Japan’s Export Jump May Be Calm Before Trumpian Storm

Image Source: Pixabay

Exports remain solid in January, but the outlook is clouded by mounting tariff threats

Japanese exports rose 7.2% year-on-year in January (vs 2.8% in December, 7.7% market consensus).

The US was the standout destination for Japan Inc., with overseas shipments to the globe’s biggest economy posting a strong 8.1% increase. This, however, appears due to front-loading before the full scope of US President Trump’s plans for tariffs. Exports to China fell 6.2%, probably due to the Lunar New Year holiday. Despite weak exports to China, shipments to Asia and ASEAN rose 6.3% and 15.6%, respectively. Regional commerce is showing healthy gains, and we believe that the rerouting of China trade flows may be one reason for the recent strength in interregional exports.

Transportation equipment, the largest export category, grew a solid 12%. Ships surged 106.9%, while motor vehicle exports increased 10.5%. Automakers in particular appear to be rushing to ship products ahead of US levies on cars. We suspect medical products jumped a robust 23.4% for similar reasons.

Meanwhile, imports rose a bigger-than-expected 16.7% (vs 1.7% in December, 9.3% market consensus). This surge led to a trade deficit of -2,758 trillion JPY. Imports of capital goods rose strongly. Overall machinery and electrical machinery orders, for example, increased 46.9% and 18.2%, respectively. This bodes well for rising capital investment in the current quarter.

Transportation equipment rose solidly in January

Source: CEIC

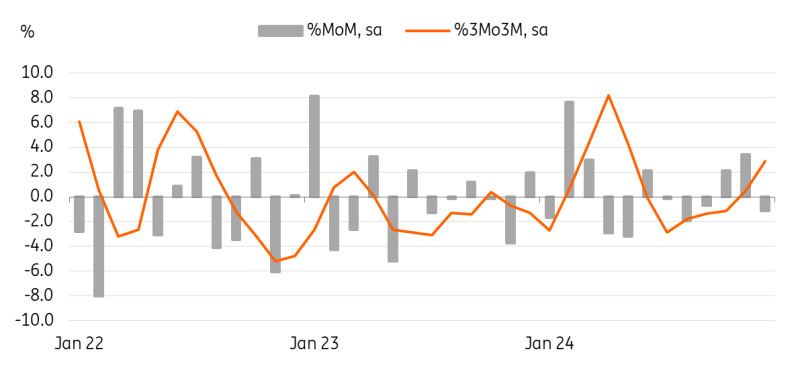

Core machinery orders fell for the first time in three months

Separately, core machinery orders unexpectedly fell by 1.2% month-on-month, seasonally adjusted (vs 3.4% in Nov, 0.5% market consensus), after solid increases in the previous two months. But when smoothing out monthly volatility, core machinery growth accelerated to 2.9% quarter-on-quarter, seasonally adjusted, in December from -1.3% in September. The January increase in imports of capital goods and core machinery orders may offer rays of hope following Monday's gross domestic product report, which saw a drop in imports. But amid great uncertainty about the Trumpian storm to come, Japan's 2025 outlook remains cloudy.

Core machinery orders point to a recovery in investment in the current quarter

Source: CEIC

More By This Author:

UK Jobs Market Stable Despite Growing PessimismThe Commodities Feed: Copper Retreats From Three-Month Highs

FX Daily: Dollar Starts Its Rebound

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more