U.S. Stocks: The Walt Disney Co. - Tuesday, July 8

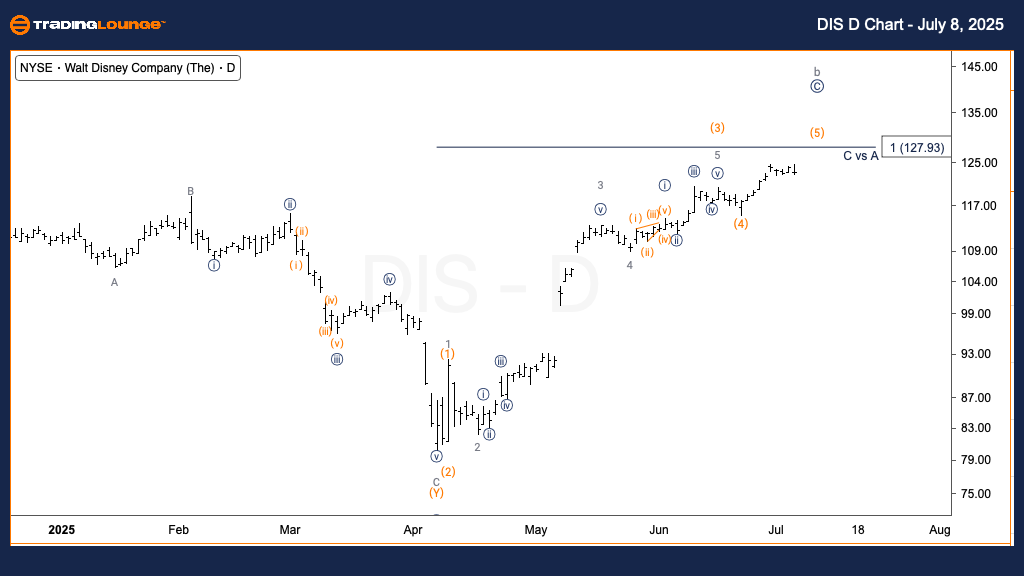

The Walt Disney Co. (DIS) Daily Chart

DIS Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (5) of C

DIRECTION: Top in Wave (5)

DETAILS:

The uptrend that began from the April 7th low appears to be nearing completion. The equality of Primary Wave C with Wave A targets the $128 level.

On the daily timeframe, The Walt Disney Co. (DIS) is in the late stages of a corrective rally, forming wave (5) of C. The move has developed in a motive structure, rising from April 7th lows. With wave C nearing equivalence to wave A at $128, this price zone is critical for identifying a potential market top. If wave (5) completes around this area, it may mark the end of the corrective cycle and signal a directional shift.

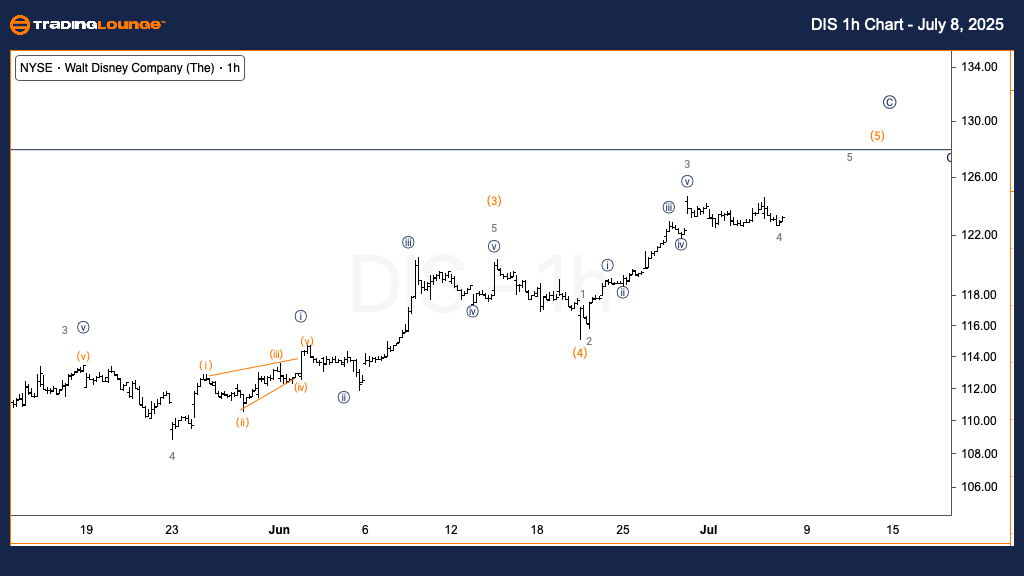

The Walt Disney Co. (DIS) 1H Chart

DIS Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave 4 of (5)

DIRECTION: Upside in Wave 5

DETAILS:

Wave 4 of (5) is underway, with expectations of one more leg up into wave 5 of (5).

A bullish alternative also suggests this structure could be part of wave 1 and 2 of a new impulsive trend.

The 1-hour chart for DIS supports a continuation of the uptrend, with wave 4 of (5) nearly complete. A final leg into wave 5 of (5) is anticipated. This would finish the larger corrective wave C. However, an alternative count hints at the formation of waves 1 and 2 within a new primary impulsive trend. If the bullish count plays out, prices may push significantly above current levels, challenging key resistance zones.

Traders should monitor closely near the $128 resistance level for potential reversal signals or confirmation of continued bullish strength.

Technical Analyst: Alessio Barretta

More By This Author:

Elliott Wave Technical Forecast: Unibail‑Rodamco‑Westfield

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Tuesday, July 8

Elliott Wave Technical Analysis: VeChain Crypto Price News For Tuesday, June 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more