Unlocking ASX Trading Success: Mineral Resources

ASX: MINERAL RESOURCES LIMITED - MIN

Elliott Wave Technical Analysis by TradingLounge

Our updated Elliott Wave technical review for MINERAL RESOURCES LIMITED (ASX: MIN) indicates promising upside potential. The recent end of a major fourth wave correction signals the likely start of a fifth wave advance. This analysis outlines expected targets and critical invalidation points for traders.

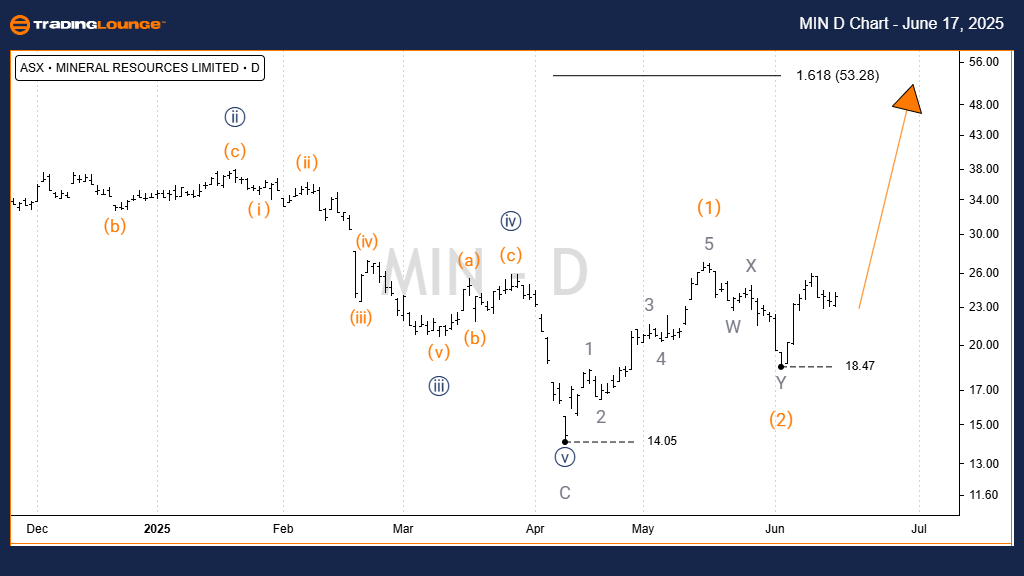

1D Chart Analysis Overview (Semilog Scale)

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Current Position: Wave 3 (orange) of Wave 5 (navy)

Details:

The corrective wave has concluded at the 14.05 level. From this base, a Motive wave is expected to drive prices higher. Our short-term target range lies between $50.00 and $80.00. The bullish outlook remains valid only if the price holds above 14.05.

- Invalidation Point: 14.05

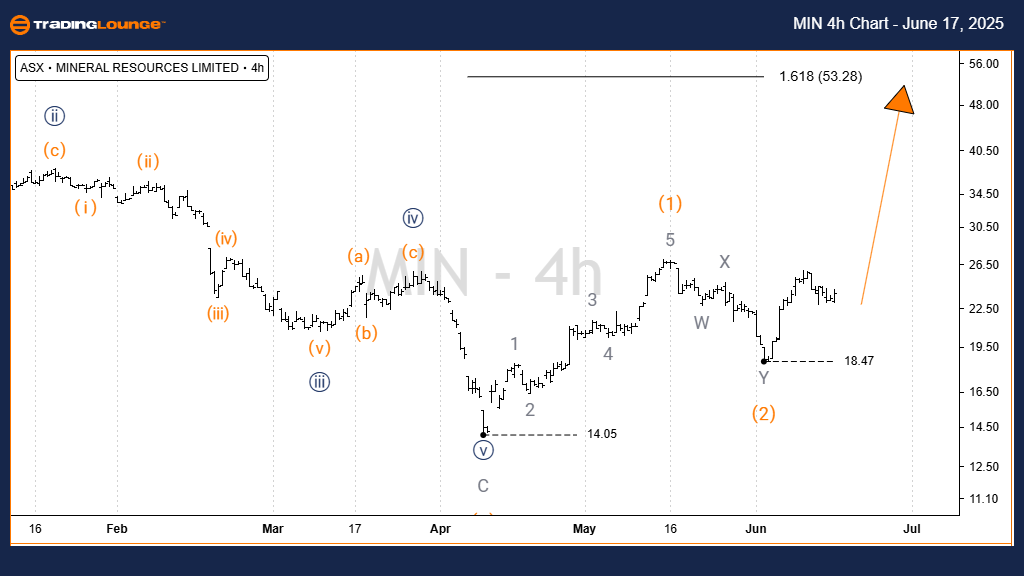

4-Hour Chart Technical View

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Current Position: Wave 3 (orange)

Details:

On a closer scale, Wave 1 (orange) completed at 14.05 as a five-wave structure. Wave 2 (orange) followed with a Double Zigzag correction ending at 18.47. This suggests Wave 3 (orange) is now in progress, targeting the 53.28 high.

- Invalidation Point: 18.47 (Bullish view requires price to stay above this level)

Conclusion

This analysis offers a structured perspective on current trends and possible market movement for MINERAL RESOURCES LIMITED (ASX: MIN). By providing validation and invalidation levels, the forecast enhances confidence in the wave count. Our approach delivers clear, objective insights to assist traders in making informed decisions.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Certified Elliott Wave Analyst - Master Level)

More By This Author:

Elliott Wave Technical Analysis: Natural Gas - Monday, June 16

Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Monday, June 16

VeChain Crypto Price News Today - Monday, June 16

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more