USD/JPY Weekly Outlook: Policy Divergence Weighing On The Yen

- The dollar strengthened after the US released several upbeat economic reports.

- Powell got the chance to restate the Fed’s determination to lower inflation by hiking at least twice this year.

- There is increased policy divergence between the US and Japan.

The USD/JPY weekly outlook is bullish as monetary policy divergence will likely keep the yen under strong selling pressure.

Ups And Downs Of USD/JPY

USD/JPY had a bullish week driven by a stronger dollar. The dollar strengthened after the US released several upbeat economic reports.

The US economy showed resilience after releasing positive data on the housing market, consumer confidence, and durables goods orders. There was more positive news on GDP and initial jobless claims in the US. These reports reinforced expectations for more rate hikes by the Fed.

Furthermore, Powell got the chance to speak this week. He restated the Fed’s determination to lower inflation by hiking at least twice this year.

On the other hand, the BOJ remains dovish, increasing policy divergence between the US and Japan. This contributed to the yen’s weakness last week.

Next Week’s Key Events For USD/JPY

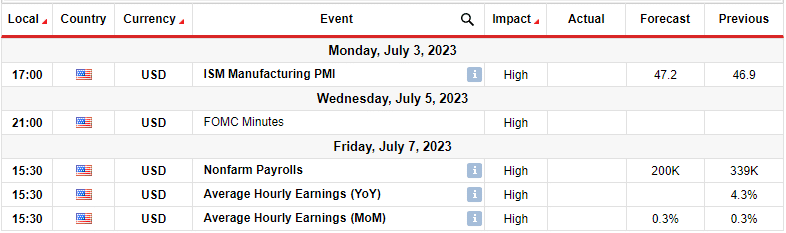

Investors will receive a slew of data from the US, including the ISM manufacturing report, FOMC meeting minutes, and monthly jobs data. The focus will be on the Fed minutes and the jobs report. The minutes will show what went into the last policy decision and give clues about the future.

On the other hand, the jobs report will show whether demand in the labor market is still high. The Fed has been raising rates to lower demand, especially in the labor market. Therefore, a higher-than-expected reading could increase expectations for more policy tightening by the Fed.

USD/JPY Weekly Technical Outlook: Bullish Momentum Hits Extreme, Bears Resurface

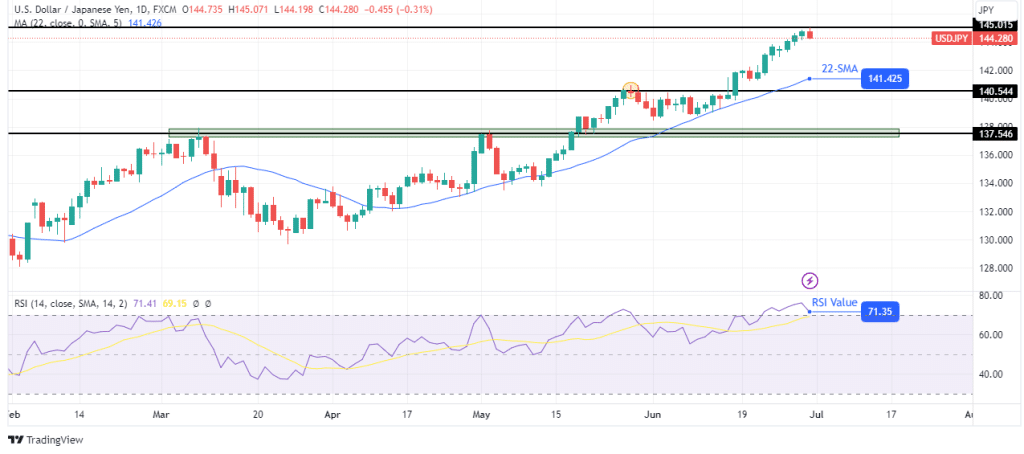

USD/JPY daily chart

USD/JPY has made new highs near the 145.01 key resistance level in the daily chart. The price is trading well above the 22-SMA. At the same time, the RSI is in the overbought region, indicating extreme bullish momentum. This might, however, allow bears to resurface and retrace the recent move as bulls take a breather.

Already, bears have pushed off the 145.01 key level. A pullback will likely retest the 22-SMA before the bulls return. Notably, the price has respected the 22-SMA in the bullish trend. It has bounced higher every time it has retested the SMA. Therefore, bulls will likely retest the 145.01 resistance level if it does so again.

More By This Author:

EUR/USD Forecast: Lagarde’s Hawkish Remarks Send Euro Higher

USD/JPY Weekly Forecast: Higher Rates Trigger Recession Woes

AUD/USD Weekly Outlook: Powell Flags Two More Rate Hikes