of military equipment proves to be extremely expensive, and the yellow metal reserves of the belligerent countries are rapidly depleted. England, Germany and the United States decide to suspend the use of the gold standard.

While the economy is at a standstill, the abundance of money (banknotes and bank deposits), causes moreover a strong and durable inflationary period. (A situation that closely resembles the one in which we live following the crisis of the coronavirus...) The share of the metal coins in the total monetary mass decreases, gold and silver become mainly reserves of values.

1918 - 1939: Between the Struggle for Monetary Hegemony and the Search for a New System

The United States then saw in this breach the means to impose their financial power. At the end of the Great War, the Wilson government demanded the repayment of the loans it had granted for nearly four years. This status as a creditor allowed the country to hold 45% of the world's gold stock after the war!

In contrast, the debtor countries paid a high price. Although France managed to reduce its debt thanks to a policy of devaluation in 1928 under the impetus of Raymond Poincaré, the situation in Germany was quite different. The Treaty of Versailles imposed the payment of the large sum of 132 billion marks to the war victors. Faced with this repayment and other structural problems, German Chancellor Friedrich Ebert decided to make continuous use of printing money. But the devaluation and acceleration of the circulation of the mark led to a loss of confidence in the currency. Hyperinflation was rife in the country. The Weimar Republic decided to create, with great difficulty, a new monetary unit: the reichsmark.

(In the face of a possible presentiment, a nuance is necessary: the rise of Hitler was not made in a context of hyperinflation, but because of a very high unemployment rate linked to the financial crisis of 1929. In 1933, when the Führer was appointed chancellor, unemployment reached 17.5%, whereas it had only been around 2% in the 1920s).

Castle of marks: German hyperinflation (1921-1924)

At the same time, under the initiative of the United Kingdom, the Genoa Conference was ratified in 1922. In order to restore an international monetary order, the 34 countries represented decided to return to the gold standard, where only the pound sterling and the American dollar were convertible into gold.

At a time when economic debate was gaining momentum, the return to the pre-war system generated much controversy. While advocating the idea of a sustainable and equitable regime, John Maynard Keynes declared the gold standard to be a "barbarous relic." He considered that the resulting scarcity of money could cause the economy to collapse.

Le statu quo est toutefois conservé, jusqu’à l’apparition de la crise financière de 1929 - qui signe l’abandon du système étalon-or. Les effets de la « grande dépression » sont sans précédent : le chômage et la pauvreté explosent, la panique bancaire se transforme en une crise économique à grande échelle. L’économiste Hans Cohrssen déclare alors : « Les difficultés techniques pour atteindre la stabilité monétaire sont mineures par rapport à la compréhension globale du problème. Aussi longtemps que l’illusion monétaire ne sera pas dépassée, il sera impossible de mobiliser la volonté politique. »

For his part, the German economist Silvio Gesell denounced the deflationary effects of the gold standard and continued his fight for a melting currency: a system in which money that was not spent - over a long period of time - was taxed in order to be reinjected into the real economy. In these mixed times, Gesell saw a growing interest in his work. Detailed in his book "The Natural Economic Order", which he published during the Great War, his theory began to spread throughout the world.

The status quo was maintained, however, until the financial crisis of 1929 - which signaled the abandonment of the gold standard system. The effects of the "Great Depression" were unprecedented: unemployment and poverty exploded, the banking panic turned into a full-scale economic crisis. Economist Hans Cohrssen declared: "The technical difficulties of attaining currency stability seem minor in comparison to lack of understanding of the problem itself. As long as the "Money Illusion" ... is not overcome it will be virtually impossible to muster the political willpower necessary for this stability."

Although Gesell died in 1930, his death was only physical, for his struggle was fiercely pursued by Cohrssen. After founding an association (the Free Economic League) dedicated to the publication of Gesell's ideas, Hans Cohrssen wrote a book in collaboration with the American economist Irving Fisher. In it, the authors put forward the monetary policy inspired by Gesell and the way in which it could be implemented. This legacy of thought, which was constantly growing, contributed to the first experimentation with fiat money in the Austrian village of Wörgl in 1932. The introduction of this local currency was a great success. Economic activity was excellent and unemployment was reduced by 20% within a year. The inhabitants of the neighboring towns were amazed and decided to replicate the concept. The movement spread throughout the world: 450 American mayors said they were ready to use it. But this new monetary policy soon came to an end. The Austrian central bank judged that its use would be detrimental to the sovereignty of the shilling and decided to ban it, without even thinking about it. The introduction of the Glass-Steagall Act in 1933 (a far-reaching financial reform) overturned the American financial system and thus put an end to the idea of a new monetary concept on the other side of the Atlantic.

Gesell's thinking remains, even today, unfinished. Will it ever be revived?

Silvio Gesell (1862 – 1930)

During the Second World War, the United States relied on its military-industrial complex to sell weapons and munitions on a massive scale in exchange for gold bullion, which it continued to accept. In 1944, the country had 70% of the world's gold stock, 25% more than in the aftermath of the Great War. This dominant position, combined with a large capital market and a powerful army, allowed Uncle Sam to influence decisions at the Bretton Woods Conference (a conference supposed to rebuild a sustainable international monetary order). On July 22, 1944, a gold standard system favorable to American interests was decreed. The value of the dollar was indexed to the price of gold, while other currencies were indexed to the dollar. In other words, the monetary stability of a country requires the acquisition of American currency.

Bretton Woods Conference in 1944

Aware of the iniquity of this regime, General De Gaulle denounced its instrumentalization by the United States. After explaining that the return to the gold standard made it possible to prevent states from giving in to "the deceptive delights of money creation," the general declared, during a conference given at the Élysée Palace in 1965, that this new regime allowed "the United States to indebt itself freely to foreigners." Sixty years later, the U.S. debt reached $30 trillion. But we were warned...

Faced with Triffin's dilemma (1) and the depletion of yellow metal resources, U.S. President Richard Nixon decided to end the Bretton Woods Agreement in 1971. The gold standard was definitively abandoned. Central banks and deposit banks could now create money ex-nihilo (out of nothing), without having to refer to the quantity of gold held. The hegemony of the dollar continues, in a different form. The world monetary system is based on confidence in the American currency, and the FED becomes the "central bank of the world", as was the Bank of England a century earlier.

Gradually, the main central banks become independent. This means that money can be created out of nothing, in unlimited quantities, without the public deciding.

Is this a victory for the banking school? Yes and no.

If the proponents of this theory consider that money must be created by commercial banks, according to the needs of economic agents, they believe that money can be issued in unlimited quantities on the sole condition that these credits are directed towards productive investment, in order to avoid inflation. According to them, prices rise when money creation does not serve the real economy.

While the adherents of this theory can be criticized for not having predicted the partial disconnection between money creation and general price increases (due in particular to new monetary policies), their ideology remains different from that which is preached today.

One dollar bill

In the light of the current period, it is appropriate to move away from this duality of economic thought and from all pre-established precepts. The singularity of the system that has prevailed since 1971 shows us - more than ever - that economics is an inexact science. The same regime that generated an exponential increase in the money supply is now facing a strong inflation whose consequences cannot be measured by anyone. The wait-and-see attitude of monetary institutions is therefore closely linked to the fear of a collapse, the origins of which go back to 2007-2008.

At the end of this cycle, the great challenge is to know if we will be able to draw inspiration from past proposals, events, and reforms to build a sustainable monetary system, or if we will choose denial and obstinacy.

Notes :

- Triffin's dilemma is an economic paradox that holds that the country whose currency is the international reserve currency must necessarily have a permanent trade deficit for non-resident economic agents to hold its currency.

More By This Author:

Euro-Inflation Downward Spiral Sets In

Energy And Real Estate Crises, Falling Precious Metal Stocks

The Importance Of Physical Gold In The Face Of The Geopolitical Context And The Futures Market Scandal

Disclosure: GoldBroker.com, all rights reserved.