Unlocking ASX Trading Success: Mineral Resources Limited - Wednesday, July 9

ASX: MINERAL RESOURCES LIMITED – MIN

Elliott Wave Technical Analysis

Greetings,

Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) stock MINERAL RESOURCES LIMITED – MIN. We observe a significant upside potential in ASX:MIN: a major fourth-wave correction appears to have ended, likely marking the start of the fifth wave. This report will highlight target levels and invalidation points.

ASX: MINERAL RESOURCES LIMITED – MIN

1D Chart (Semilog Scale) Analysis

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3 of Wave 5 (orange/navy)

Details:

A large corrective wave resolved at the 14.05 low, clearing the path for a motive wave to push higher. Next targets range between $50.00–$80.00. For our bullish outlook to remain valid, price must stay above 14.05. A dip under 18.47 doesn’t invalidate the bullish case; instead, it indicates that wave 2 (orange) is extending before wave 3 (orange) resumes upward movement.

Invalidation point: 14.05

ASX: MINERAL RESOURCES LIMITED – MIN

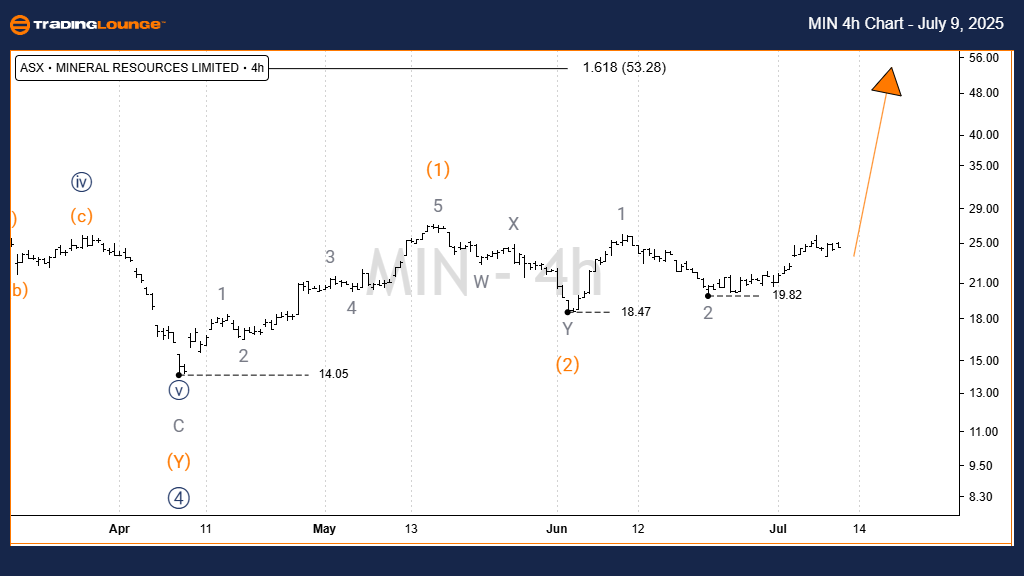

4‑Hour Chart Analysis

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3 (orange)

Details:

Zooming in, since 14.05 wave 1 (orange) completed as a five-wave structure, and wave 2 (orange) corrected with a Double Zigzag at the 18.47 low. This suggests wave 3 (orange) has commenced, targeting the 53.28 high. Again, minor dips below 18.47 don’t negate the bullish bias but reflect wave 2’s extended structure. Maintaining prices above 14.05 is key for this outlook.

Invalidation point: 14.05 (prices must remain above this level)

Conclusion:

Our analysis delivers a balanced view of ASX: MINERAL RESOURCES LIMITED – MIN, combining broader and short‑term wave perspectives. We specify clear price levels for validation and invalidation to reinforce confidence in our wave count. With this approach, we aim to provide readers with a professional and objective market perspective, helping to capitalize effectively on current trends.

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

More By This Author:

Elliott Wave Technical Forecast: Unibail‑Rodamco‑Westfield

U.S. Stocks: The Walt Disney Co. - Tuesday, July 8

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Tuesday, July 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more