The Year The Bond Market And The Bank Of Canada Parted Ways

What a difference a year makes when it comes to setting monetary policy. In October 2018, the Bank of Canada (BoC) raised its overnight rate to 1.75%, satisfied that it was “appropriate” for the current and near-term economic conditions. For the past 15 months, at each of its policy rate meetings, the BoC re-affirmed that there was no need to cut rates. Meanwhile, the Federal Reserve and other central banks were cutting rates during 2019, in anticipation of a slowdown due to trade and geopolitical events. The BoC saw no reason to do the same. At the beginning of 2019, the Canadian yield curve exhibited all the characteristics one would expect for an economy that was growing within the established inflationary guidelines. The curve was positively sloped and real long- term rates were also positive.In short, the bond market and the BoC were on the same page starting at the beginning of 2019.

(Click on image to enlarge)

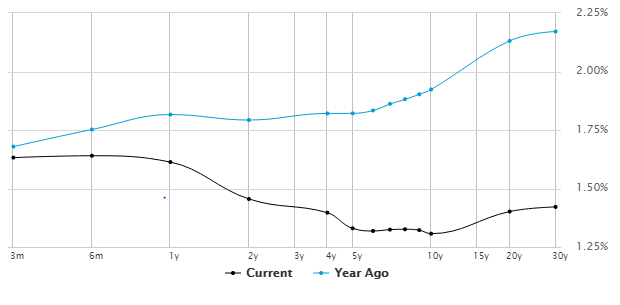

Canadian Government Bond Yields, Feb 2019 vs Feb 2020

It did not take long for the bond market to detect signals that Canada was headed for a recession. By spring 2019, long term bond yields started to fall steadily and as the year wore on, the yield curve, first flattened, and subsequently inverted. Strangely, this inversion was characterized by Governor Poloz as “innocent”, another way of saying that the inversion is irrelevant when it comes to forecasting future growth.Accordingly, the BoC continued through the year to maintain that the bank rate was “appropriate”. Accordingly, there was no reason to emulate what the Federal Reserve or the ECB were doing to counter the effects of the slowdown on international scale.

In its January 2020 rate decision, the BoC supported its position to maintain the bank rate: “Looking ahead, Canadian business investment and exports are expected to contribute modestly to growth, supported by stronger global activity and demand. The Bank is also projecting a pickup in household spending, supported by population and income growth, as well as by the recent federal income tax cut. In its January MPR, the Bank projects the global economy will grow by just over 3 percent in 2020 and 3 ¼ percent in 2021. For Canada, the Bank now forecasts real GDP will grow by 1.6 percent this year and 2 percent in 2021, following 1.6 percent growth in 2019.”

Canadian bondholders do not share any of this outlook. The Canadian bond market has fully inverted such that all bonds from 3- months to 30 years are less than the bank rate. Given that inflation is running around 2 %, Canadian bonds are negative in real terms. Surely, what was “appropriate” for the start of 2019 can't be “appropriate” for the start of 2020 according to the yield curve. The curve indicates a recession is on its way and it will get worse the longer the BoC delays a change in monetary policy.

So are yields declining due to flight to safety or because a Canadian recession is built in? Kudlow was out saying the US economy is strong and that declining bond yields are simply a flight to safety.

Kudlow statement is a total contradiction in terms. I never had much respect for his his understanding of economics. If the economy were so strong then why is there a flight to safety? Strong economies have upper sloping yield curves.

The Canadian bond market is taking its cue from the US bond market which is also inverted. At the same time oil and other commodity prices are weak. Manufacturing has been declining for nearly six months straight. And Canada now feels a chill from China and its impact upon worldwide supply chains. The Canadian stock market hit an all-time high earlier in the week so we can't say there's any flight to quality

Simply bond investors have a completely different outlook on the future compared to stock market investors.