The Ruble: Convertible No Longer

From Anders Aslund at Project Syndicate:

And on March 8, the central bank decided to stop exchanging rubles for foreign currencies, which means that the ruble is no longer convertible.

More specifically, from Law360:

[T]he Bank of Russia said that citizens holding accounts in dollars and other convertible currencies can withdraw no more than $10,000 in cash until Sept. 9. Withdrawals will be given in dollars, at the market rate on the date, regardless of which currency the account is in.

“Banks may take several days to bring the required amount in cash to a specific branch,” the central bank said. Citizens can withdraw the rest of their cash held in foreign currency accounts in rubles at the market rate on the day of issue, the Bank of Russia added.

Russians will continue to be able to hold funds in foreign currency accounts. Lenders will not sell currency to citizens during the next six months, but they can exchange cash currency for rubles at any time and in any amount, the Central Bank of the Russian Federation, as it is also known, said.

The latest controls on the movement of capital were imposed after a decision by the Bank of Russia on Feb. 28 to block foreign investors from selling Russian securities and an order for the Moscow stock exchange to remain closed, as it attempts to stem the flow of money out of the country.

President Vladimir Putin has in the meantime approved a special executive order calling for foreign debt to be repaid in rubles, including on bonds originally issued in foreign currencies, to maintain the stability of the Russian market and protect the interests of creditors.

Concerns are mounting that Russia will have problems serving its hard-currency debt after a string of unprecedented financial sanctions imposed by Britain, the U.S. and Europe.

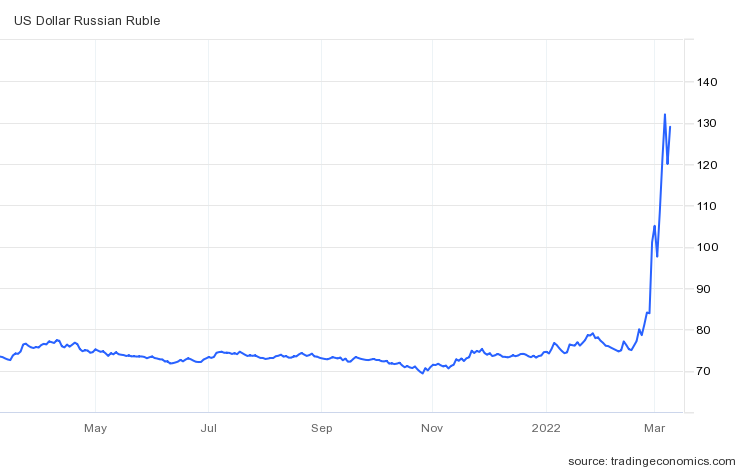

The ruble has collapsed, with no real recovery in value, despite some fluctuations.

A longer perspective highlights how truly disastrous the collapse is.

(Note: time-averaged data in this long-span graph).

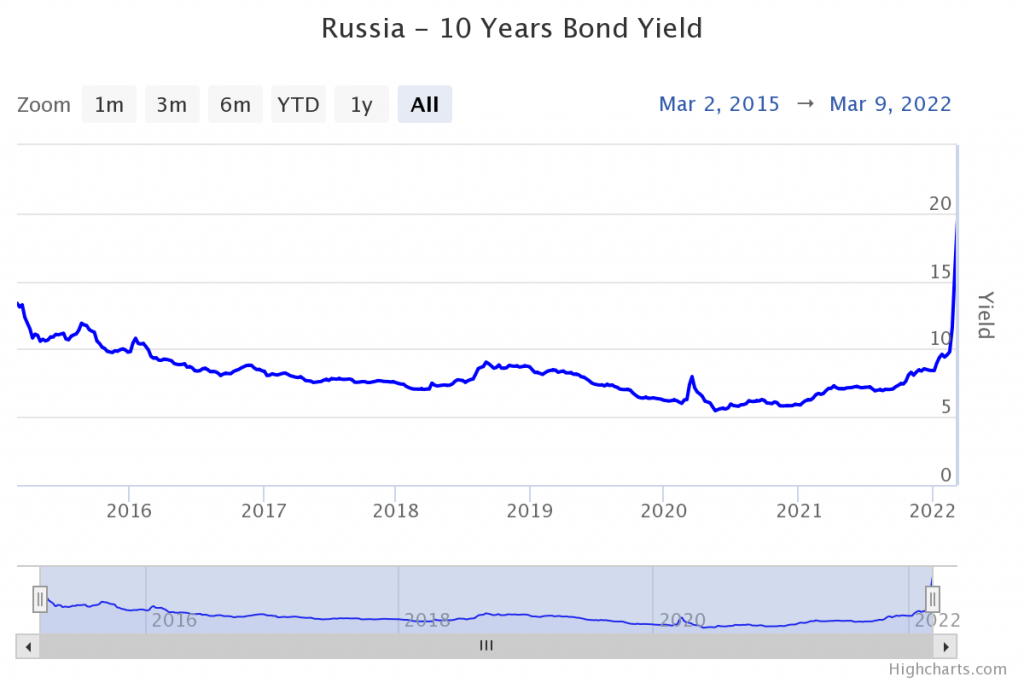

The policy rate remains at 20%, while sovereign yields have skyrocketed. Once again, looking at the longest span available.

CDS on 5-year bonds were on March 3 412 (a record going back as far as 2015), with an implied probability of default of 6.87% assuming a 40% recovery rate (WorldGovernmentBonds). However, an March 5th FT article notes that the implied probability of default inferred from CDS’s might be misleading:

Russia’s five-year CDS now trades at around 45 percentage points upfront, a level that implies investors can expect to receive more than 50 cents on the dollar in a restructuring of Russia’s foreign debt. The price of the bonds themselves, however, at around 20 cents on the dollar indicates a much less favourable outcome for holders.

The issue could come to a head if Russia fails to make its next interest payment on its dollar debt on March 16, something investors see as increasingly likely. Moscow this week made an interest payment on its rouble-denominated debt — which is not covered by CDS — but said the money would not reach foreign holders, citing a central bank ban on sending foreign currency abroad.

Some traders even fear that the swaps could end up not paying out anything at all, emulating previous CDS mishaps such as car rental company Europcar in 2021 and Dutch lender SNS Reaal in 2013.

Analysts at JPMorgan say the small print of some of the debt may mean the bonds are beyond the scope of CDS in the event of a default. Six of Russia’s 15 dollar bonds contain a “fallback mechanism” allowing Moscow to repay in roubles rather than dollars or euros.

A further three bonds are subject to settlement in Russia, meaning they have effectively become untradeable since Russian authorities blocked offshore settlement at Euroclear.

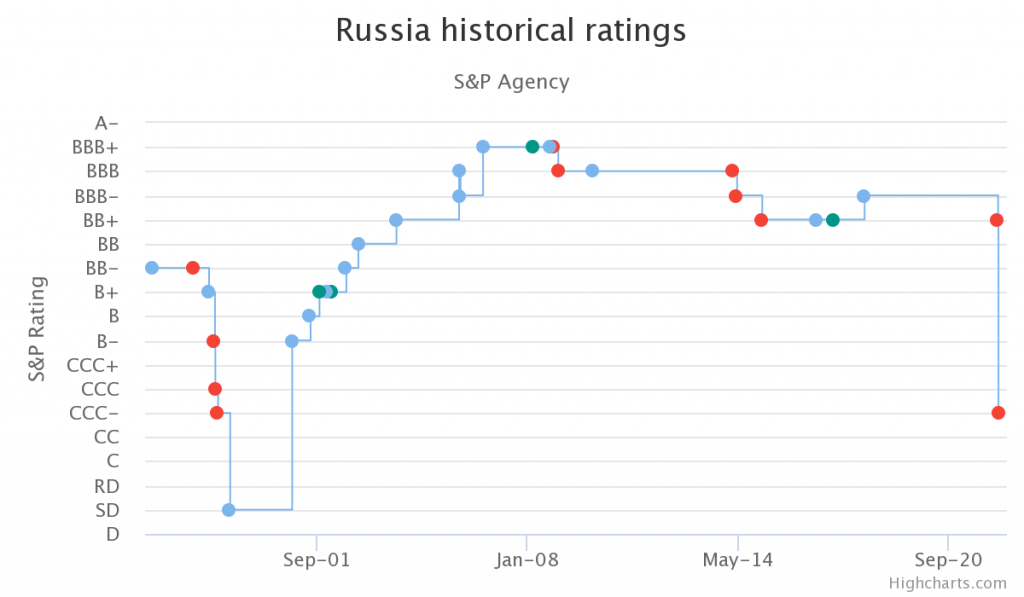

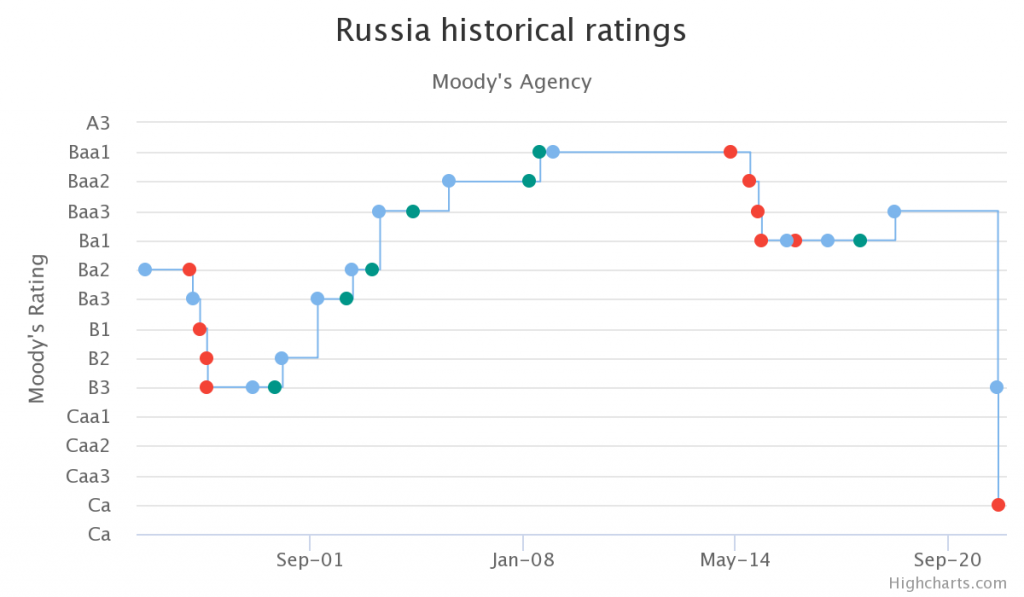

Here’re time series on the credit ratings for Russian sovereign debt, from S&P, and from Moody’s.

So we are headed toward a (very) likely sovereign default.

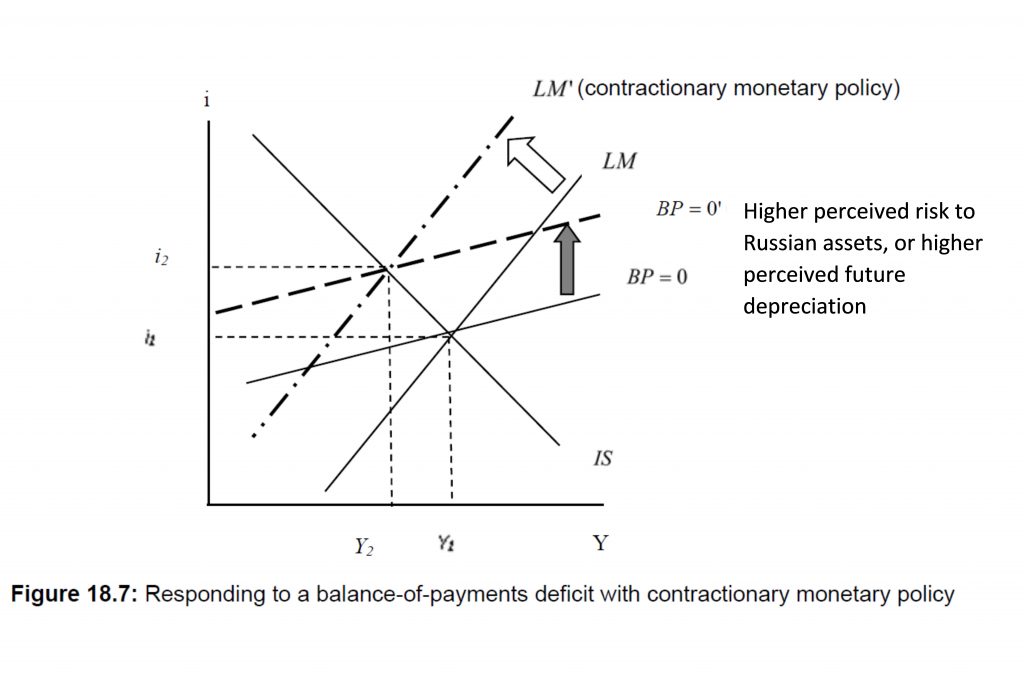

Two weeks ago, I interpreted the external macro situation thus:

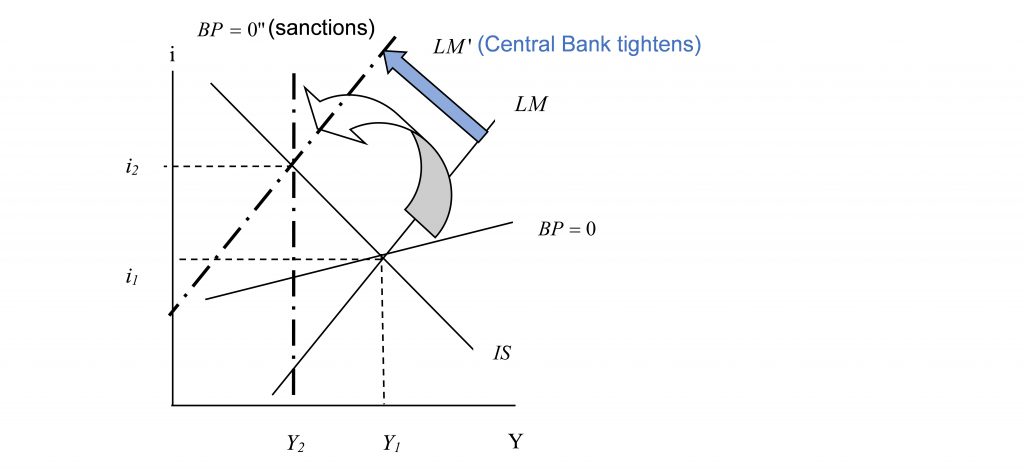

This depiction is no longer relevant. The closest description is “sudden stop” combined with reserve exhaustion. Between the imposition of sanctions, the end of currency convertibility, the situation is more like the below, where the BP=0 line has rotated counterclockwise.

Figure 18-6 (modifed) from Chinn-Irwin textbook.

At income level Y1, interest rate i1, reserves are being decumulated. The money supply would shrink as reserves flow out (unless those flows are sterilized); but the central bank has raised rates — here I depict it as sufficiently high to staunch outflows (at i2). I’m not sure that’s the case. If that’s not the case, then available reserves (those not frozen) will be exhausted.

Disclosure: None.