USD/CAD Weekly Forecast: Less Hawkish Fed Amid Low US CPI

- In May, consumer prices in the US showed minimal growth.

- The Fed paused for the first time after ten consecutive rate hikes.

- The Canadian dollar reached a nine-month peak against the dollar.

The USD/CAD weekly forecast is bearish as cooling US inflation could lead to a less hawkish Fed. Moreover, the Fed’s pause may likely weigh down the greenback.

Ups And Downs Of USD/CAD

USD/CAD had a bearish week caused by dollar weakness and Canadian dollar strength. The dollar weakened initially after the release of US inflation data. In May, consumer prices in the US showed minimal growth, resulting in the smallest annual inflation increase in over two years. However, despite this, the underlying price pressures remained robust.

Soon after came the FOMC meeting, where the Fed paused for the first time after ten consecutive rate hikes.

Moreover, USD/CAD fell as the Canadian dollar rose. On Friday, the Canadian dollar reached a nine-month peak against the US dollar due to increased oil prices. Additionally, investors adjusted their expectations for the highest level of interest rates in the current cycle from both the Bank of Canada and the Federal Reserve.

Next Week’s Key Events For USD/CAD

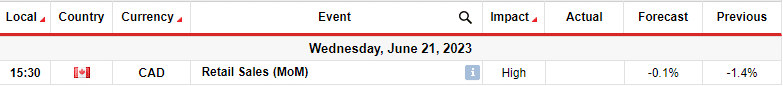

Next week will be quiet for USD/CAD as investors are not expecting much from the US or Canada. The only key report coming out will be Canada’s retail sales. The report is a key indicator of consumer spending in the country.

Notably, higher-than-expected sales would indicate a still-hot economy needing higher rates for longer. On the other hand, a lower-than-expected reading would confirm the impact of already implemented rate hikes. Therefore, this report might influence the Bank of Canada’s monetary policy outlook.

USD/CAD Weekly Technical Forecast: Risk Of Pullback At The 1.3200 Support

USD/CAD daily chart

The bearish bias for USD/CAD is strong on the daily chart. By breaking below the 1.3351 support, the price has made a lower low, confirming bears are stronger. Furthermore, the RSI is oversold, showing solid bearish momentum. The 22-SMA trades far above the price, showing bears are in control.

The new bearish swing comes after a period of consolidation, indicating a continuation of the trend before the consolidation. However, the price has reached the 1.3200 support level, which might pause after the sharp move.

A pullback in the coming week would likely retest the 1.3351 key level as resistance before bears continue seeking lower lows.

More By This Author:

EUR/USD Weekly Forecast: Bulls To Roar On Downbeat US Data

Gold Price Gathering Energy, Facing Resistance At $1,970

AUD/USD Outlook: Recession Risks Rise After RBA Hike