AUD/USD Outlook: Recession Risks Rise After RBA Hike

Today’s AUD/USD outlook is slightly bearish. Australia’s risk of entering a recession has significantly increased as the central bank surprised the markets by raising rates this week.

Moreover, it expressed its willingness to tighten further to control high inflation. Even if it means sacrificing job preservation.

For the past year, Governor Philip Lowe of the Reserve Bank of Australia has been discussing the challenge of balancing lower inflation with maintaining low unemployment rates. However, the governor’s stance shifted this week.

Lowe emphasized that the path ahead would be difficult. Furthermore, he said prioritizing reducing high inflation would take precedence over job preservation.

This change in approach had led economists to factor in at least one more rate hike and a genuine risk of a recession. It would be the country’s first recession in over three decades, excluding the downturn caused by the COVID-19 pandemic in 2020.

The Commonwealth Bank of Australia currently places the odds of a recession this year at 50%. Additionally, it forecasts a slowdown in growth to an annual rate of 0.7% in the last quarter and an increase in the jobless rate to 4.7% by mid-2024.

The economy is already experiencing a slowdown to below-average levels. Recent data revealed that it grew by just 0.2% in the March quarter. Following the surprise rate hikes in May and June, markets now indicate the possibility of two more hikes reaching 4.6%.

AUD/USD Key Events Today

The pair will likely consolidate with no key economic data from the US or Australia.

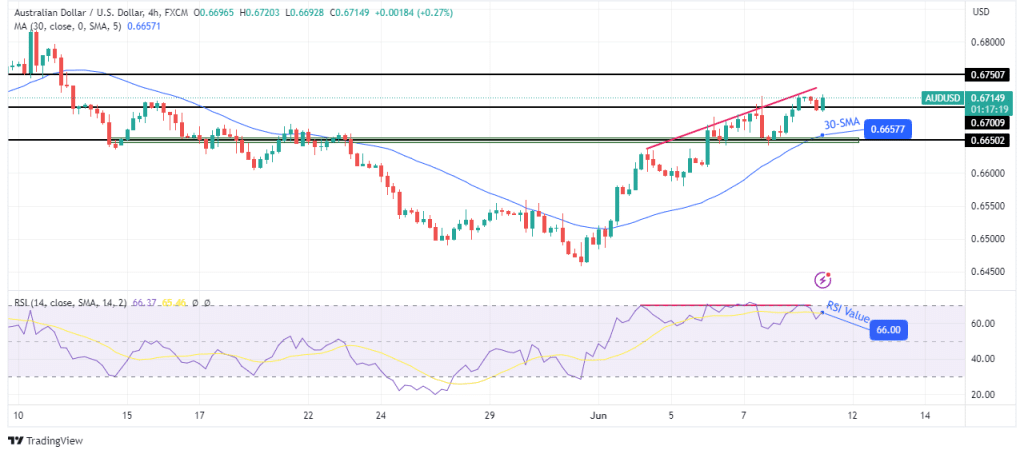

AUD/USD Technical Outlook: RSI Consolidation Points To Bullish Weakness.

(Click on image to enlarge)

AUD/USD 4-hour chart

On the 4-hour chart, the bias for AUD/USD is bullish. The price is consistently making new highs while trading above the 30-SMA. This is a sign buyers are in control. Moreover, the RSI trades above 50, pointing to strong bullish momentum.

However, while the price is making higher highs, the RSI has paused and is moving sideways below the overbought region. This is a sign that bullish momentum is weakening and might lead to a pullback to the 30-SMA and the 0.6650 support.

More By This Author:

USD/CAD Forecast: Rising Oil Prices To Support CADAUD/USD Weekly Forecast: RBA to Hike Rates Amid Hotter CPI

USD/CAD Weekly Outlook: Markets Lean Towards Fed’s Pause