The Next China For Silver

Image Source: Pixabay

China’s dominance of the solar manufacturing industry runs to the tune of +80%, so it’s not surprising that country dominates silver headlines.

But investors need to take stock of India’s growing influence on silver markets. Long known as precious metals afficionados, Indians have been storing their wealth in gold and silver for a very long time.

Indians buy gold and silver as a method of savings, especially because it can always be sold for cash if needed, and because they have little trust in their currency which has gone through endless, dramatic cycles of debasement.

Indians are big gold buyers, and they buy with excess cash following their harvest season. Hindus will often wait to make larger gold purchases for their fall festivals of Dhanteras and Diwali.

India and East Asia together represent about 65% of global silver jewelry demand. Silverware represents about 6% of silver demand, with most of that coming from India.

Although India’s affinity for silver has mostly been for physical coins and bars, silverware and silver jewelry, the nation of 1.45 billion people is enjoying a strong and growing economy. As the country continues to modernize, they are turning to renewable energy along the way, and that means a lot more solar power.

And according to the International Energy Agency (IEA), India will lead the world with the largest energy demand growth of any nation over the next 30 years. It seems highly likely that a lot of that will go to renewable energy.

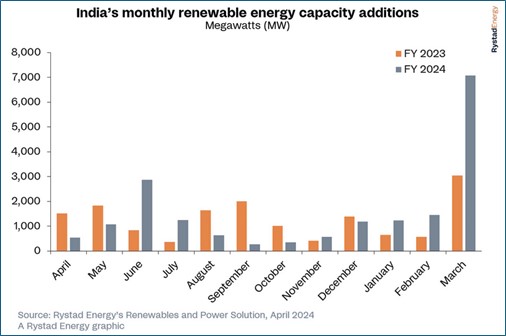

This chart from Rystad shows a massive surge in renewables so far and forecast for 2024 over 2023.

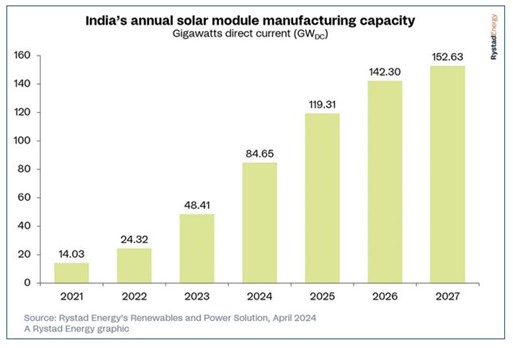

In fact, research from Rystad Energy suggests India will see explosive growth in solar manufacturing capacity over the next three years. According to their estimates, India is set to triple its panel manufacturing capacity by 2027.

Adani Green Energy is turning large swathes of barren land in India’s Gujarat State into the world’s largest renewable energy park. It will take five years to build, but when finished it’s estimated to be five times the size of Paris and will meet the energy demands of a population the size of Switzerland’s.

Once ready, this desert will host wind turbines but mostly solar panels, generating 30 GW of energy to power 16 million homes.

As the solar industry itself transitions to more advanced technologies like TopCon and HJT which require from 50% to 150% more silver than the former PERC technology, the demand for silver is set to soar.

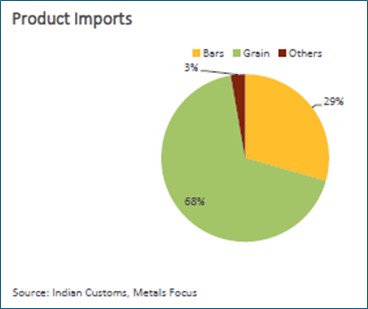

And it seems that has already started to happen in India. This chart shows the breakdown of recent silver imports in July. About two thirds of silver is in grain form, from which it is modified and converted into a usable form, such as silver paste (for solar panels), other applications like electronics, medical applications, silver jewelry and silverware. You can see that some 29% is in the form of bars suggesting this is mostly for investment purposes.

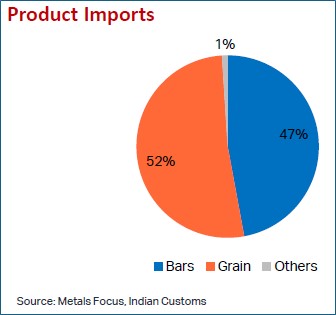

Now look at the same chart from March, and we can clearly see a huge shift from bars toward grains, suggesting demand has moved dramatically towards industrial applications.

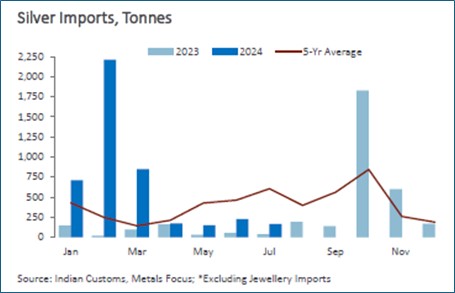

The next chart plots silver imports to India for 2023 and 2024.

Notice the surge in imports this past February, when they reached 70.7 Moz of silver. That was 64% of 2023’s full year imports…in just one month! Last year, India imported about 3,625 metric tons of silver. Indian ministry data show that in the first half of 2023 the country imported 560 tons, while the same period this year saw imports jump to 4,554 tons.

According to Chirag Thakkar, CEO of Amrapali Group Gujarat, a leading silver importer, industrial demand could cause imports to double to between 6,500 and 7,000 tons. Thakkar told Reuters on the sidelines of the India Gold Conference that, “There is a traditional demand for jewellery. People are also buying for investment purposes now that the duty cut has made silver more affordable.”

In late July, Reuters reported that India had slashed import duties on gold and silver for the world’s second-largest bullion consumer.

The government cut import duties from 15% to 6% on gold and silver “To enhance domestic value addition in gold and precious metal jewellery…”

Naturally, that’s another driver that’s triggering huge demand for silver, and therefore imports, into this massive market that already boasts a very long-term affinity towards precious metals.

One thing is certain, I will be watching ongoing developments closely as India moves towards becoming a silver demand powerhouse.

More By This Author:

Silver: Breaking An Important "Curse" – And Looking Strong

Top Picks 2024: Aya Gold & Silver

The Mining Life Cycle

EDITORIAL POLICY AND COPYRIGHT: Companies are selected based solely on merit; fees are not paid. This document is protected by ...

more