Thursday, September 22, 2022 11:00 AM EST

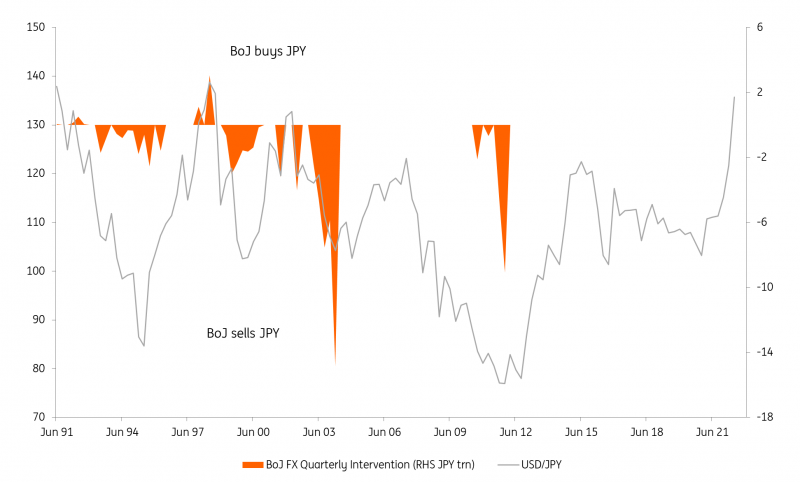

Japanese authorities have today intervened to sell USD/JPY for the first time since 1998. With the Fed turning ever more hawkish and the BoJ still printing money, it looks like the Japanese government wanted to stop a quick run to 150. Japanese authorities could well be doing battle with the FX market for the next 6-9 months as the dollar stays strong.

Pixabay

The warnings were there

Over recent weeks the warnings from Tokyo had been building. Descriptions of one-sided moves and moves out of line with fundamentals morphed into more explicit threats to intervene. Today those threats materialized in intervention, with the Bank of Japan selling USD/JPY to the market from around the 145.70 level.

The Ministry of Finance's website suggests it now reports intervention on a bi-monthly basis. The next release of data is on 30 September. Comparisons with markets 20-plus years ago come with the appropriate health warning. For what it’s worth, when Japanese authorities started intervening to sell USD/JPY in December 1997, they made a splash by buying around JPY1trn over a consecutive three-day period – i.e. they sold close to US$8bn.

Objectives and outlook

Presumably, Tokyo wanted to break the cycle of an ever-higher USD/JPY, even though Japan’s policy of effectively draining liquidity with JPY buying operations is at odds with the BoJ’s ongoing JPY-liquidity add through its various quantitative easing programmes. Japanese officials will be well aware of this contradiction and probably hope to slow or stabilize USD/JPY – rather than actively seek a reversal of the very powerful dollar bull trend.

We are also a little surprised that Tokyo went with the intervention. Either authorities had Washington’s blessing or they wanted to flex their domestic policy muscles against the overriding G20 mandate of flexible exchange rates. The issue now will be whether G20 central bankers and finance ministers agree that FX markets have become disorderly when they issue their next Communique on 12 October.

Clearly, investors are going to think twice about paying for USD/JPY over 145 now. And one can argue that we will now enter a volatile 140-145 trading range. But expect investors to be happy to buy dollars on dips near 140/141 knowing that Tokyo will find it impossible to turn this strong dollar tide – a tide that should keep the dollar supported through the remainder of this year.

BoJ sells USD/JPY for the first time since the late 90s

Source: Japanese MoF, ING

More By This Author:

BoJ Maintains Its Ultra-low Rate Policy, Pushing Yen To 145 And Above

National Bank Of Hungary Preview: A Nice Occasion To Slow Down

The Commodities Feed: FOMC Day

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.