The FTSE Finish Line - Monday, Jan. 12

Image Source: Pexels

London's FTSE 100 faced early pressure on Monday, slipping as a stronger pound weighed on the export-heavy index. This downturn coincided with rising tensions between the Trump administration and Federal Reserve Chair Jerome Powell, alongside a slump in banking stocks triggered by President Trump's unexpected proposal to cap credit card interest rates. The pound advanced 0.4% against the dollar, buoyed by reports that the Trump administration had threatened Powell with a criminal indictment. This development raised concerns over the U.S. dollar's reliability as a safe-haven currency, further unsettling global markets. However, U.S. markets rebounded at the start of trading, boosting risk sentiment among UK investors and helping the FTSE 100 recover into positive territory by the close.

Banking stocks bore the brunt of the market's uncertainty, with Barclays sliding 3.3% and Close Brothers Group dropping 1.2%. The declines followed Trump's Friday proposal to impose a one-year cap on credit card interest rates at 10%, set to take effect on January 20. The lack of specific details surrounding the proposal left investors uneasy. Amid this volatility, investors turned to safe-haven assets, driving precious metal miners up by 4.3%. Gold prices surged to a record-breaking high of over $4,600 an ounce, reflecting increased demand for stability.

In other developments, the UK job market showed signs of cooling in December, marking the 39th consecutive month of declining hiring activity. While starting salaries rose, the trend kept the Bank of England focused on potential interest rate cuts following its December decision. Despite the broader market's challenges, certain individual stocks stood out. Semiconductor wafer maker IQE soared 34.6% after announcing that its revenue and adjusted core profit for fiscal year 2025 are expected to reach the upper end of its forecasts. Similarly, biotech firm Oxford Nanopore Technologies gained 7% after projecting annual revenue growth ahead of expectations.

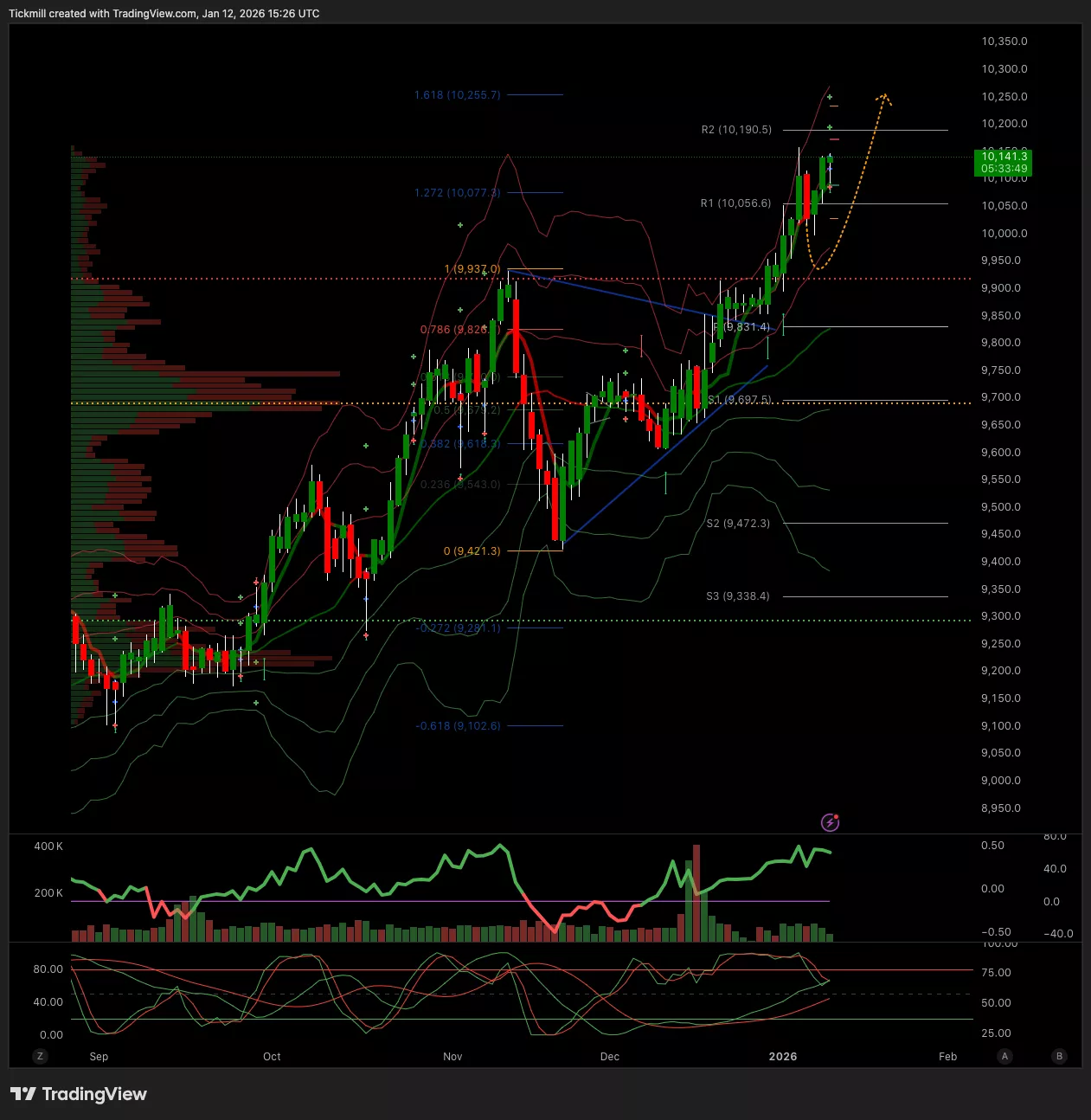

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 10050 Target 10250

- Below 9930 Target 9800

(Click on image to enlarge)

More By This Author:

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Jan. 12

Daily Market Outlook - Monday, Jan. 12

Daily Market Outlook - Friday, Jan. 9