Unlocking ASX Trading Success: Cochlear Limited - Wednesday, June 18

COCHLEAR LIMITED - COH Elliott Wave Technical Analysis TradingLounge

Greetings,

Today’s Elliott Wave update from TradingLounge focuses on COCHLEAR LIMITED - COH, a key player on the Australian Stock Exchange (ASX). Based on current analysis, COH may have completed a Wave 2 correction and is now beginning a Wave 3 rally, which could signal further upside. This article highlights the next price target, the invalidation level of our wave count, and the possible medium-term trend for this stock.

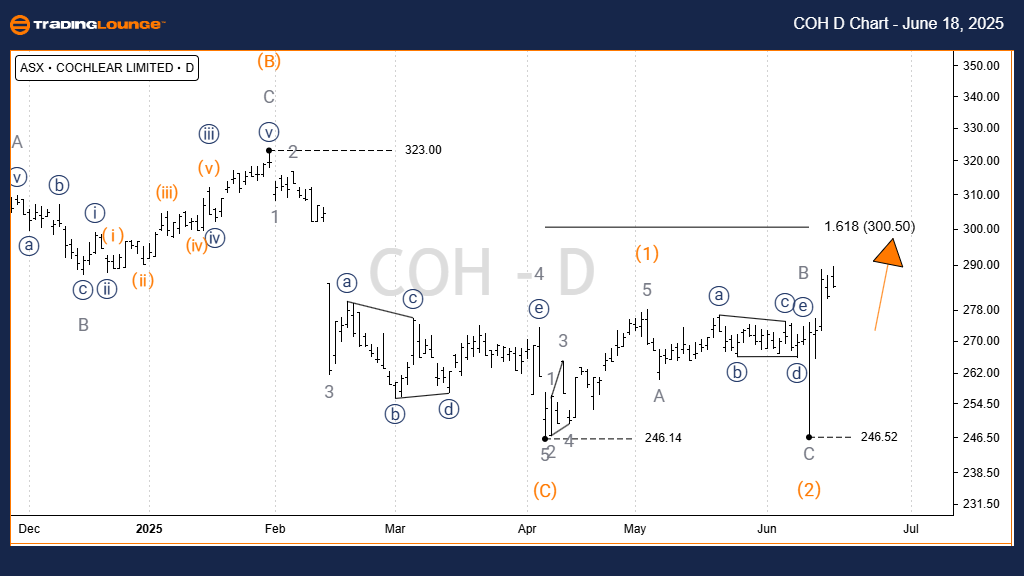

COCHLEAR LIMITED - COH Elliott Wave Technical Analysis (1D Chart – Semilog Scale)

- Function: Major trend (Intermediate degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 5)) - navy

Details:

It appears that Wave 4)) - navy ended with a three-wave corrective move labeled A, B, C) - orange. The price action now hints at the start of Wave 5)) - navy, likely pushing the stock higher. This wave could drive the price back toward the $350.00 level, which marked the top of Wave 3)) - navy.

- Invalidation point: 246.52

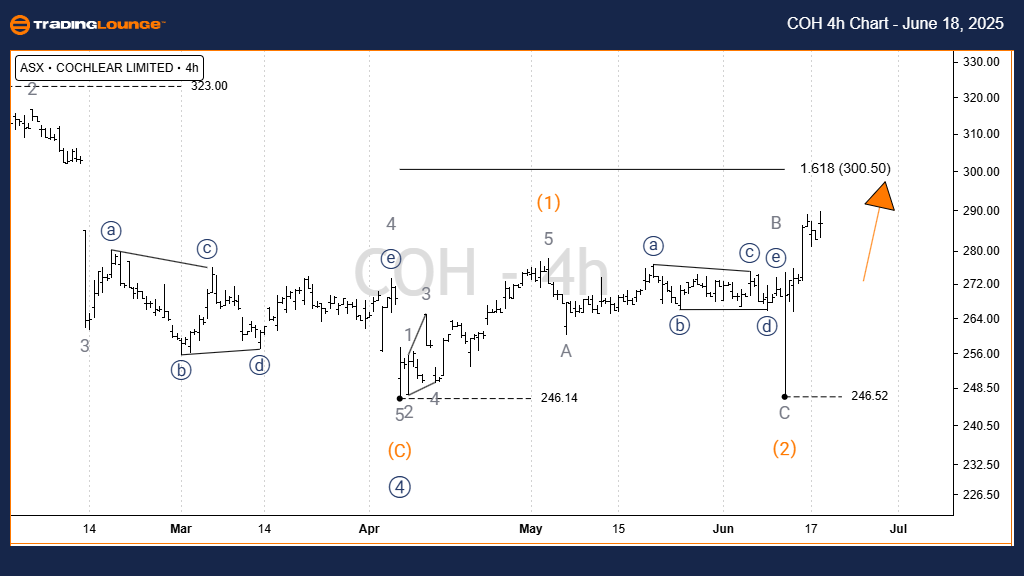

COCHLEAR LIMITED - COH Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

- Function: Major trend (Intermediate degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave B - grey of Wave 2) - orange

Details:

On the shorter timeframe, following a Diagonal Wave 1) - orange, COH experienced a strong decline during Wave 2) - orange, forming a classic Zigzag pattern. This corrective wave appears to have ended at 246.52, setting the stage for Wave 3) - orange. This next move could aim for $300.50 or potentially higher.

- Invalidation point: 246.52

Conclusion

Our forecast aims to give a clear picture of COCHLEAR LIMITED - COH’s technical outlook. We outline both medium-term and short-term trends to help traders act confidently. By identifying precise validation and invalidation levels, we enhance the clarity and reliability of our wave counts. This approach helps traders make informed decisions based on clear, professional market analysis.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Certified Elliott Wave Analyst - Master Level

More By This Author:

Unlocking ASX Trading Success: Mineral Resources

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Tuesday, June 17

Elliott Wave Technical Analysis: Shanghai Composite Index - Tuesday, June 17

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more