The ETF Portfolio Strategist - Sunday, April 25

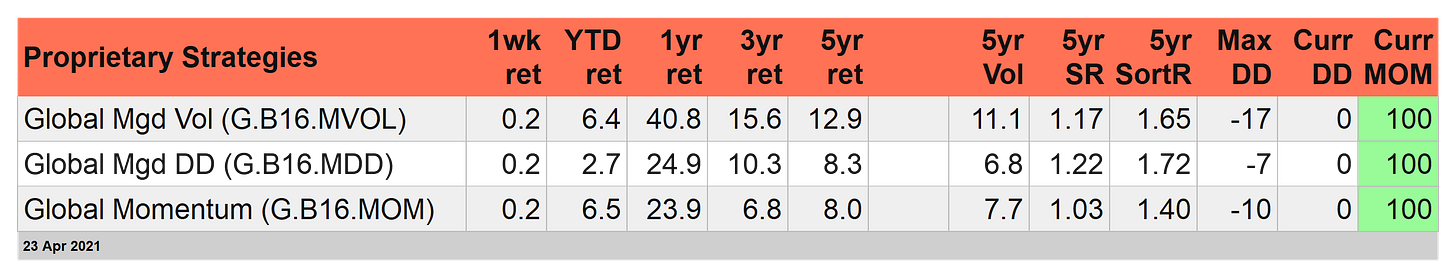

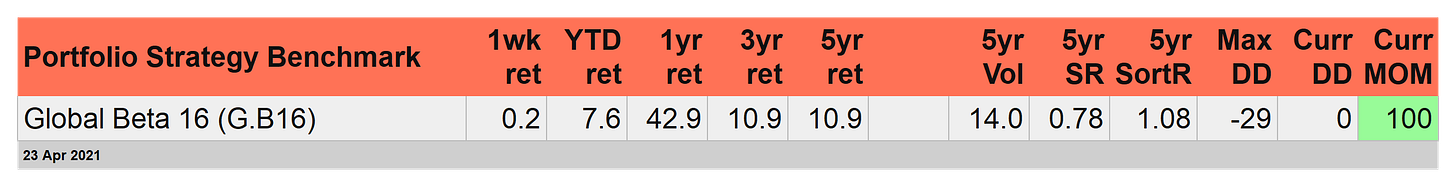

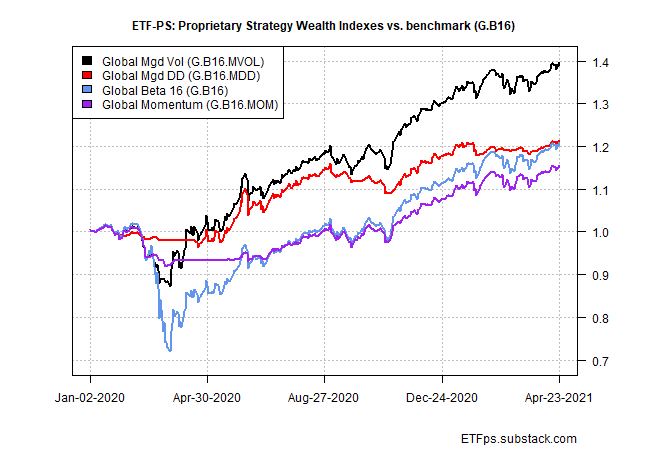

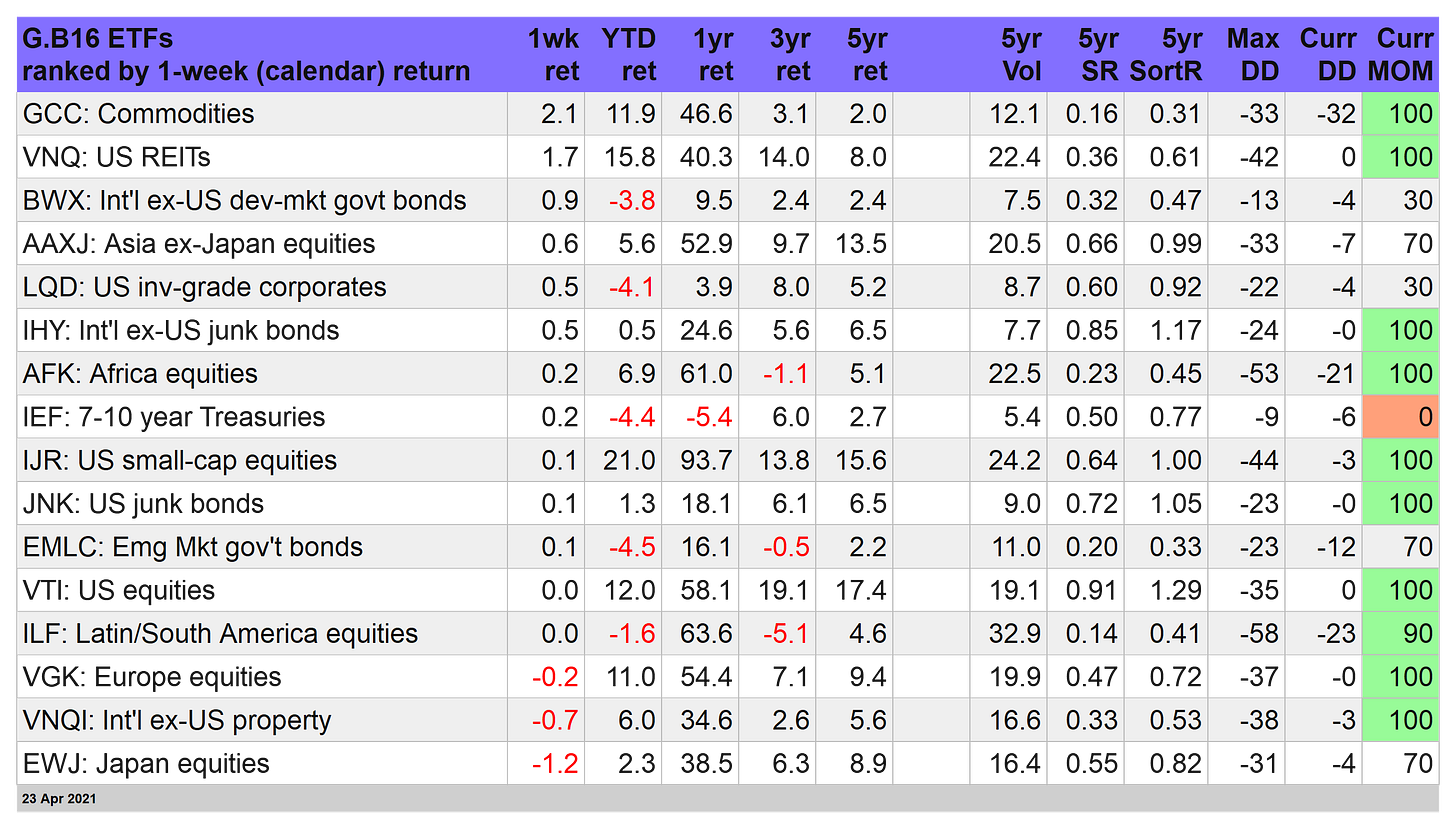

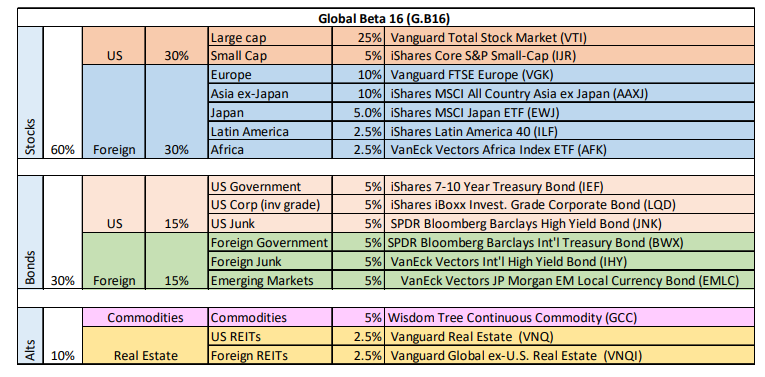

A rally across most global markets last week lifted all three of our proprietary strategies, which use the same 16-fund opportunity set that defines their benchmark. In a performance quirk, each of the proprietary strategies rose 0.2% for the trading week (through April 23), matching the gain for the benchmark -- Global Beta 16 (G.B16).

For year-to-date results, G.B16 still enjoys a comfortable lead over the proprietary portfolios, rising 7.6% so far in 2021. Beta, in short, remains tough to beat in the current environment.

Global Momentum (G.B16.MOM) is posting the strongest year-to-date gain for the proprietary strategies via a 6.5% increase. That’s just ahead of the second-best 2021 proprietary performer: Global Managed Drawdown (G.B16.MDD), which is up 6.5%. The distant third-place proprietary strategy is Global Managed Volatility (G.B16.MDD) with a relatively weak 2.7% gain for the year so far.

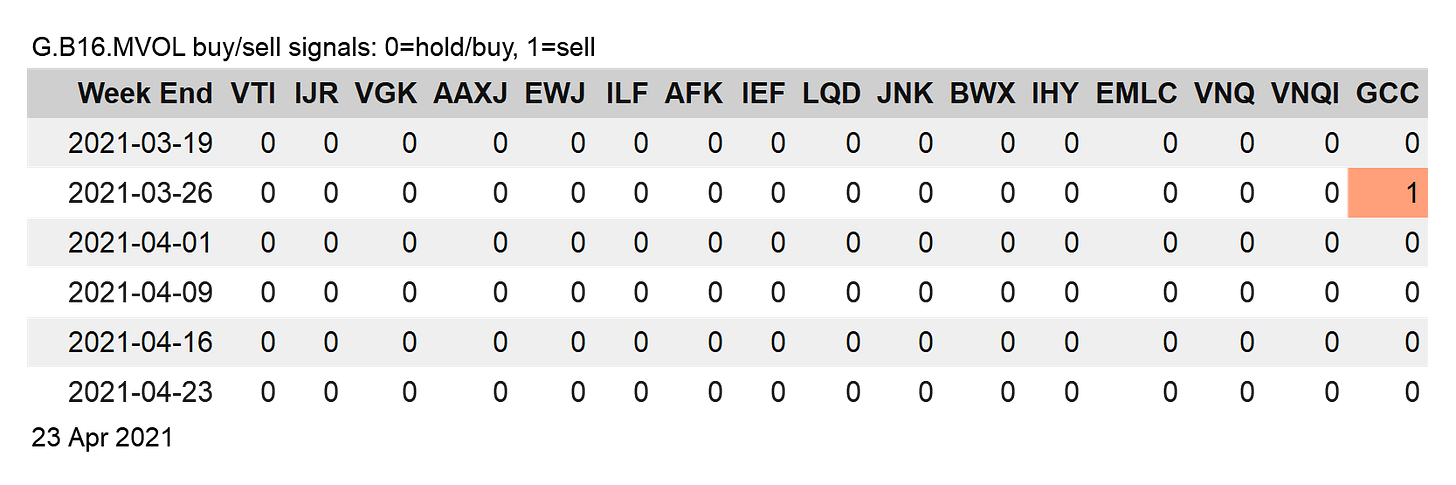

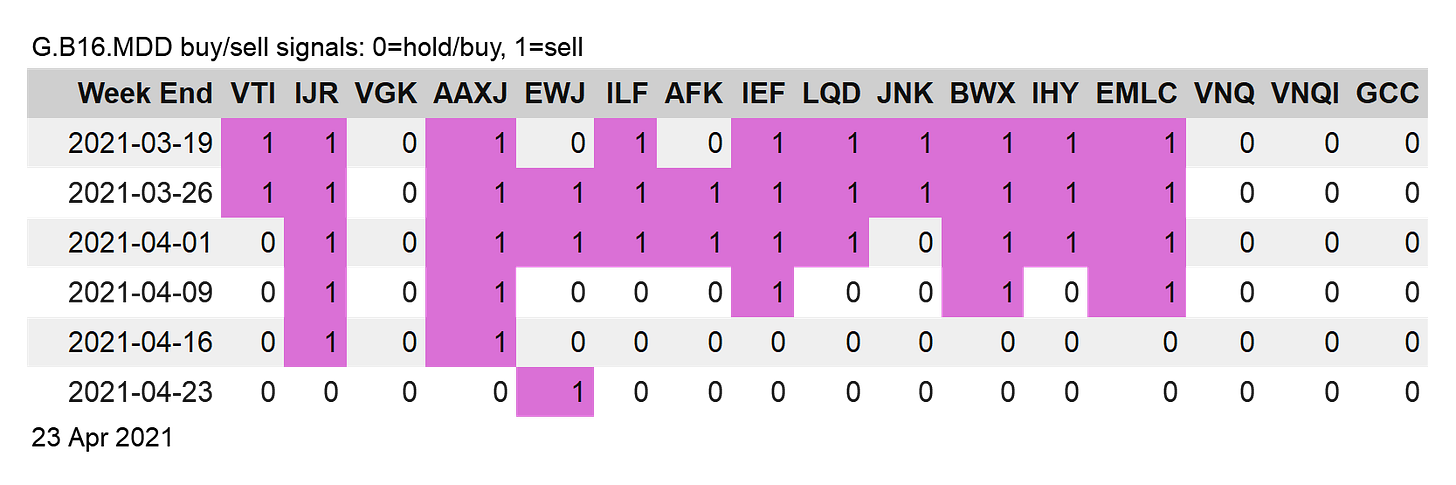

Meanwhile, risk-management rebalancing activity was minimal last week for the proprietary strategies. There were no changes for G.B16.MVOL, which remains risk-on for all its target funds. Meanwhile, G.B16.MDD recorded one change at last week’s close: iShares MSCI Japan ETF (EWJ), which shifted to a risk-off posture.

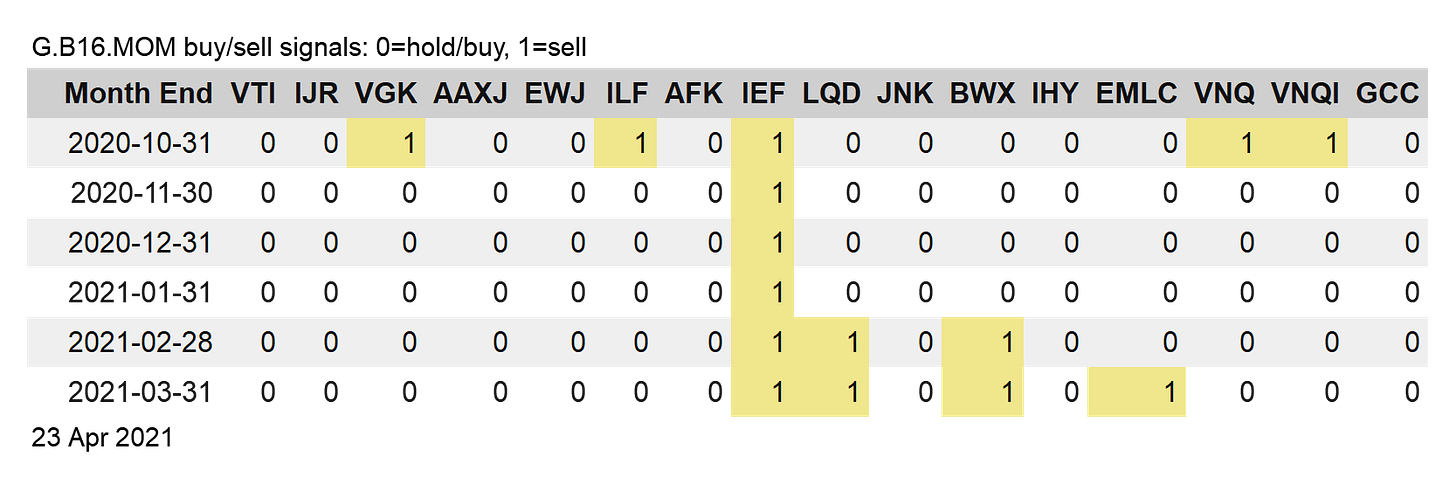

Otherwise, the remaining funds for G.B16.MDD are still risk-on. G.B16.MOM, by design, is only rebalanced at the end of each month and so for the moment remains risk-on for 12 of its 16 funds per the Mar. 31 rebalance.