Unprecedented Bull Market In Precious Metals Complex: What’s Next?

Image Source: Unsplash

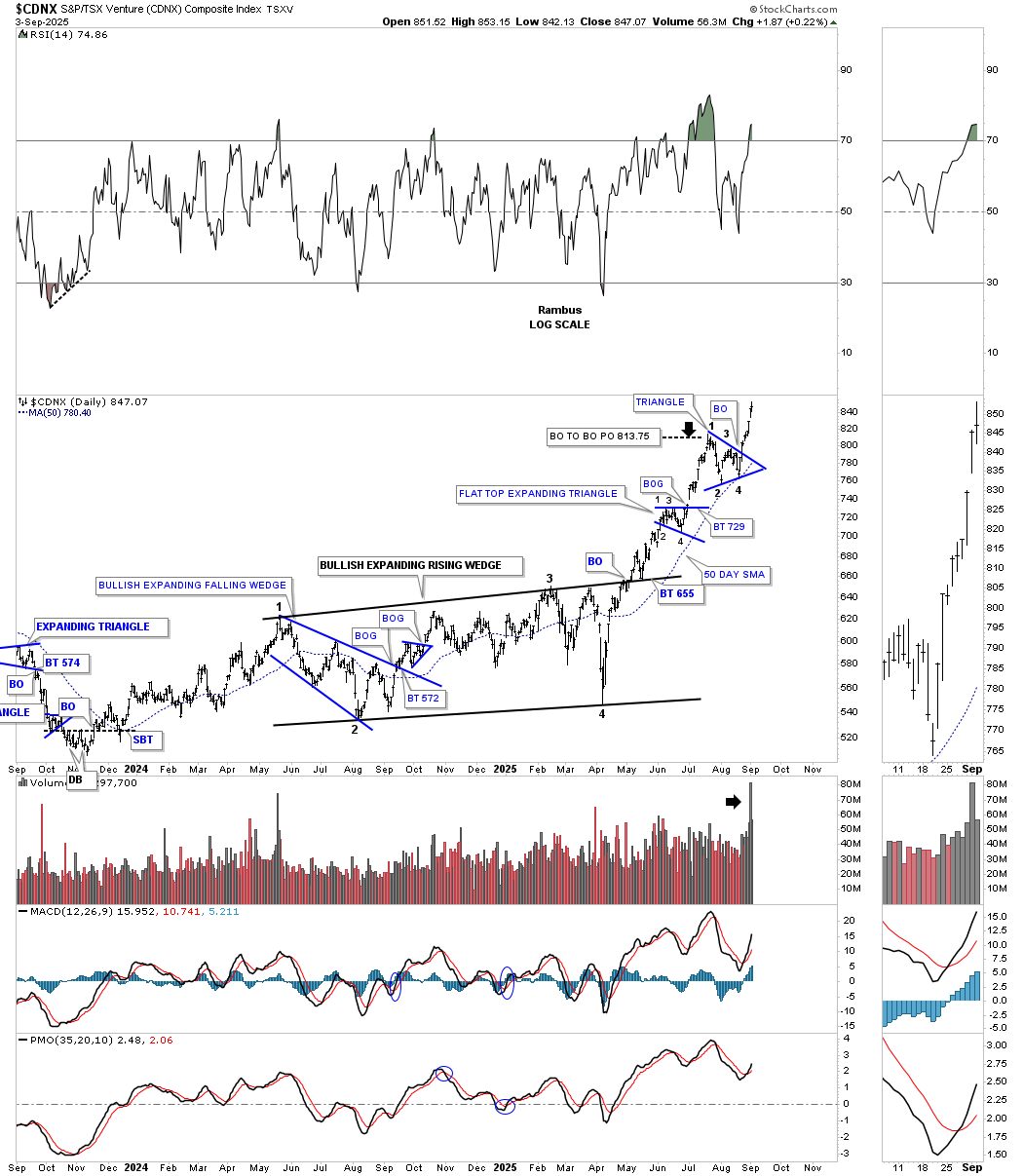

If you’ve been wondering why many of the junior and micro-cap PM stocks are beginning to show some life, the CDNX is a good index to look at. One of the most beaten-down areas within the PM complex have been the junior and micro-cap stocks, which have gotten no love until April of this year, 2025. At the April low on the CDNX, Canadian Venture Composite, where many of the junior and micro-caps reside, this beaten sector put in the 4th reversal point in its one-year bullish expanding rising wedge consolidation pattern, which is a pattern few chartists recognize, but is a very bullish pattern.

Since that April low, the CDNX has been on fire and just completed the second consolidation pattern since the breakout above the top trend line of the bullish expanding rising wedge. What makes this particular bullish expanding rising wedge so bullish is that it’s just the right shoulder of a much larger H&S bottom. Note how the volume has increased since the breakout of the most recent triangle consolidation pattern.

To show you how the bullish expanding rising wedge on the daily chart above fits into the bigger picture, below is a longer-term daily chart, which shows the bullish expanding rising wedge forming the right shoulder of the much larger three-year double H&S bottom. Note how well the neckline symmetry line showed us where to look for the possible right shoulder low for both necklines #1 and #2. As you can see, the left shoulder formed a symmetrical triangle.

More By This Author:

Backtest Nailed: Silver Breaks OutUS Dollar Short-Term Headwinds For The PM Complex?

Can Big Chart Patterns Lead To Even Bigger Chart Patterns?