The Mortgage Market Is Contributing To The Decline Of The Canadian Economy

Image source: Pixabay

In its most recent policy statement, the Bank of Canada acknowledged that it was concerned with the consequences in 2024 when many Canadians have to contend with higher mortgage rates. A TD Canada report identified that:

“High household debt is the biggest vulnerability of the Canadian economy. As more homeowners reset their mortgages at higher rates, less disposable income is available to maintain consumer spending.”

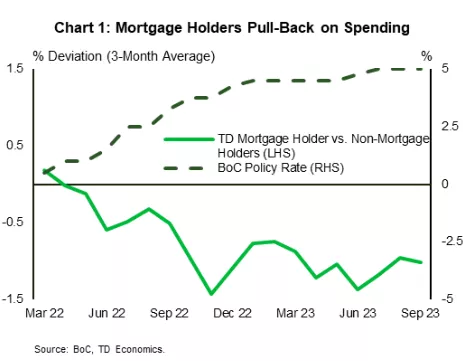

The TD economists looked at the bank’s mortgage and credit data to measure how much mortgage borrowers are adjusting their spending patterns in the face of the relentless rise in interest rates. The trend is unmistakable, as mortgage holders steadily reduced their household spending in response to a succession of rate hikes. This is borne out by the fact that those who reset their mortgage rates in 2023 have already curtailed spending more than those in a similar situation did in 2021 and 2022. In other words, these higher rates are really starting to bite. There is every reason to expect those who must reset their mortgage rates in 2024 will likely add to those who have already trimmed their consumption.

Three-quarters of all household debt is tied up in the mortgage market, so mortgage rate hikes of 300+ bps will have to be financed by way of cutbacks in consumer expenditures. The TD report notes that Canadians have to put aside 15.4% of their incomes to cover debt service, a rate that has increased from 13.6% in 2020 and certainly is beyond recent experience even during the 2008 financial crisis. No wonder the Bank of Canada needs to be very mindful of raising rates further. The stakes are too high towards triggering a recession if that has not already happened.

Nearly 70% of all households in Canada are mortgage-free, so their consumption patterns remain unaffected by developments in the mortgage market. But what about those with mortgages? The Bank of Canada estimates that nearly 50% of all mortgages will have to be re-financed by the end of this year and 65% of all mortgages by the end of 2024. Given this financial pressure, it is very likely that the consumption side of the national income will decline.

The Bank of Canada is no doubt aware of these data on mortgage refinancing. The issue before the Bank is when should it start cutting rates in order to minimize the negative income effects arising out of its aggressive policy to date. This writer maintains that the Bank overshot in this rate cycle. The longer it waits to cut rates, the more damaging the current rate environment will be to the economy.

More By This Author:

Canadian Banks Signal Trouble Lies Just Around The Corner

The Bank Of Canada Is Finished Raising Rates Now For When To Consider Cutting Rates

As The Bank Of Canada Searches For The Perfect Rate Conditions