The Neglected Tool

Whether or not any central banker chooses to appreciate the fact, money is an important economic tool. Before it ever gets to be a store of value, there has to be some correct supply so as to become a medium of exchange (and almost by virtue a unit of account). The problem throughout history has been to foresee and then apply the “correct” amount.

Central banks have become corrupted as to that vital task. In these days of activist institutions, central bankers ironically attempt to influence entire economies without the slightest understanding of money. As I write so often, there is no money in monetary policy. If you think there is, so much the better for Jay Powell.

In days gone by, central banks were instead mechanical; that is, they responded to real world conditions by taking concrete monetary steps. The Financial Times in 2007 wrote tellingly about how the Bank of England used to work, just months before it would prove to the world how it no longer did.

High up on the wall of the Court Room at the Bank of England is a dial, linked to a weather vane on the building’s roof. Now a novelty for visitors to the Bank’s grandest function room, knowing the direction of the wind was a deadly serious tool of monetary policy on its installation in 1805.

If the wind was coming from the east, ships would soon be sailing up the Thames to unload goods in London. The Bank would need to supply lots of money, so traders could buy the wares landed at the docks. If a westerly was blowing, the Bank would mop up any excess money issued to stop too much money chasing too few goods, thereby avoiding inflation.

No mere theory here, inflation was an immediate problem for places where foreign trade could be so highly influential. FT in this one passage specifies for us only the one consequence but doesn’t quite get to the other. What happens if the bank isn’t there to supply currency as the ships come in at the docks? More importantly, what would prevent the central bank from doing this?

The first question is in explanation rather simple, in circumstance very harsh. Without sufficient money, money itself becomes dear (liquidity preferences) and a whole range of nasty economic consequences follows from it. Imagine a shipowner having taken the inordinate risk of sending a fully crewed vessel on a dangerous journey all the way around the world only to have it return without sufficient money supply to sell off the goods obtained during the voyage.

In that case, with few exceptions, the shipowner would be forced to discount his price severely. Deflation. If leveraged, or even if not, he could be forced out of business and if there are enough like him then widespread unemployment well beyond the risky trans-ocean trade industry.

But what might hold the central bank from filling the supply? In 1805, the lack of reliable information was at the top of the list. In 2005, or 2018, the lack of reliable theory has replaced it as our greatest, most dangerous economic foe.

Last week, Bloomberg reported the following grim news out of China, the more time passes the grimmer the news:

Purchases of passenger vehicles by dealerships plunged for a third straight month, an industry group said Friday. With trade ties with the U.S. worsening by the day and car sales barely up for the year already, the industry is now facing the prospect of its first contraction since at least the 1990s.

See what I mean by unreliable theory; “trade ties with the US.” While economic conditions have deteriorated in China they’ve started to really bother Chinese share prices, too. From February 2016 through January 2018, nearly two years straight, Chinese stocks were an almost strait line advance (though not nearly at the same slope as American stocks).

What changed in January? Rhetoric, for sure, as President Trump started to sound tough(er). That’s not what most markets were focused upon though, instead being forced to reckon with dollars more than tariffs. The world’s biggest dollar problem belongs to the Chinese.

Furthermore, everything the People’s Bank of China has done this year has continued to focus our attention in this direction. The cuts to the RRR, the shift toward more “accommodation” while at the same time maintaining (and failing) a priority toward CNY, all tell us what’s really going on.

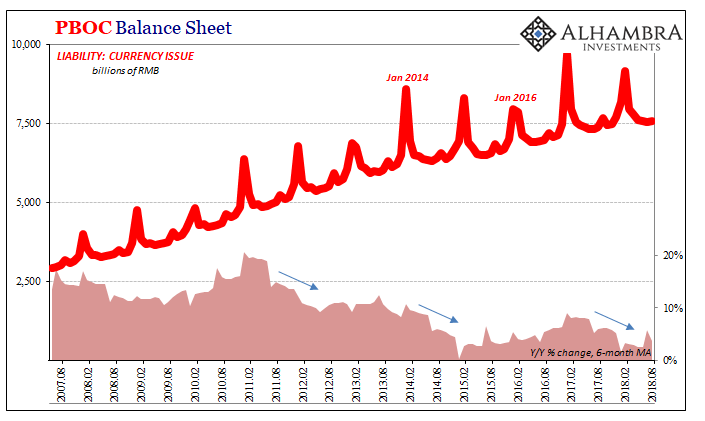

The Chinese must choose between providing dollars they require to conduct trade (dollar short) and absorbing the internal monetary consequences of that (shown below), or letting the external eurodollar problem go consistently unanswered. As I told my audience in the Cayman Islands last week, the economy suffers either way. There is no happy ending here without first the eurodollar fixes itself (because Jay Powell isn’t going to do it, operating as the Federal Reserve has for decades under a modern doctrine of “benign neglect” that is today missing benign leaving for the world only neglect).

To put it back in terms of 1805 Bank of England, the PBOC is signaling that the ships are going to be sailing in but it doesn’t have the money to be able to supply the markets for their goods soon to be unloaded. The reason it doesn’t have money is what I wrote last week after the RRR was reduced for a third time this year:

The RRR cut signals that the reserve problem therefore dollar problem is anticipated to grow worse. The PBOC is actually telling us that they expect in the months ahead the same or perhaps bigger commitment to “stepped up support.” CNY doesn’t need support if there is no worsening “capital outflow” situation of retreating eurodollar funding.

This will require more monetary contraction in bank reserves than we’ve already seen. The central bank is forecasting more problems ahead.

The way the actual global reserve currency system works, eurodollar not dollar, is that places like China have to have the dollars first. The Chinese are practically begging us to understand they still don’t think they will be able to get any. Thus, bank reserves and even physical RMB currency will continue to suffer as a direct consequence. The economy right now already today is showing the expected results.

It explains so much more than just a radical alarm in China’s auto market.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more

As far as I can tell, you are describing the results of America trying to reduce its trade deficit with China. The trouble China is facing is a natural consequence of its economic policy, which is basically to turbocharge international sales by having the government subsidize costs of production at individual companies, allowing them to undercut the international market prices. This kind of policy allows China to accumulate foreign currency (lots of dollars), and they spend the excess on dollar-denominated securities (like treasuries). The dollar shortage you describe stems from the reality check on this false business model, now emanating from American government. It's not that China isn't getting the dollars they need; it's that they're being restricted from continuing to inflate their sales using unbalanced business practices, reducing the amount of dollars they were bringing in from these inflated sales. A decade of artificially inflated business cannot go without natural consequences, as China now pays the price for its economic abuse.

Very insightful.

I liked reading your comments but haven't seen them in a while.

An intelligent and thought provoking answer!

Nice article explaining China's issue. Too many people mistakenly think China has no problems with so many US Treasuries.

This is an interesting explanation of things that should have been made way more clear back in college economics class, the second semester. Sort of obvious when explained this way. THANKS!!