The Myth Of Japanese Policy Ineffectiveness

The Bank of Japan recently provided another example of how Japan is not stuck in a “liquidity trap”, and never has been. Here’s Bloomberg:

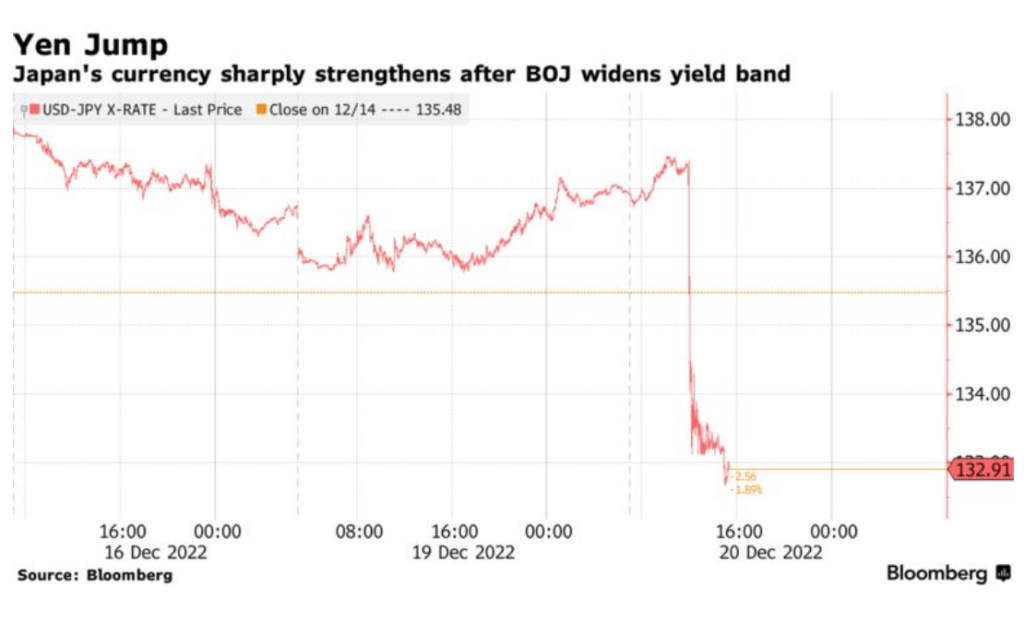

Bank of Japan Governor Haruhiko Kuroda shocked markets by doubling a cap on 10-year yields, sparking a jump in the yen and a slide in government bonds in a move that helps pave the way for possible policy normalization under a new governor.

The BOJ will now allow Japan’s 10-year bond yields to rise to around 0.5%, up from the previous limit of 0.25%, while keeping both short- and long-term interest rates unchanged, according to a policy statement Tuesday.

The move caused a sharp appreciation in the yen, clear evidence that the effect was highly contractionary:

This action makes it even more likely that Japan will undershoot its 2% inflation target over the next decade. It was an obvious policy mistake, an unforced error.

But this is nothing new:

1. In 2000, the BOJ raised interest rates after years of deflation, insuring that the deflation would continue.

2. In 2006, the BOJ raised interest rates and sharply reduced the monetary base (quantitative tightening) after years of deflation, insuring that the deflation would continue.

In this case, it’s misleading to blame the BOJ. Kuroda probably opposed the move, at least in private. But he’s scheduled to be replaced by a more hawkish bank president in early 2023, and the bond price targeting program is likely to be abandoned. Ironically, in the long run the new BOJ president may well deliver even lower nominal interest rates than Kuroda.

The Japanese government may claim that it wishes to achieve 2% inflation, but is unable to do so. Their actions make it quite clear that this is not their actual policy goal, they are content with near-zero inflation. And yet most American macroeconomists will continue to believe in the myth that Japan is “stuck” in a liquidity trap, unable to achieve inflation.

“This is the west sir. When the legend become fact, print the legend.”

More By This Author:

I Don't Do Unconditional ForecastsDifferent Varieties Of Inflation

Guilty Of Intent To Commit Charity?