The Shift In How Canadian Banks Do Business

While the banking industry came through the pandemic in a relatively strong position, the future of global banking remains very uncertain, according to a recent report by McKinsey (Global Banking). Earnings multiples and valuations for the banking sector do not stack up well compared to the performance of near competitors and the overall market. Specifically, banks have underperformed with respect to two key measurements: price/earnings (P/E); and rate of return on equity (ROE). Hence, the report notes that “banking is currently valued more in line with an average utility, with a price-to-earnings ratio (P/E) of 15 times, than with a specialized financial services provider, where P/Es are 20 to 30 times.”

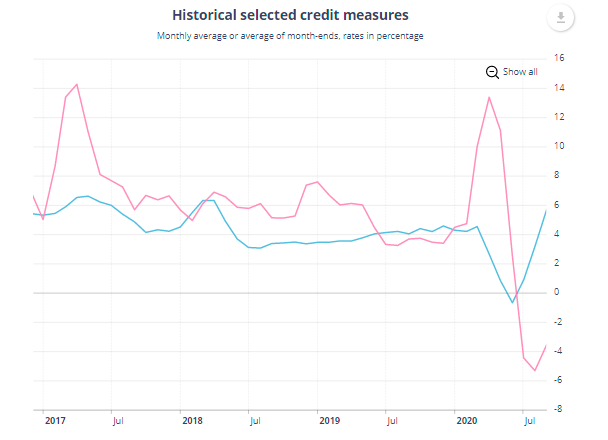

The Canadian banks have fared considerably well during the pandemic. Initially, they set aside very large provisions for loan losses, only to re-instate them in subsequent quarters, boosting profits each quarter. However, the industry continues to create credit on a relatively slow scale with household credit growing at less than 6%, while business credit continues to decline (Figure 1). It is no wonder that the Canadian banks, en masse, announced large dividend increases (averaging 10%) and share buybacks. Simply, the industry is not able to deploy all its capital fully and chose to reward its investors instead.

Figure 1 Canadian Banks Business Credit (Red) and Household Credit (Blue)

Source: Bank of Canada

Canadian banks seem to have settled into specific market patterns. The all-important mortgage industry has become a commodity in which the banks are falling over each other to attract customers with incentives to switch lenders and offer heavy discounts to posted mortgage rates. A similar pattern has emerged with respect to consumer credit, especially credit cards. The corporate sector has shifted much of its borrowing to the corporate bond market to take advantage of very low fixed rates for 5 years or more. Those who are not able to tap the investment-grade market have found good opportunities in high-yield corporate bonds.

The McKinsey report stresses:

“If we split revenues between those generated by the balance sheet and those that come from origination and sales (for example, mutual funds distribution, payments, consumer finance), the trend is clear: growth and profitability are shifting to the latter category, which has an ROE of 20 percent—five times higher than the 4 percent for balance-sheet-driven business—and now contributes more than half of banks’ revenues.”

In other words, banks will no longer rely on future growth from traditional lending activities which utilize deposits as a source of capital to lend to businesses and households. Instead, growth comes from investment banking and client portfolio management ---standard capital market activities which are fee-based and require much lower capital requirements. The banks no longer look to their asset bases as a source of generating profits, especially in a low-interest-rate environment. Canadian banks experience a segmentation in profitability. Small-medium size business are finding it harder to obtain capital, as banks shift resources to extending their capital market activities to take advantage higher rates of return.