“The Housing Market Is Almost Frozen" - An Even Bigger Problem Emerges For China

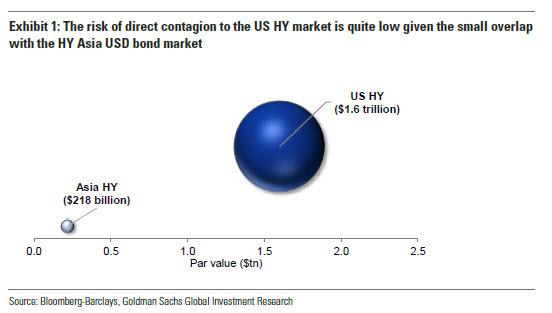

With Wall Street's fascination with risk associated with Evergrande's default fading fast, and the sellside pumping out charts such as this one showing that the contagion in China junk bond market is unlikely to spillover globally...

... the smartest men in the room are once again missing the forest for the trees because as we explained in detail over the weekend, and again reminded earlier this week...

Remember: for China this is not about Evergrande, it's about preserving confidence in the property sector

— zerohedge (@zerohedge) September 22, 2021

... for Beijing the real risk is not whether foreign creditors are impacted - in fact Evergrande's willingness to default on offshore bondholders while preserving operational cash flow and continuing to build homes shows just how much China "cares" about Blackrock's P&L - but how an Evergrande crisis could impact China's massive, $60 trillion, property sector, something which CCB International, the Chinese investment bank, touched on in a recent research note in which it said that Evergrande "contagion risk has spread from financing to land sales, property sales, project deliveries and home prices."

And indeed, as the FT reports this morning, some very ominous cracks in China's property market - which according to Goldman is the largest asset class globally - are starting to emerge.

In a letter to the Shaoxing municipal government in eastern Zhejiang province, the local office of developer Sunac China appealed for “policy assistance” as it was struggling through what it called a "turning point in China’s real estate industry."

"We have never experienced such a radical change in the external environment," Sunac’s Shaoxing office said, pointing to a 60% year-on-year fall in home sales over the summer.

"The market is almost frozen," it added in the letter, which was first reported by the Financial Times. “The radical change in policy and environment has seriously disrupted our business and made it very difficult to maintain normal operations.”

The sudden, sharp collapse in China's property market is shown in the charts below which reveal that the amount of actual land transactions was not only well below the land supply in recent weeks, an unprecedented divergence, but that volumes were 65% below year-ago levels as potential buyers are suddenly terrified of investing in real estate as the Evergrande fate remains in limbo, with some worried that some of the 65 million empty apartments could hit the market and lead to a crash in property values.

(Click on image to enlarge)

While the plunge in transactions is demand-induced, there are also concerns that an Evergrande insolvency and eventual collapse could lead to a supply crunch. As reported earlier, in July a Chinese city halted sales at two Evergrande projects alleging the troubled developer misappropriated funds by only depositing a portion of the proceeds from housing sales into the escrow accounts, according to a local government statement. To ensure Evergrande doesn’t divert these funds, the housing bureau in Nansha district created an escrow account under its own name this month to take in proceeds from Evergrande homebuyers, cutting off the developer’s direct access to the money.

A lack of funds has already led to a construction halt on some unfinished housing properties, sparking social unrest among buyers. In Guangzhou, buyers surrounded a local housing bureau earlier this month to demand Evergrande restart construction.

As we discussed over the weekend, one of the most troubling downstream consequences from chaos in the property sector would be social unrest, and as we noted, maintaining social order has always been a key priority for the Communist Party, which has no tolerance for protests of any kind.

In Guangzhou, homebuyers surrounded a local housing bureau last week to demand Evergrande restart stalled construction. Disgruntled retail investors have gathered at the companys Shenzhen headquarters for at least three straight days this week, and videos of protests against the developer in other parts of China have been shared widely online.

Without a social safety net and with limited places to put their money, Chinese savers have for years been encouraged to buy homes whose prices were only ever supposed to go up (similar to the US before 2007 when even idiots like Ben Bernanke said that the US housing market never goes down). Today, buying a house (or two) is a cultural touchstone. And while housing affordability has become a hot topic in the West, many Chinese are more likely to protest falling home prices than spiking ones.

Which brings us to a must read report from Goldman's Kinger Lau published overnight and focusing entirely on China's property sector - instead of just Evergrande - where it addresses a glaring dilemma: Beijing's desire to regulate and deleverage the housing sector even as it keeps property prices rising, a dynamic we summarized concisely earlier this week inside a tweet:

Markets used to focus on China's "impossible trinity" but it's time to shift to China's "impossible dilemma": you can't have deleveraging/tightening/"3 red lines" AND rising home prices at the same time.

— zerohedge (@zerohedge) September 22, 2021

China wants both, will have to pick one

In his must read report (available for professional subscribers in the usual place) Goldman's Lau explains that what is going on with Evergrande, and in fact the turmoil gripping China's broader property sector is largely self-inflicted as "regulatory actions in China Internet have resulted in more than US$1tn market cap loss on the tech sector since mid-Feb, but in the past two weeks, investor focus has shifted to the US$60tn China property market which is linked to ~20% of Chinese GDP and represents 62% of household wealth."

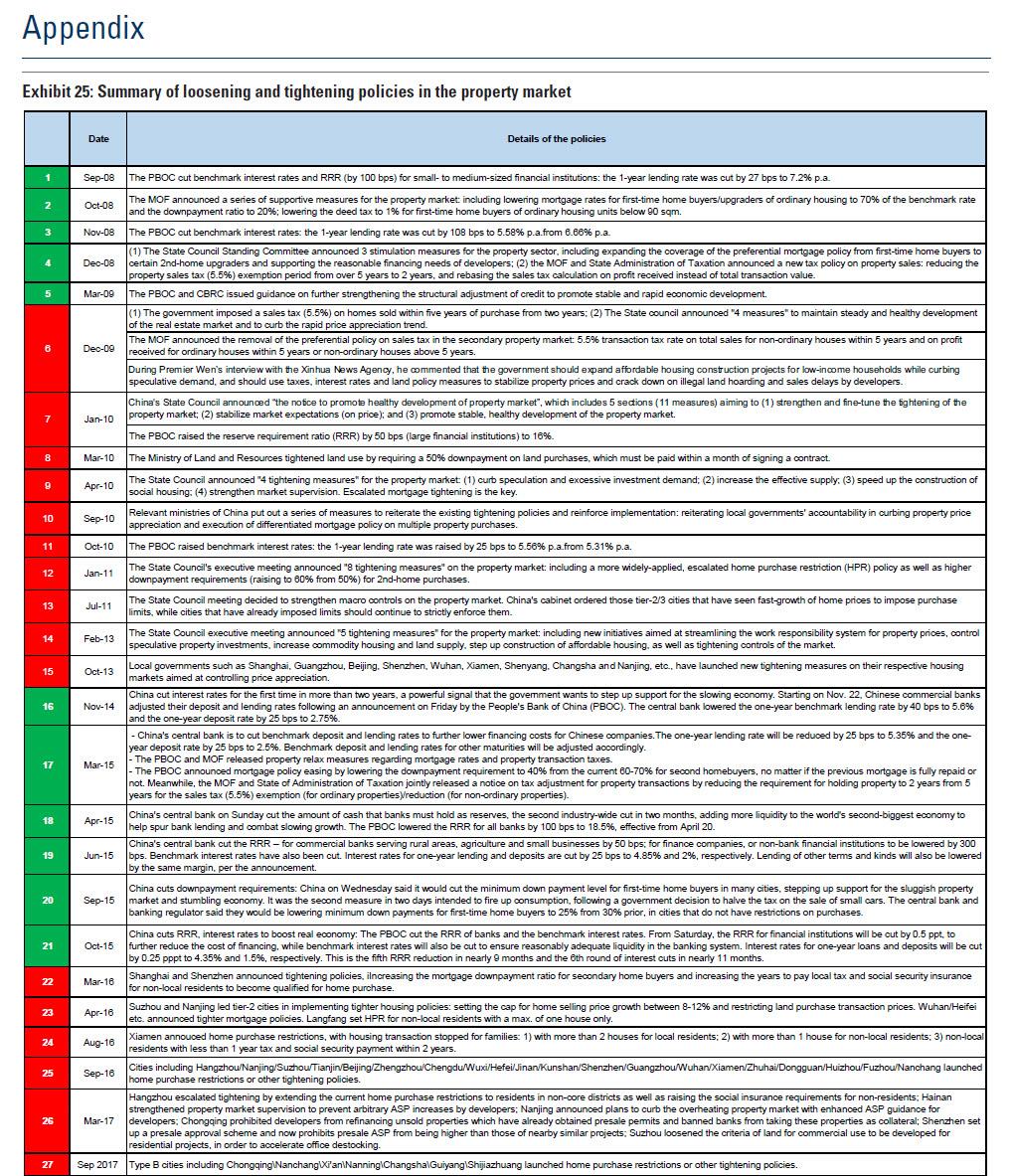

Specifically, Goldman notes that more than 400 new property regulations (shown in the appendix) that are largely tightening in nature have been announced ytd to restrain housing market activity, spanning supply, demand, funding, leverage, to price control measures. It is these measures that have contributed to a 14% year-on-year fall in property sales and $90 billion of market-cap losses among developer stocks in 3Q alone.

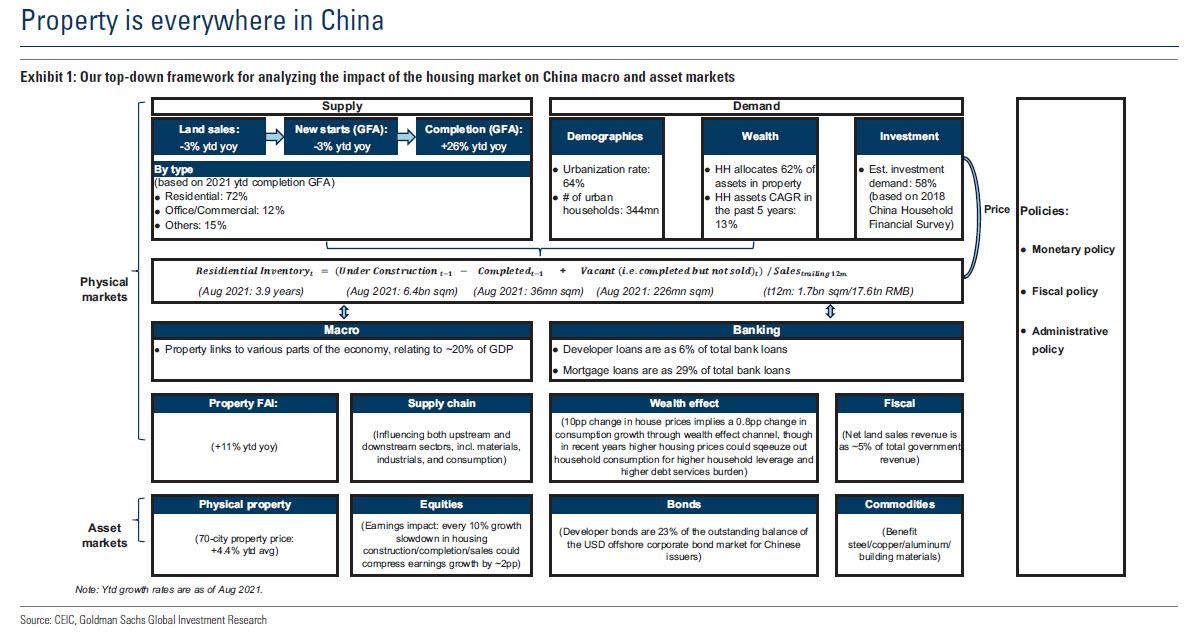

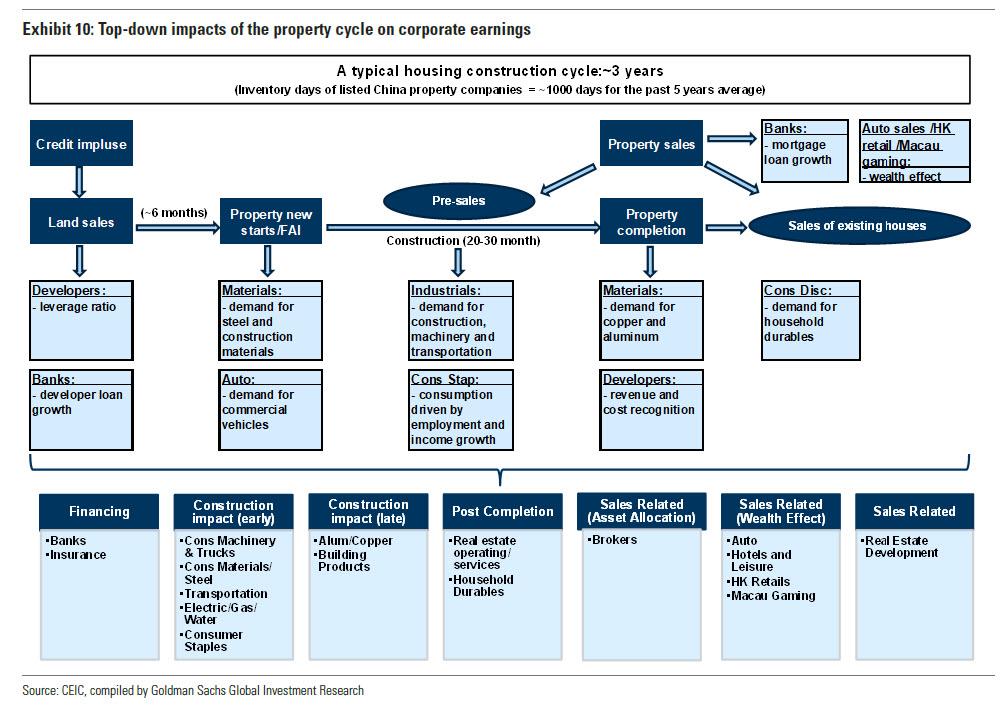

In his attempt to summarize the critical linkages between China's all-important property sector and the broader economy (something we first tried to do back in 2017 in "Why The Fate Of The World Economy Is In The Hands Of China's Housing Bubble"), Goldman first focuses on the immediate catalyst behind the current crisis, which according to the bank has to do with the unprecedented regulatory tightening "in the largest asset class globally."

Or, as Goldman puts it succinctly, "Property is everywhere in China"

(Click on image to enlarge)

Some explanatory notes on the chart above:

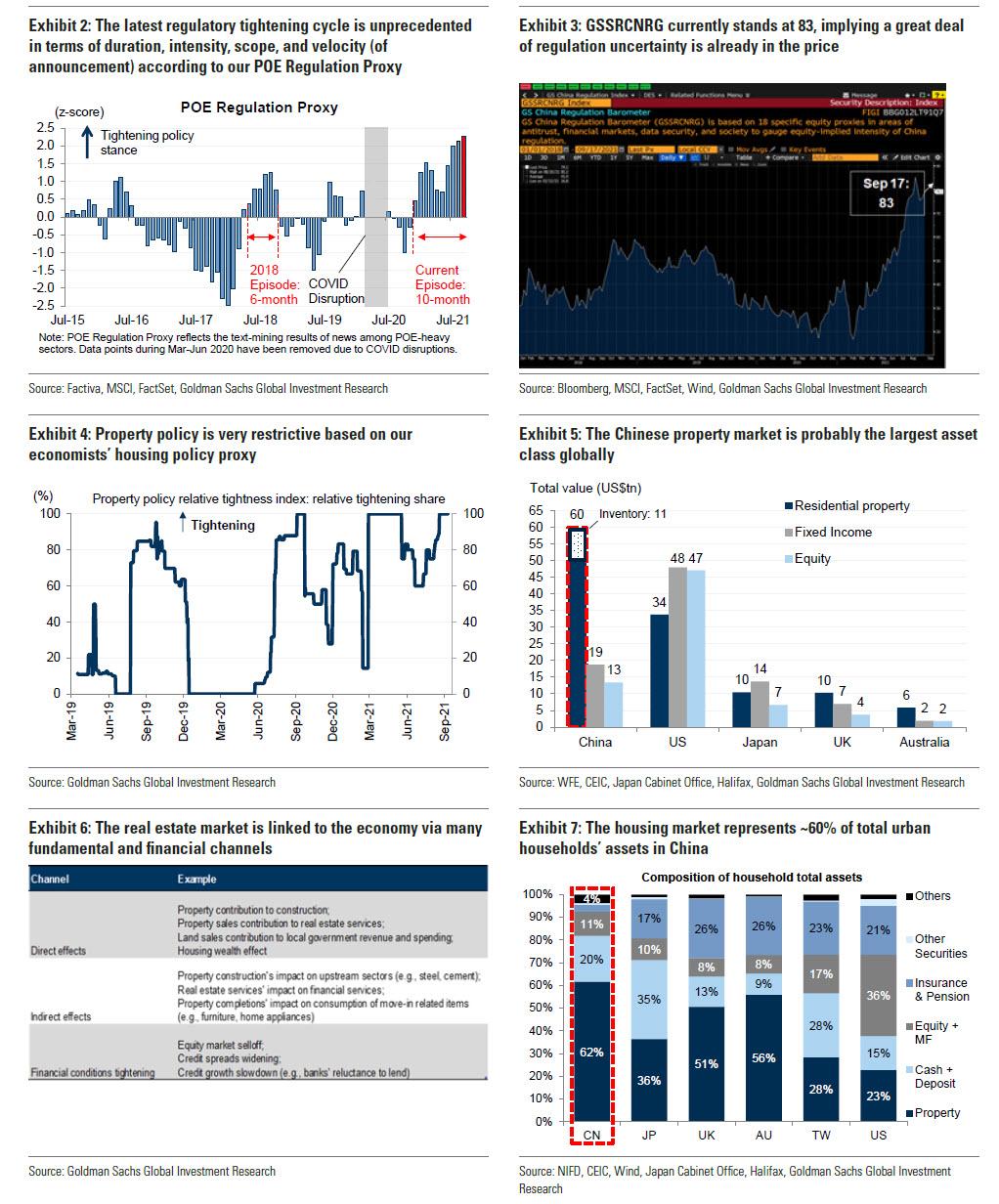

- The regulatory cycle keeps evolving: The ongoing regulatory tightening cycle, which is unprecedented in terms of its duration, intensity, scope, and velocity (of new regulation announcement) as suggested by our POE regulation proxy, has so far provoked significant concerns among investors in and have resulted in more than US$1tn market cap loss on China Tech.

- From Tech to Social Sector, and then to Property: According to Centaline, more than 400 new property regulations have been unveiled ytd across the central and local governments to address the issues of rising property prices and imbalanced supply/demand in certain areas, over-reliance on property for economic growth and fiscal revenues, and potential speculation in the real estate market where 22% of property could be vacant and ~60% of recent-year purchases were driven by investment demand. Property market tightening isn’t a new feature in the Chinese policy cycle over the past decade, but the severity of the measures, the scope of tightening, and the determination of policy implementation (e.g. the 3 Red Lines) are arguably unprecedented.

- China property is big: Almost two years ago, Goldman took a deep dive into the US$40tn Chinese residential housing market and analyzed its impacts on macro and asset markets. Since then, the market has grown to US$60tn in notional value including inventory, likely the largest asset class in the world on current prices. It has also registered Rmb26tn (US$4tn) of home sales with more than 3bn sqm of GFA being sold, almost 3x the size of HK SAR. Additionally, it is well-documented that Chinese households have a strong investment and allocation bias towards real assets for different economic and cultural reasons—as of Aug 2021, property accounted for around 62% of household assets in both the total and net terms, vs. 23% in the US and 36% in Japan, where stocks are the dominant household assets.

- Property is ubiquitous in China, fundamentally and financially: Goldman economists estimate that the housing sector contributes to around 20% of GDP via direct and indirect channels such as property FAI, property construction supply chain, consumption, and wealth effect. In the financial markets, 15% of aggregate market earnings (i.e. ~US$150bn out of US$1tn in 2020) could be exposed to ‘property demand’ in the extended housing construction-to-sale cycle which typically spans over three years, and that property-related loans (developer loans, mortgages, shadow banking)/ developer bonds represent 35%/23% of banks’ loan books/the outstanding balance of the offshore USD credit (IG + HY) market,respectively.

And visually:

(Click on image to enlarge)

While a full-blown property crisis would impact virtually every aspect of the Chinese economy, starting with capital markets, shadow banks, and social stability, the most immediate one for global investors is of course, the equity market. Here are Goldman's key observations on this topic:

The regulation headwinds have resulted in a noticeable slowdown in property activities in recent months: nationwide property sales have fallen 14% yoy in3Q21 alongside stable prices in the primary market but large declines of transactions in the secondary market; property FAI and new starts have fallend rastically, although completion growth momentum has remained strong largely on favorable base effects.

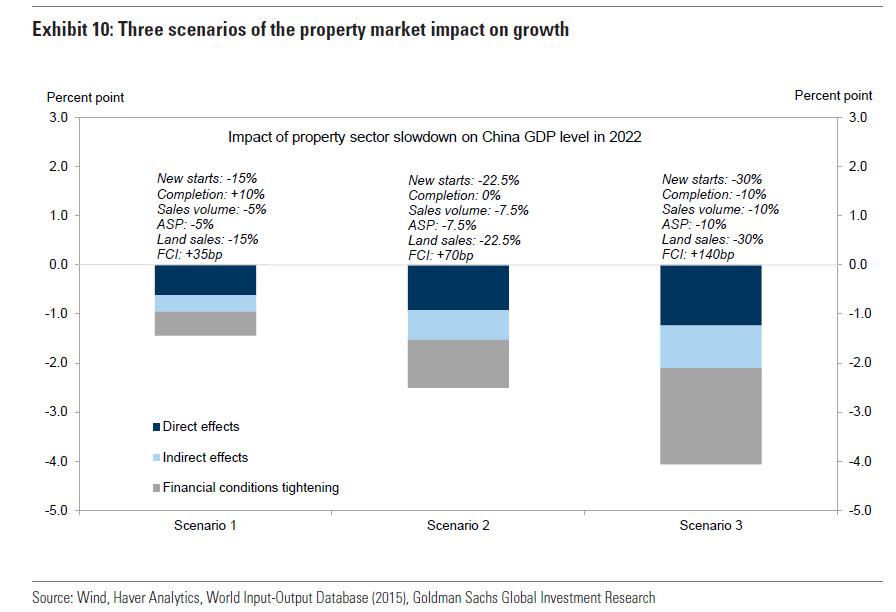

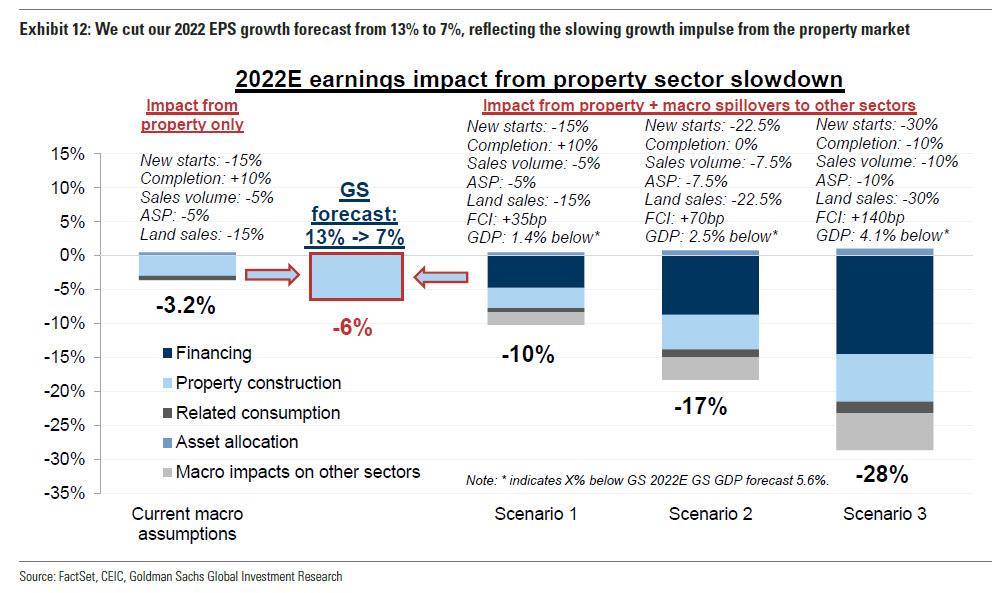

At the macro level, Goldman economists have laid out 3 scenarios to model the contagion impacts from reduced property impulse on macro growth. Overall, they see 2022 GDP growth hit ranging from 1.4% to 4.1% depending on the magnitude/severity of the property market slowdown and the tightening of financial conditions domestically, although their scenario analysis does not take into consideration potential monetary and fiscal policy easing in response to the property market declines.

(Click on image to enlarge)

While listed developers only account for 4% of earnings in the aggregate listed universe, the housing market could be linked, directly and indirectly, to ~15% of corporate earnings, and every 10pp growth deceleration in housing activity could reduce profit growth of the housing market by ~2pp, all else equal.

Broadly, Goldman lists five key transmission mechanisms along the extended property market food chain:

- Property developers and management companies (4% of equity market earnings): Developers’ earnings are highly sensitive to the property market fundamentals. However, given the time lag between transaction (pre-sales) and revenue recognition (accrual-based accounting), reported earnings usually lag sales by around 2 years, meaning that their current- and next-year earnings may not fully reflect the latest situation in the physical market. For property management companies, their near-term earnings profile is more sensitive to completions than sales but slowing property sales could dampen their future growth prospect.

- Financial institutions (54% of equity market earnings): Developer loans and mortgage loans account for 35% of commercial banks’ aggregate loan book. Goldman's banks analysts see the potential for mortgage NPLs to rise (at 0.3% now, 1% increase in mortgage NPL ratio translates into 18.7% drop in net profits per their bear case) although their risk exposures to property-related WMPs have fallen substantially since 2016. For insurers, Goldman's team believes the listed insurers’ exposure to the property sector is low, but the potential indirect wealth effect could pose a bigger fundamental challenge. While not directly linked to the housing market, equity brokers’ earnings cycles have been negatively correlated with property sales, likely reflecting the asset allocation decisions/flows from Chinese households between the two asset classes.

- Construction (2% of equity market earnings): From new property FAI start to completion, the construction cycle for commodity housing typically lasts 20-30 months in China. It drives demand for construction materials (China is the largest consumer of copper, iron ore and steel), although the focus of materials and their consumption intensity varies in different parts of the cycle. The process also directly impacts construction-related equipment, with excavators, heavy-duty trucks, bulldozers, cranes, and loaders all exhibiting reasonably high demand correlation with land sales.

- Consumption: (3% of equity market earnings): Whether property purchase is considered consumption (at least for first time buyer) remains an open-ended debate, but the housing market is undoubtedly a key demand driver for a wide range of consumption items, including white goods,consumer durables like furniture equipment, and certain electronic products(e.g. Audio devices and air conditioners). Goldman's study shows that housing completion usually leads the sales and earnings in these sectors by 6-9months.

- Wealth effect (1% of equity market earnings): At the micro level, capital appreciation (or depreciation) in the housing market could have short-term material impact on discretionary spending given the potential wealth creation from the US$60tn asset market, especially considering the relatively high investment ratios there. Industries that are sensitive to this channel encompass the Autos (luxury), Macau gaming, HK retailers and travel-related companies (before the pandemic), which tend to lag property sales by around two quarters, although these relationships may be also reflective of the broader macro dynamics including liquidity easing.

A snapshot of the various top-down impact of the Chinese property cycle on corporate earnings is shown below:

(Click on image to enlarge)

In sum, mapping Goldman' base case assumptions on GDP growth and property activities for 2022 onto corporate earnings via these channels,the bank lowers its 2022E EPS growth for MSCI China from 13% to 7%, but as the bank warns "the earnings downside (delta) could be much more significant (-28pp) if their bear cases prevail."

(Click on image to enlarge)

And should more companies warn that "the market is almost frozen" as a result of the Evergrande crisis, the bear case is virtually assured.

We conclude with Goldman's observations on the contagion risks which according to the bank - and contrary to the market - "are building", even if systemic risks can still be avoided.

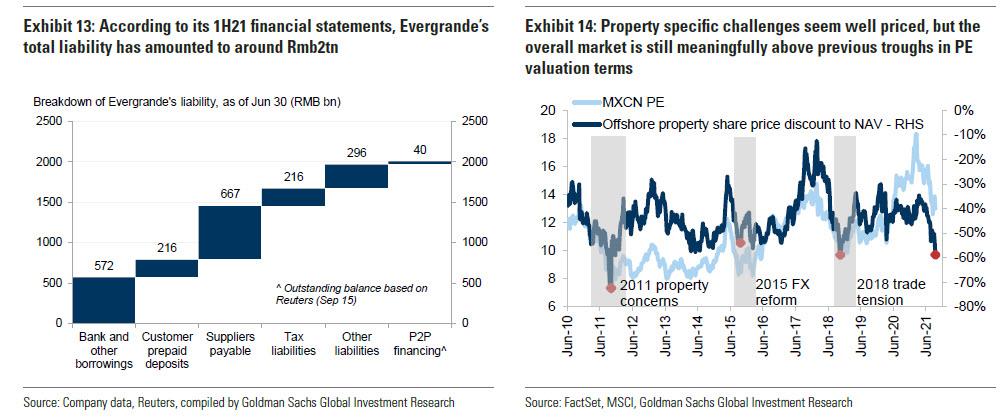

While the restrictive policies have cooled the market, it has put highly-geared developers, notably Evergrande, in the spotlight as their deleveraging path becomes increasingly challenging. On one hand, Goldman agrees with us, and says that on a standalone basis, Evergrande should not be a serious systemic threat given that its total liability of Rmb1.9tn accounts for 0.6% of China’s outstanding TSF, its bank loans of Rmb572bn represent 0.3% of systemwide loan book, and its market share in nationwide commodity housing sales stood at 4% by 1H21. However, the real risks emerges in the context of the slowing property market: indeed, as in other systemic/crisis episodes, investors are concerned about specific weak links which could spread to the broader system via fundamental and financial channels in the case of disorderly default, and therefore the financial condition tightening risk could be much more significant than the Rmb1.9tn liability would suggest, according to Goldman.

(Click on image to enlarge)

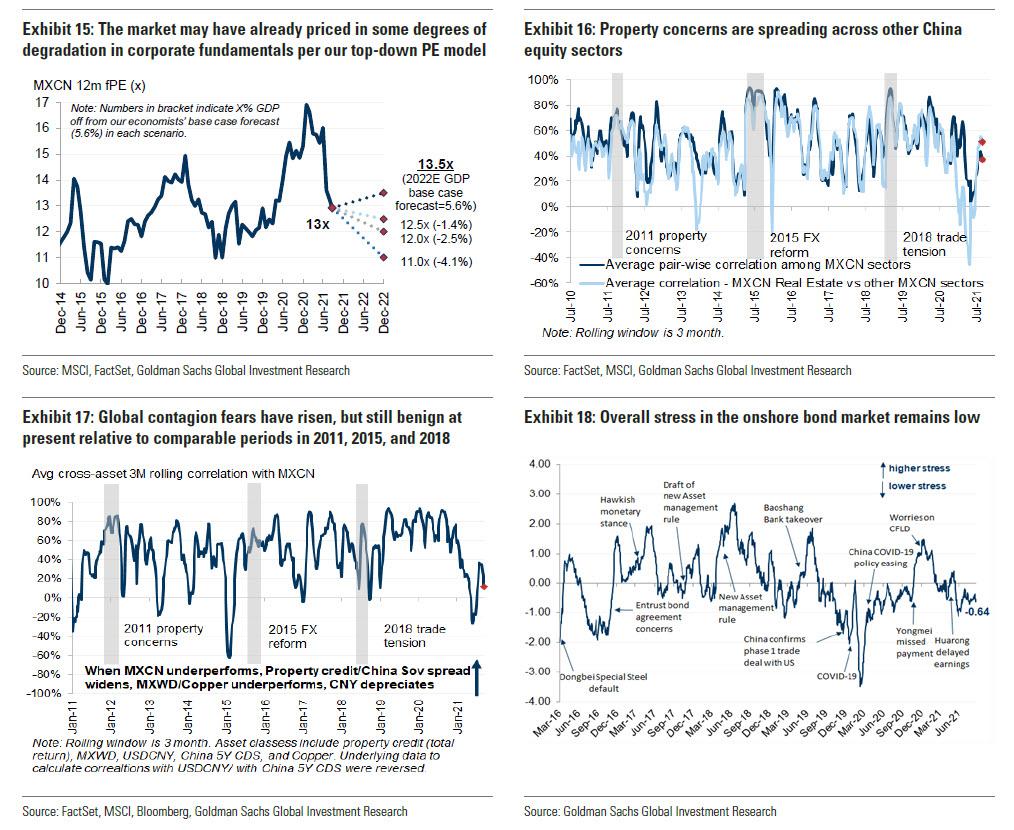

How much risk is priced in? This is a popular question from investors but also a difficult one to answer given the fluidity of the situation. However, the following analyses lead Goldman to believe that the market may have priced in some degrees of degradation in macro/corporate fundamentals and possibly policy response from the authorities (i.e. a “muddle-through” scenario), but not a harsh scenario that is systemic and global in nature

- Episodic analysis: Historical physical property market downturns were short-lived and shallow, but if we focus on episodes where developer equities traded at depressed valuations to proxy for property-related concerns (eg.2H11, early 2015, and late 2018), prevailing NAV discounts of listed developers(-60%) are roughly in-line with those difficult times. At the index level, MSCI China bottomed at around 10-11x fwd P/E and 10% ERP in those periods, vs. 13xand 9% at present respectively.

- Fair PE targets: The MSCI China index is currently trading on 13x fP/E, having already de-rated from 19.6x at the peak in mid-Feb. Applying Goldman's three scenarios to its top-down macro PE model, the bank estimates that the index fair PE could fall to 12.5x in the base case, and 11.0x in their most bearish case.

- Correlation analysis: Intra- and inter-sector, and cross-asset correlations with regard to Chinese stocks or developer equities have all risen in the past weeks, albeit from a low base. However, compared with previous cases where concerns related to China regulations or trade relations had spooked global markets (e.g. 2015 FX reform, 2018 US-China trade war), the absolute correlation levels are more benign at present, suggesting a global contagious impact is not fully priced in.

(Click on image to enlarge)

In light of all this, the good news is that in Goldman's view systemic risks could still be avoided considering:

- broad liquidity and risk-appetite indicators such as 7d repo, the onshore funding stress index, as well as the A-share market performance/ turnover suggest that the imminent "minsky moment" remains a narrative but far from a reality;

- the effective leverage (LTV) for the housing market is low, around 40% to 50% per our Banks team’s estimate;

- the institutional setup in China where the government has strong control over its banking system makes a market-driven collapse less likely to happen than would otherwise be the case;

- Losses will be realized by stakeholders associated with highly-geared developers, but the liabilities are relatively transparent and are less widely socialized in the financial markets than in previous global financial crises;

- the potential economic, social, and financial impacts have been well publicized and discussed, and it appears that the authorities are assessing the situation and starting to take actions; and,

- economists believe there is potential for the authorities to ease policy to prevent a disorderly default of Evergrande from developing into a crisis leading up to the Sixth Plenum in November.

Ultimately, timing will be key to a happy ending: Given the outsized market value of China property, and its intricate linkages to the real economy and the financial markets, deleveraging the property market and improving financial stability - two contradictory concepts - could raise systemic concern if policy actions are pursued too aggressively, or without clear coordination among regulators and communication with the market.

Importantly, as market concerns over tail risk and spillovers start to build, there is increasing focus on the narrowing window for policymakers to provide the necessary circuit breakers to ring-fence the (collateral) damages and stop the downward spirals.

A key risk from continued delayed action would be a bigger snowball effect and more damage on markets and investor (already strained) confidence in Chinese assets. As such, Goldman expects the market to focus on potential actions that could be pursued, such as a combination of debt restructuring (bank loans, WMP, credits), conditional government involvement in working capital bridges and unfinished property projects, and a coordinated plan to divest and cash in assets.

Finally, as promised earlier, here is a summary of the key loosing (green) and tightening (red) policies in China's property market.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more