Sunday, March 10, 2024 3:40 PM EST

Image Source: Pixabay

I recently spent five days in Toronto attending and speaking at two back-to-back mining conferences. The second was the truly massive PDAC conference. There’s an expression in the mining world: The PDAC Curse. But we may have seen the “curse” go into “reverse” this year, and that’s bullish for silver.

PDAC stands for the Prospectors and Developers Association of Canada. Each year the PDAC mining conference is held in March in Toronto. It’s quite simply the world’s largest mining conference. It draws about 1,500 exhibitors, and some 25,000 delegates.

The “curse” part comes from how shares of mining companies tend to go into a selloff around this time. No one really knows why. Maybe it’s just a certain amount of hype and buildup before the big event that later loses steam. But it doesn’t really matter because this tends to be a temporary phenomenon anyway.

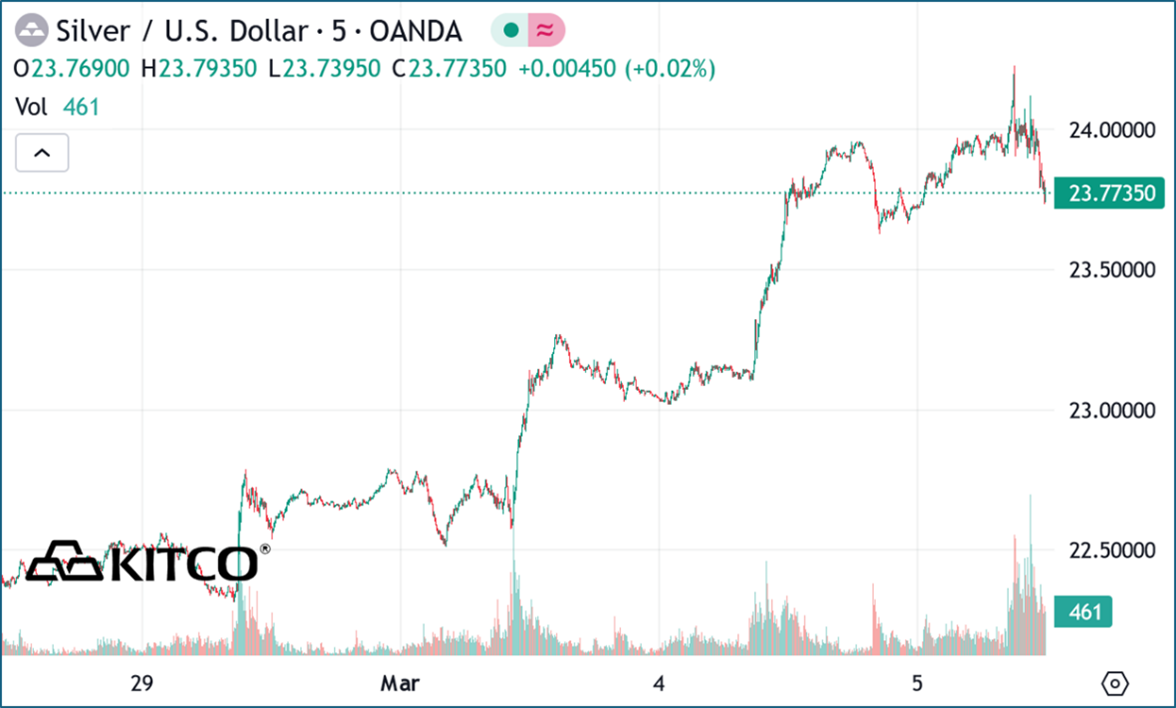

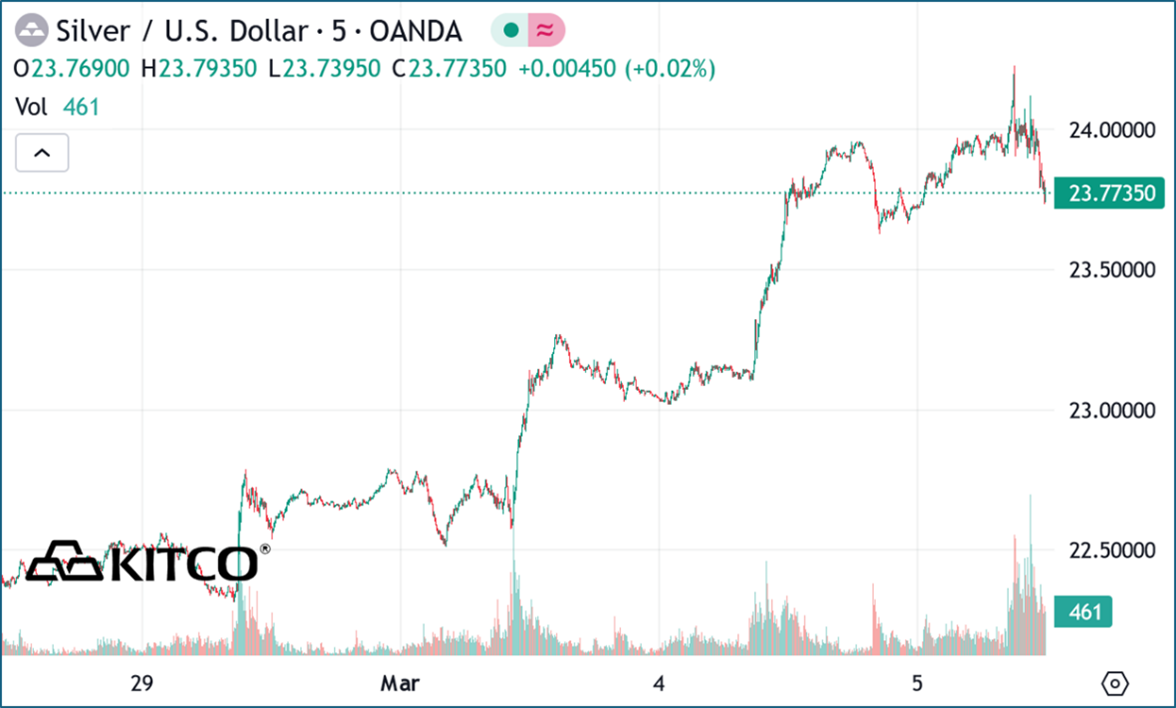

This year, though, the story was different. With gold screaming to $2,141 early on March 5, it was only about $10 away from its previous all-time high in early December at around $2,151. For its part, silver rallied from $22.35 up to $24.40, an 8.2% jump in just three trading days.

Could this be the start of a new bull market? There are decent odds it is. Of course, we’ll never know for certain until we can look back on these last few days. One thing is sure: The sentiment remains terrible and that’s a positive sign. Even Bitcoin has been trading at all-time highs and excitement is barely to be found. There is so much pessimism.

Moreover, virtually no one is participating. How do I know? Back in 1960, gold represented 5% of global financial assets. Today, even around $2,100, gold represents 0.6% of global financial assets. I expect there’s going to be some serious FOMO (fear of missing out) fueling some big rallies.

This is how new bull markets are born. So, we at least have the right setup. If gold can break $2,151 and hold above, that may be it.

I believe we are still close to the start of a new long-term bull market in precious metals. No one knows exactly when that will be – it may have already begun. But it’s only by being invested in advance that you can reap the most gains.

My recommended action would be to consider buying silver.

More By This Author:

Top Picks 2024: Aya Gold & SilverThe Mining Life Cycle Agnico Eagle: A Core Holding For Gold Investors

EDITORIAL POLICY AND COPYRIGHT: Companies are selected based solely on merit; fees are not paid. This document is protected by ...

more

EDITORIAL POLICY AND COPYRIGHT: Companies are selected based solely on merit; fees are not paid. This document is protected by copyright laws and may not be reproduced in any form for other than personal use without prior written consent from the publisher.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Resource Maven (Maven) nor its affiliates assume any responsibility to update this information. Maven is not registered as a securities broker-dealer or an investment adviser in any jurisdiction. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Maven cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Maven in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Maven accepts no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content.

The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Maven does not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites. Maven has not reviewed the Internet website of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website's users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.

less

How did you like this article? Let us know so we can better customize your reading experience.