Unlocking ASX Trading Success: Car Group Limited - Wednesday, April 23

ASX: CAR GROUP LIMITED – CAR

Elliott Wave Technical Analysis – TradingLounge

Greetings, our Elliott Wave analysis today focuses on CAR GROUP LIMITED (ASX:CAR).

We believe ASX:CAR may have recently completed a corrective wave—specifically, wave (4) orange as a Zigzag pattern. This development opens up new bullish potential. The following analysis outlines the probable next trend and key levels that validate or invalidate this view.

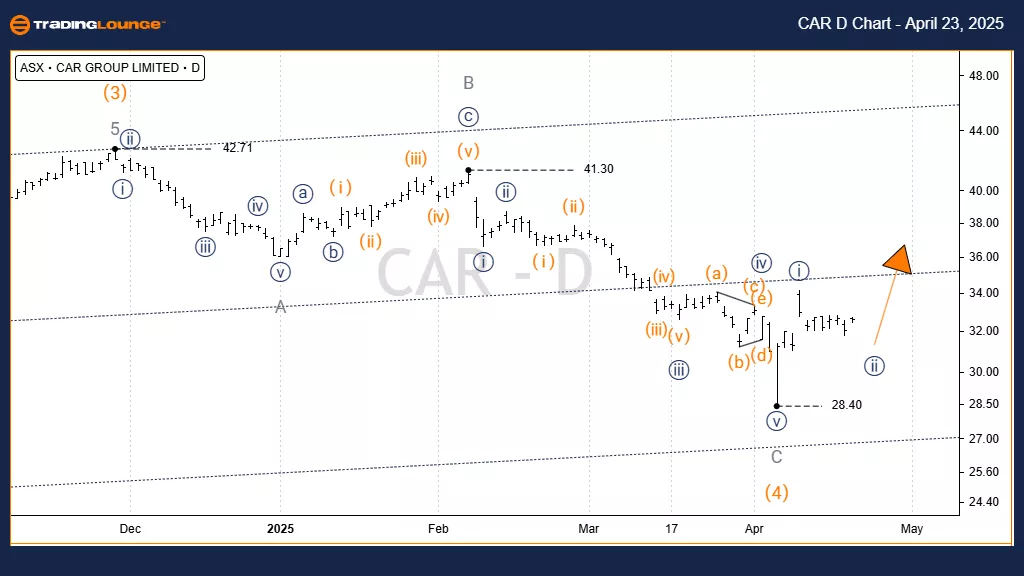

1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ii)) navy of Wave (5) orange

Details:

Wave (4) orange has likely ended near the 28.40 low after forming a Zigzag labeled A-B-C grey. The C wave displayed a five-wave structure, suggesting it has completed. Consequently, wave (5) orange appears to be unfolding. The market has completed wave i)) navy and is now forming wave ii)) navy, which is still pushing slightly lower. Once this correction ends, wave iii)) navy is expected to resume the uptrend.

Invalidation Point: 28.40 – Prices must stay above this level to maintain this bullish outlook.

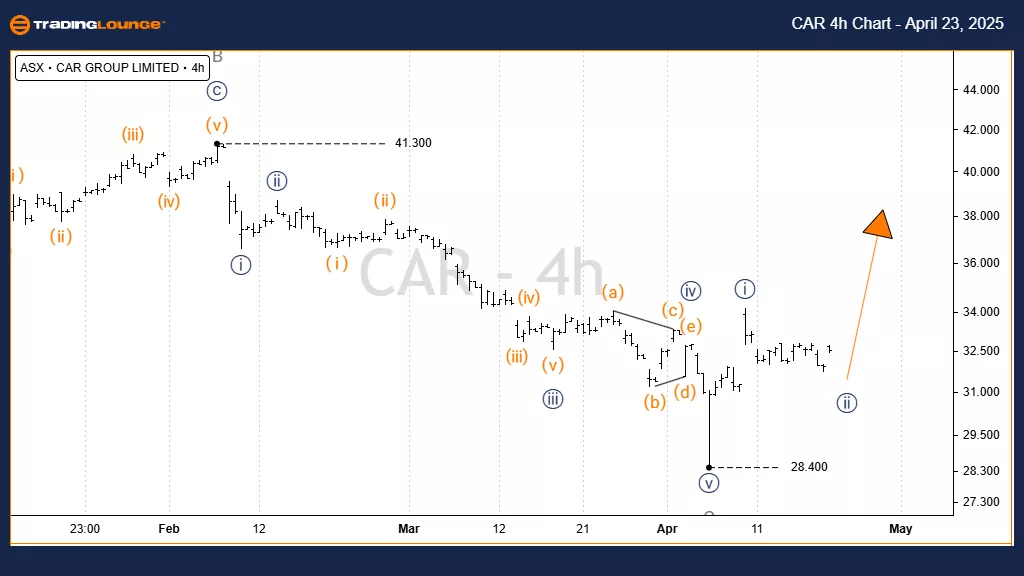

4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii)) navy of Wave (5) orange

Details:

Since the 28.40 low, wave i)) navy completed successfully. We are now witnessing wave ii)) navy developing further downward pressure. This wave may not be finished yet. Once it concludes, we expect wave iii)) navy to push back up—potentially retesting the 41.30 high.

Invalidation Point: 28.40 – A breach below this would invalidate the current count.

Conclusion:

Our updated Elliott Wave outlook for CAR GROUP LIMITED (ASX:CAR) delivers both contextual trend insights and actionable short-term perspectives. The analysis outlines precise price levels to support or invalidate the wave count, boosting confidence in trade setups. This objective framework offers readers a reliable guide for navigating market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M

More By This Author:

Elliott Wave Technical Analysis: Palo Alto Networks Inc. - Wednesday, April 23

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Wednesday, April 23

Elliott Wave Technical Analysis: Tasi Index - Wednesday, April 23

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more