Daily Market Outlook - Thursday, Jan. 8

Photo by Kanchanara on Unsplash

Global government bonds and US Treasuries surged during Asian trading hours, driven by bleak US economic data and escalating geopolitical tensions. Meanwhile, stocks appeared set to endure a second straight day of losses. Treasuries saw gains across the yield curve, with the 10-year benchmark yield dipping nearly 1 basis point to 4.14%. Australian bonds also climbed as the nation's central bank signalled a cautious approach to future interest rate hikes. Similarly, New Zealand's government debt saw an uptick. In Japan, bond futures continued their upward momentum after a 30-year debt auction yielded slightly better-than-expected results, despite a weaker bid-to-cover ratio. Asian stock markets shed 0.6%, while futures tied to US and European equities extended their declines. Among commodities, platinum and silver led losses in precious metals, while oil prices ticked higher as the US ramped up efforts to assert control over Venezuela. Thursday's market activity echoed rallies in UK gilts and German government bonds, as disappointing economic figures spurred traders to strengthen expectations for interest rate cuts. This came against the backdrop of record-breaking global bond sales, with borrowers rushing to meet insatiable investor demand for risk. Elsewhere, gold prices slipped for a second consecutive day as markets braced for the annual rebalancing of commodity indexes. This adjustment could potentially trigger the sale of billions of dollars in futures contracts in the coming days. Optimism on Wall Street took a hit as traders grappled with mixed economic signals and reevaluated evolving geopolitical tensions, all while keeping an eye on a surge of social media activity from the US president. Bond yields dipped across global markets. The S&P 500 edged down by 0.3% after reaching its second intraday high of 2026 just the day before, while the Nasdaq 100 struggled to maintain a small gain. Market momentum faltered following remarks from President Donald Trump, which impacted homebuilders and defence contractors. Meanwhile, Valero Energy led a rally among refiners after Trump announced that Venezuela would send millions of barrels of oil to the United States.

The U.S. data calendar is settling into a more regular rhythm, bringing a steady stream of labour market updates this week. Wednesday’s ADP report offered a small dose of reassurance with employment returning to growth, yet the 41,000 increase in jobs, though better than the slightly revised 29,000 drop in November, fell short of the 50,000 median expectation. The familiar trouble spots remain evident: small businesses only added 9,000 jobs after slashing 96,000 positions in the prior month, marking the fourth straight month of declines for this critical sector. Job creation continues to be uneven, with healthcare and education driving most of the gains, followed by leisure and hospitality. In contrast, business and professional services saw a sharp downturn, shedding jobs at the fastest rate since June. The JOLTS report painted a mixed picture, leaving interpretation open to perspective. On one hand, a rise in quits and a decline in layoffs suggest workers may feel more confident and less vulnerable to job losses. On the other hand, job openings dropped again (7.146 million, down from a downwardly revised 7.449 million), and hiring rates slipped as well (5.115 million, down from 5.368 million), reinforcing the narrative of a weak employment landscape. Complicating matters further are seasonal adjustment issues and lingering effects from the recent government shutdown, which continue to muddy the data. As for Friday’s upcoming Nonfarm Payrolls (NFP) report, with a median forecast of 70,000, there’s little reason to believe it will provide much clarity on the labour market’s direction.

Overnight Headlines

- ECB’s Pereira Says Price Stability In Place, Urges EU Reforms

- RBA’s Hauser: Current Cutting Cycle Likely Over, Inflation Still High

- Fed’s Bowman Floats Bank Rating, Regulatory Threshold Changes

- Trump Wants To Lower Oil Prices To $50 A Barrel, Sources Say

- Trump Opens New Front Against China With Brazen Arrest Of Maduro

- Samsung Posts Record Profit After AI Supercharges Memory Market

- JPMorgan Chase Reaches A Deal To Take Over The Apple Credit Card

- US Blue-Chip Bond Sales Hit $88B, Busiest Week Since 2020

- Trump Signs Order Pressing Defence Firms To Cut Buybacks

- Ford Hints At Robotaxis With Plans For Eyes-Off-Road Technology

- Trump’s Bid To Block Corporate Homebuying Blindsides Wall Street

- AbbVie Close To Deal For Cancer Drugmaker RevMed, WSJ Says

- Chevron In Talks With US To Extend Venezuela Operating Licence

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1650-60 (2.4BLN), 1.1670-80 (2.1BLN), 1.1685-90 (748M)

- 1.1695-1.1700 (1.2BLN), 1.1745-50 (714M), 1.1800 (2.2BLN)

- USD/CHF: 0.7925 (350M), 0.8035 (508M). EUR/GBP: 0.8750 (251M)

- GBP/USD: 1.3400 (275M), 1.3425 (206M), 1.3465 (236M)

- AUD/USD: 0.6690-0.6700 (650M), 0.6730 (1.1BLN)

- USD/CAD: 1.3785 (473M), 1.3825 (200M)

- USD/JPY: 156.15 (2.2BLN), 156.50-60 (1.1BLN), 157.00 (3.5BLN), 157.50 (592M), 158.00 (2BLN)

CFTC Positions as of December 23rd:

- - S&P 500 CME net short position down 18,436 to 372,091

- - S&P 500 CME net long position down 27,949 to 936,689

- - CBOT US 5-year Treasury net short up 41,847 to 2,340,036

- - CBOT US 10-year Treasury net short up 72,262 to 742,370

- - CBOT US 2-year Treasury net short up 11,570 to 1,362,703

- - CBOT US UltraBond net short down 18,163 to 232,146

- - CBOT US Treasury bonds net short down 37,884 to 8,742

- - Bitcoin net short at –479 contracts

- - Swiss franc net short at –43,989 contracts

- - British pound net short at –41,199 contracts

- - Euro net long at 159,891 contracts

- - Japanese yen net long at 1,223 contracts

Technical & Trade Views

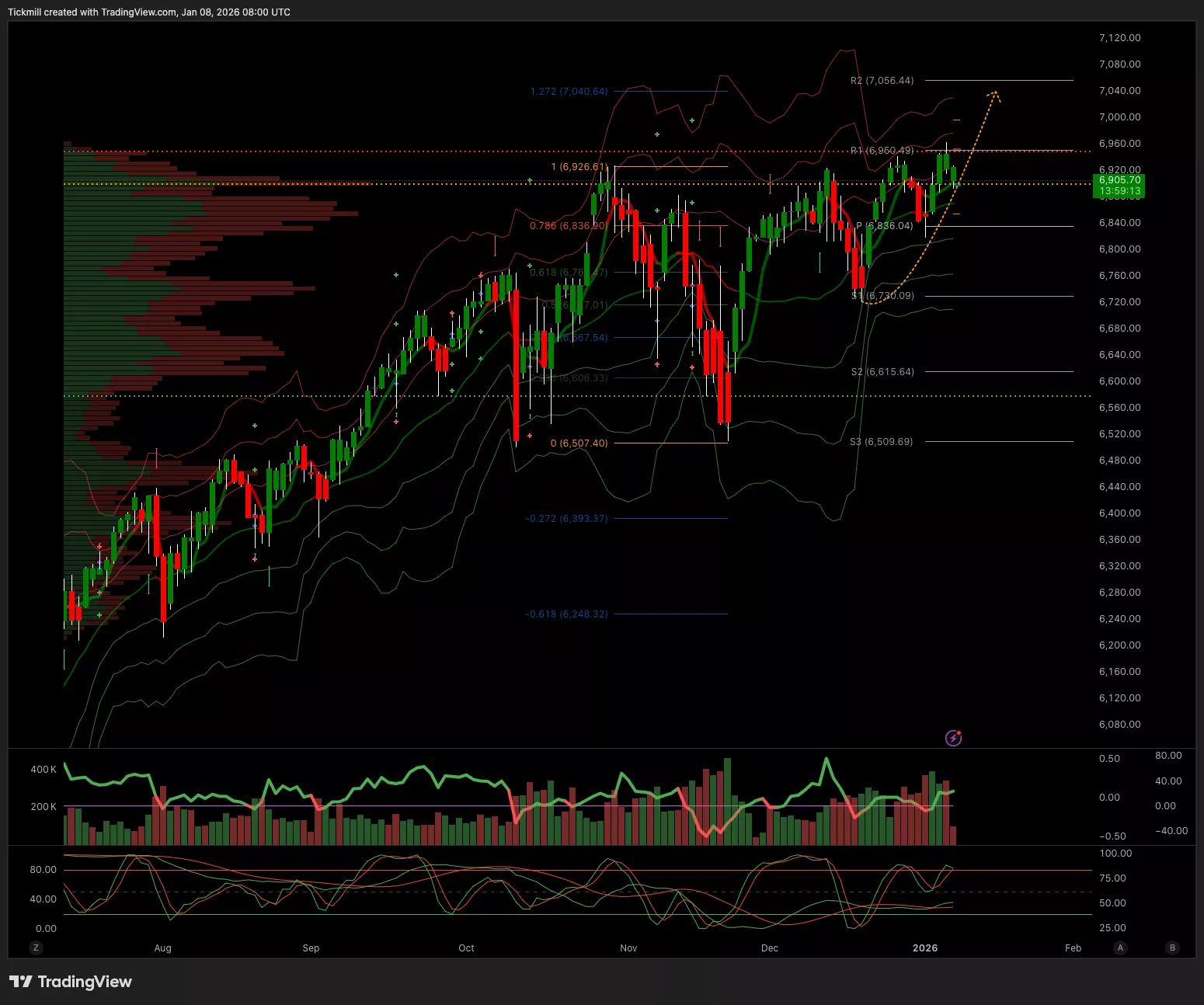

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6890 Target 7030

- Below 6860 Target 6812

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.1750 Target 1.18

- Below 1.1730 Target 1.1630

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.3490 Target 1.36

- Below 1.3490 Target 1.3440

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 157.40 Target 160

- Below 156.50 Target 155

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4400 Target 4687

- Below 4360 Target 4200

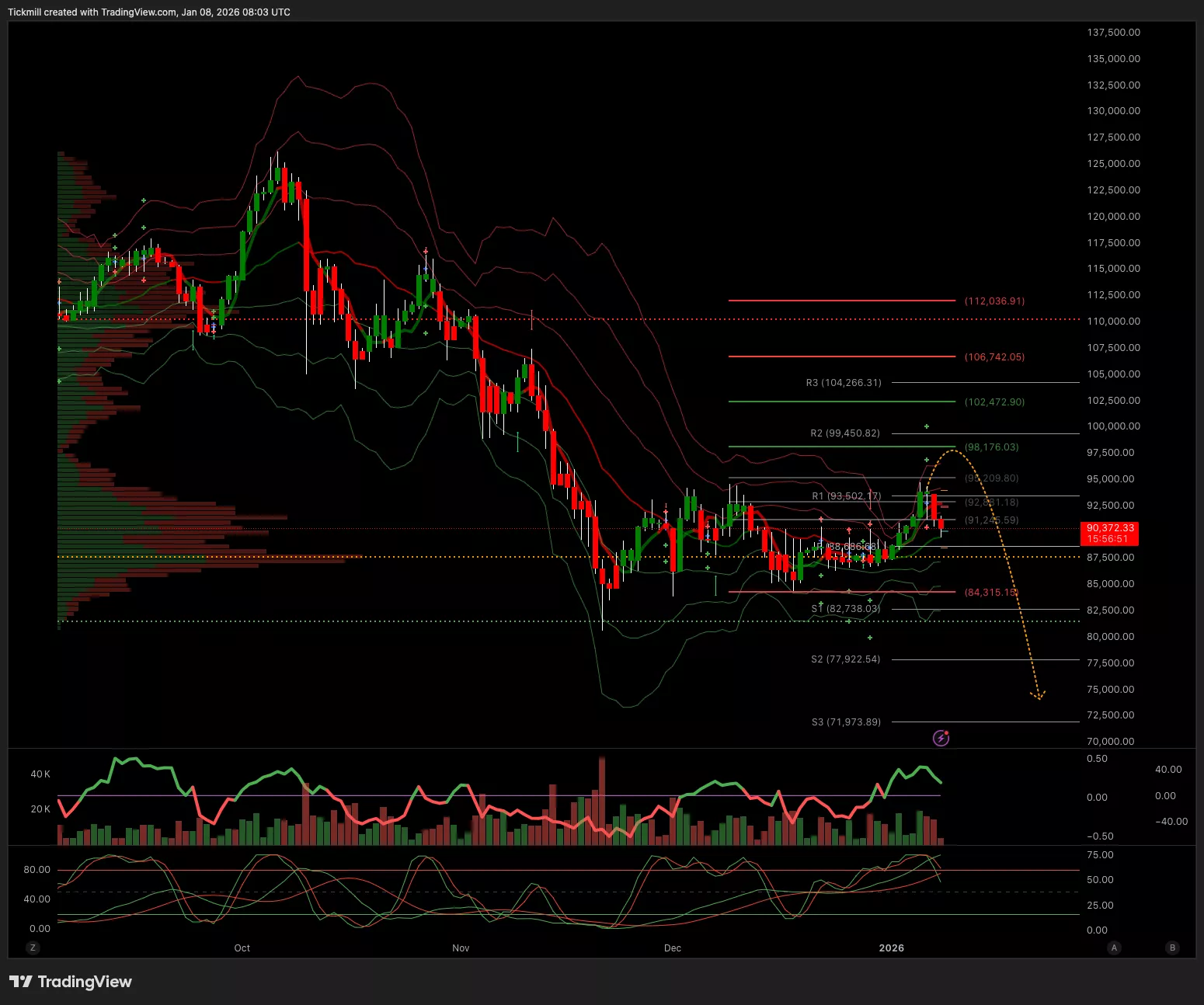

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 91.8k Target 98.17k

- Below 91.2k Target 88.7k

More By This Author:

The FTSE Finish Line - Wednesday, Jan. 7

Daily Market Outlook - Wednesday, Jan. 7

The FTSE Finish Line - Tuesday, Jan. 6