Wednesday, February 19, 2025 12:28 PM EST

Photo by Colin Watts on Unsplash

Let’s start with the bad news: UK headline inflation is back at 3%, up from 2.5%, after briefly dipping below the Bank of England’s 2% target last Autumn. That’s a tad higher than expected, though almost entirely because of a near-1% month-on-month increase in food prices, which is hard to explain. Even so, headline CPI is poised to remain in the 3% region for much of this year and we expect a peak of 3.5% later this year. Much of this can be traced back to household energy bills, which are set to increase again in April due to rising wholesale natural gas prices.

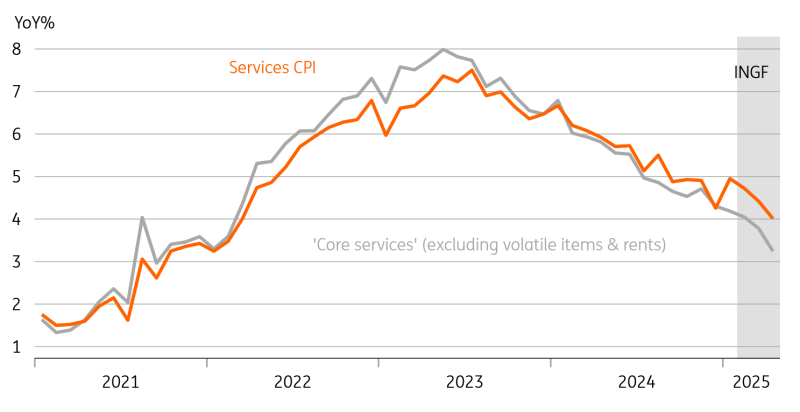

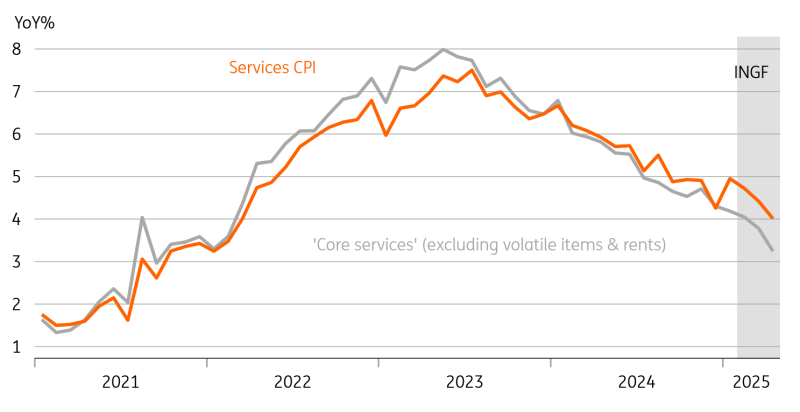

But energy and food are of little relevance to the BoE’s decision-making. What really matters is service sector inflation, and here the news is getting better. Admittedly services CPI did rebound up to 5%, though that was lower than expected and followed an artificially low reading in December. Airfares didn’t properly account for the usual surge in prices around Christmas.

Again though, airfares don’t matter for monetary policy. And once you strip out the volatile items as well as rents, ‘core services’ inflation is falling. There isn't a single official measure of this, but when we calculate it, we tend to strip out things like airfares, package holidays, and also rents. Rental growth has been relentless, but the Bank of England doesn't seem to put much weight on it.

By our calculations, that measure of ‘core services’ inflation now sits at 4.2%, down from 4.7% two months ago.

UK services inflation measures

Core services excludes items like air fares, package holidays, education and rents

Source: Macrobond, ING calculations

We expect this trend to continue. We think the measure of ‘core services’ can dip below 4% within the next couple of months, while overall services inflation could be there by the summer. Crucially, that’s a faster fall the Bank of England is currently forecasting. Huge chunks of the services basket are subject to annual price hikes in April, which owing to lower headline inflation, should be less aggressive than they were in April 2024.

If we’re right, that wouldn’t necessarily speed up the pace of rate cuts, but it would help cement a total of four cuts this year. We also expect rates to fall to 3.25% in 2026, which is a fair bit lower than markets are currently pricing.

More By This Author:

The Commodities Feed: Supply Risks Vs. Peace Talks

FX Daily: Euro Paying EU’s Isolation

Japan’s Export Jump May Be Calm Before Trumpian Storm

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.