USD/JPY Weekly Forecast: Higher Rates Trigger Recession Woes

The USD/JPY weekly forecast is bullish as safe-haven dollar strength will likely continue amid global recession worries.

Ups And Downs Of USD/JPY

The USD/JPY experienced a bullish week, primarily driven by the strengthening dollar. The dollar’s rise was primarily influenced by hawkish statements by Fed Chair Jerome Powell during his testimony to Congress.

Additionally, a succession of global interest rate hikes unsettled investors, prompting a rush toward the dollar as a safe haven. Concerns emerged regarding the possibility of these hikes leading to an economic downturn.

On Thursday, the US dollar and Treasury yields increased due to Federal Reserve Chair Jerome Powell’s suggestion that additional US interest rate hikes might be necessary to manage inflation.

Powell conveyed this message during his remarks to lawmakers in Washington on Wednesday. He emphasized that if the current economic trajectory persists, it is reasonable to anticipate two more 25-basis-point rate increases.

Next Week’s Key Events For USD/JPY

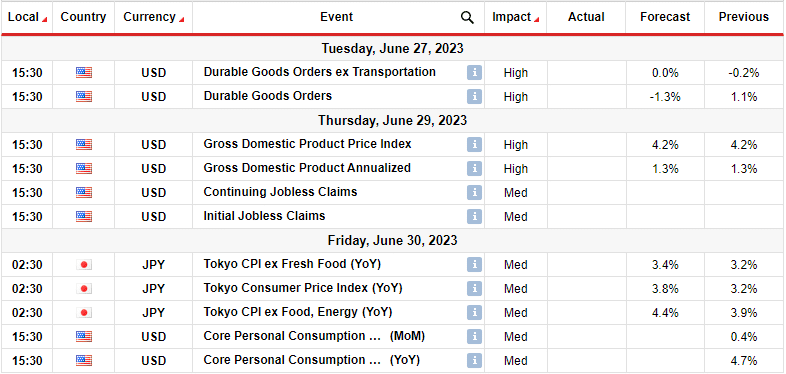

(Click on image to enlarge)

Investors will receive several important reports from the US and Japan that will likely cause some volatility next week. The most significant reports will be GDP and core PCE data from the US and inflation data from Japan.

GDP data will show whether there was growth in the US economy and the impact of high-interest rates on the economy. On the other hand, the core PCE report is a major tool the Fed uses to gauge inflation. Therefore, it holds a lot of weight and could impact the Fed’s policy outlook.

Finally, Tokyo’s inflation data is a leading indicator of inflation in Japan. Consequently, a high reading could reflect higher inflation in Japan.

USD/JPY Weekly Technical Forecast: Looming Resistance At The 144.00 Level.

(Click on image to enlarge)

USD/JPY daily chart

USD/JPY is on a strongly developed uptrend in the daily chart. The price has consistently reached new highs while making higher lows. It has also respected the 22-SMA by bouncing higher every time it has retested the level.

Buyers recently broke above the 140.61 resistance level to make a new high. Now, the price is approaching the 144.00 resistance level, where it will likely pause for a pullback before the uptrend continues. Buyers have momentum on their side, as seen in the overbought RSI. Therefore, there is a high chance the bullish trend will continue.

More By This Author:

AUD/USD Weekly Outlook: Powell Flags Two More Rate HikesUSD/CAD Outlook: Hawkish Central Banks Dampen Risk Appetite

Gold Price Recovers Amid Weaker Greenback, Eying UK CPI