Daily Market Outlook - Friday, Jan. 9

Photo by Adam Śmigielski on Unsplash

Asian markets stayed within a tight range as investors awaited two major events on Friday: the U.S. payrolls report and a possible Supreme Court ruling on Trump's tariffs. The MSCI Asia Pacific Index initially climbed but later dipped 0.2% before bouncing back as traders sought direction. Japanese equities surged over 1.5%, fueled by a weaker Yen against the Dollar and strong earnings from Fast Retailing. Meanwhile, Rio Tinto shares slipped amid ongoing discussions to acquire Glencore, a move that could create the world's largest mining company. Together, the two giants would boast a combined market value nearing an impressive $207 billion. While specific details remain scarce, the companies hinted that the proposed deal might involve an all-stock acquisition, with Rio Tinto possibly taking over "some or all" of Glencore. Industry watchers are eagerly awaiting more information about this groundbreaking development. European equity futures hinted at a positive start, while U.S. benchmark futures remained flat. Treasuries edged lower, and the Dollar Index appeared to be on track for its best week since November. In the U.S., mortgage-backed securities gained momentum after Trump unveiled plans to purchase $200 billion in mortgage bonds. Investors are gearing up for a pivotal Friday, with back-to-back risk events that could shift market sentiment in the near term. These developments may serve as one of the biggest tests for global stocks since their rebound from April's tariff-induced slump. Elsewhere in the markets, oil prices continued their upward climb as traders monitored geopolitical situations in Venezuela and Iran. Precious metals like gold and silver saw declines, while the South Korean Won weakened against the Dollar following the country's launch of 24-hour currency exchange trading in July.

Investors are on alert as they anticipate critical U.S. jobs data that should show a slow but stable labour market. President Donald Trump's global tariffs' constitutionality is under review by the Supreme Court, which could disrupt financial markets. The judgement, which might come Friday, has markets cautious. The Supreme Court's verdict is expected to dominate headlines and cause market volatility, considering last year's global tariffs. After the initial tariff shock, markets and risk assets rebounded fast. After November, conservative and liberal justices questioned whether the International Emergency Economic Powers Act of 1977 gave Trump the authority to implement tariffs, fuelling speculation that the court may overturn them. Importers who have already paid tariffs may seek $150 billion in refunds if the tariffs are ruled down. Additionally, the trade accords signed last year amid great publicity remain uncertain. Investors will focus on December's employment data before the court's ruling to better understand the U.S. labour market. It may provide some insights, but this analysis is unlikely to allay concerns about interest rates in 2024. Markets expect two rate cuts this year, while a split Federal Reserve has suggested one. For now, traders expect the Fed to maintain rates at its next meeting. Many economists and politicians have called the labour market a “no hire, no fire” situation. The jobs report is likely to shed light on its health.

Domestically, the UK data calendar has been fluid this week. The BoE Decision Maker Panel for December, published earlier than expected, and the KPMG/REC jobs report, delayed to next week, offered limited new insights. The DMP results showed continued negative trends in employment and elevated inflation expectations (3.5-4.0%), which remain above MPC targets. While firms' price expectations show a slight downward trend, it's not significant enough to sway policy hawks. An accelerated rate easing in 2026 would require clearer signs of worsening employment or sharper declines in price expectations. This survey didn’t significantly alter the narrative.

Overnight Headlines

- Investors Look To Dec Payrolls For ‘Clean’ Read On US Employment

- Trump’s Cuts Shrink Federal Workforce Across Most Agencies

- Trump Instructs Fannie, Freddie To Buy $200B In Mortgage Bonds

- US Senate Votes To Block Trump From More Military Action In Venezuela

- France To Vote Against EU–Mercosur Trade Deal

- Canada Warns Of Arctic Conflict After Trump’s Greenland Threats

- BoC Sees Senior Departures As Carney Pushes Budget Cuts

- Japan’s Household Outlays Rose Ahead Of Takaichi’s Stimulus Plan

- China CPI Hits Fastest Pace Since Feb 2023, In Line With Estimates

- GM To Take $7.1B Charge On EV Pullback And China Restructuring

- Glencore, Rio Tinto Restart Merger Talks

- LG Electronics Expects First Quarterly Operating Loss In Nine Year

- Merck In Talks To Acquire Cancer Drugmaker Revolution Medicines

- CK Hutchison Picks Goldman, UBS For HK–London IPO Of Watson Group

- Toyota Beats Nissan In Quarterly EV Sales In Japan For First Time

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1500 (7BLN), 1.1600-10 (2.2BLN), 1.1700 (286M), 1.1750 (662M)

- 1.1785-1.1800 (3BLN)

- GBP/USD: 1.3350 (362M), 1.3400 (200M), 1.3500 (370M)

- AUD/USD: 0.6680 (335M), 0.6700 (185M)

- NZD/USD: 0.5700 (275M), 0.5800 (724M)

- USD/CAD: 1.3800 (678M), 1.3835-50 (523M), 1.3900 (205M), 1.3950-65 (1.2BLN)

- USD/JPY: 156.85-157.00 (610M), 157.50 (334M), 158.00 (750M)

CFTC Positions as of December 23rd:

- - S&P 500 CME net short position down 18,436 to 372,091

- - S&P 500 CME net long position down 27,949 to 936,689

- - CBOT US 5-year Treasury net short up 41,847 to 2,340,036

- - CBOT US 10-year Treasury net short up 72,262 to 742,370

- - CBOT US 2-year Treasury net short up 11,570 to 1,362,703

- - CBOT US UltraBond net short down 18,163 to 232,146

- - CBOT US Treasury bonds net short down 37,884 to 8,742

- - Bitcoin net short at –479 contracts

- - Swiss franc net short at –43,989 contracts

- - British pound net short at –41,199 contracts

- - Euro net long at 159,891 contracts

- - Japanese yen net long at 1,223 contracts

Technical & Trade Views

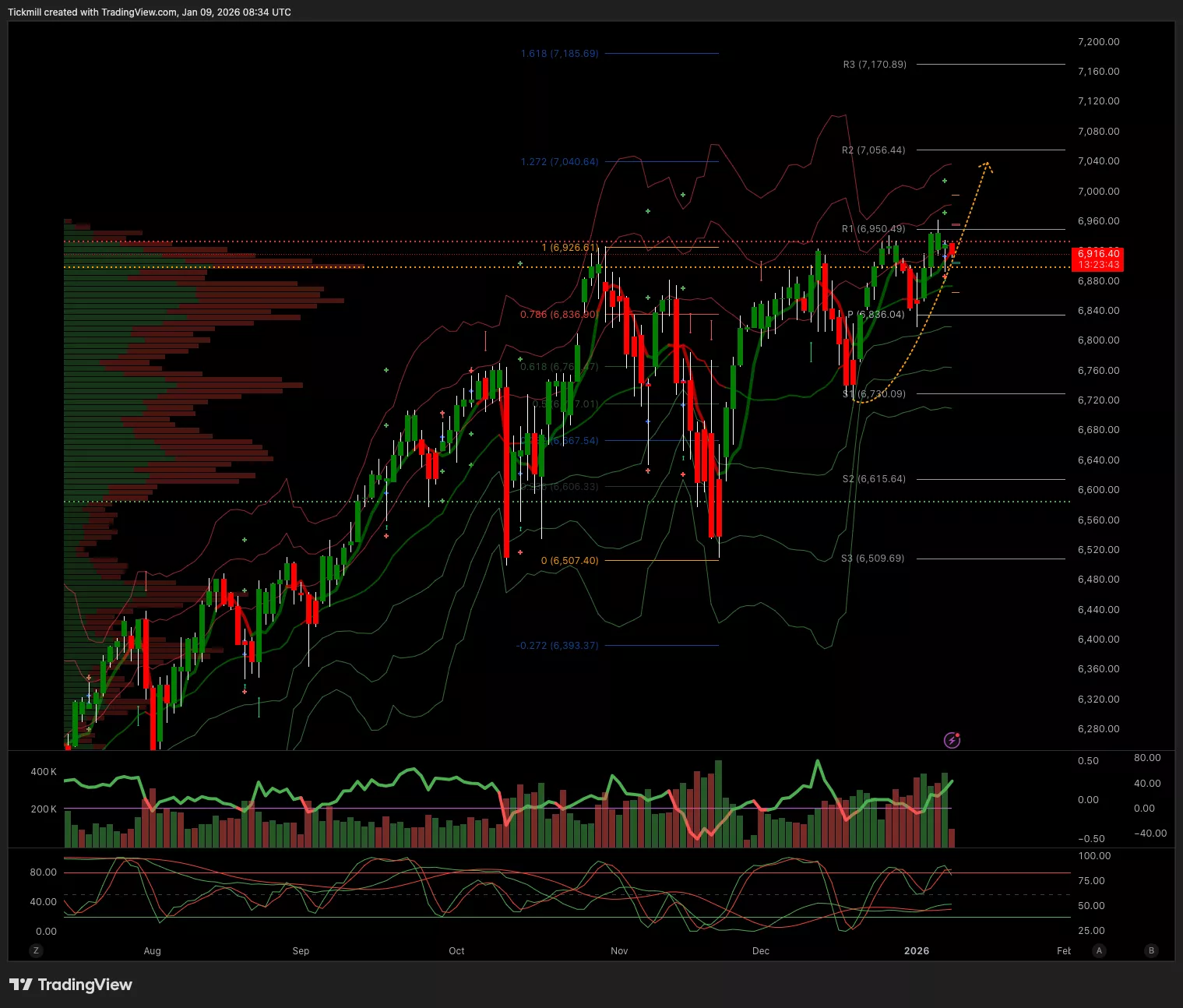

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6890 Target 7030

- Below 6860 Target 6812

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.1750 Target 1.18

- Below 1.1685 Target 1.1580

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.3490 Target 1.36

- Below 1.3490 Target 1.3390

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 157.40 Target 160

- Below 156.50 Target 155

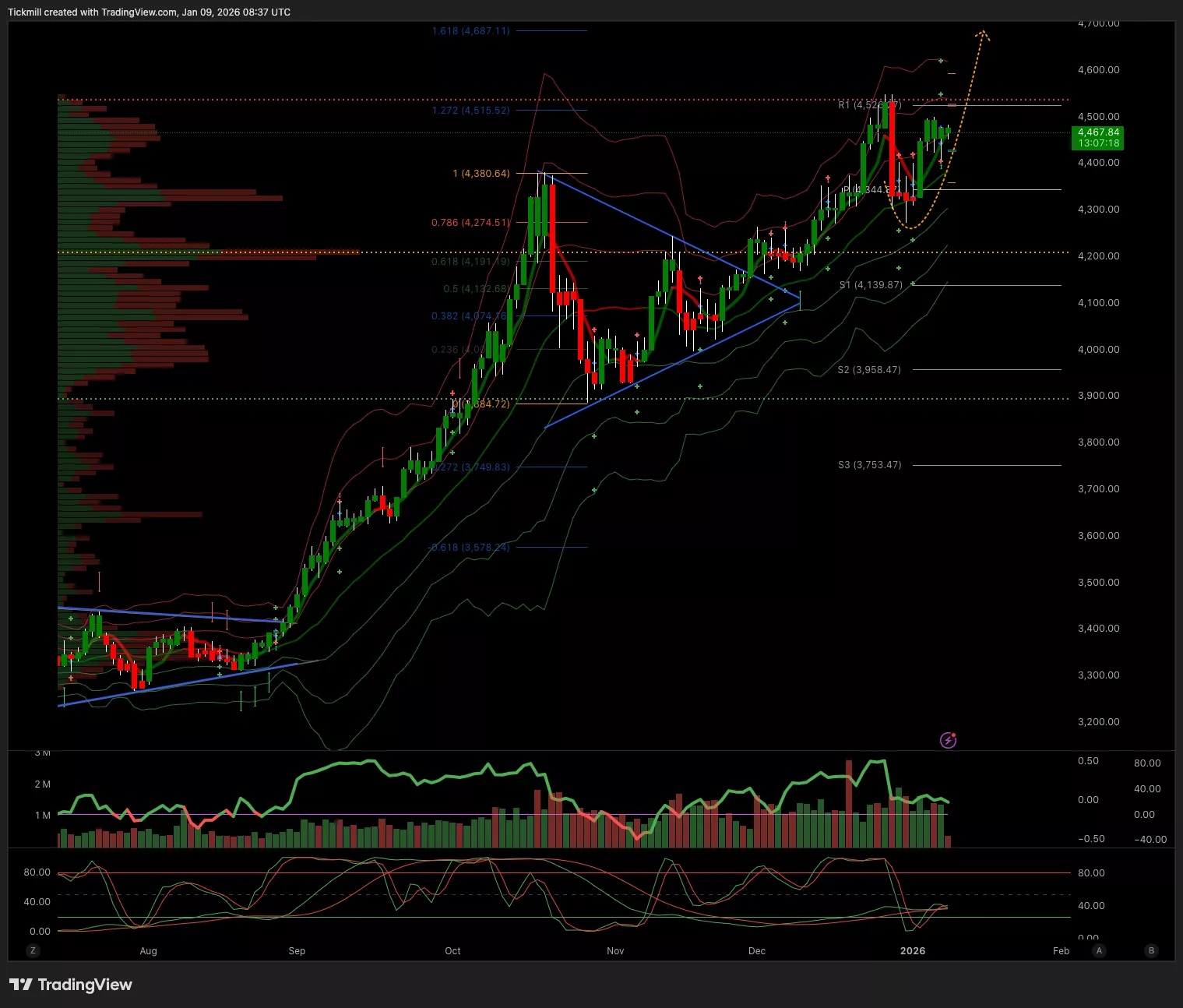

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4400 Target 4687

- Below 4360 Target 4200

More By This Author:

The FTSE Finish Line - Thursday, Jan. 8

Daily Market Outlook - Thursday, Jan. 8

The FTSE Finish Line - Wednesday, Jan. 7