The ETF Portfolio Strategist - Saturday, April 24

In this issue:

- Commodities rally to six-year high.

- US stocks are flat, breaking a four-week winning streak.

- US Treasuries continue to recover.

- Broad, global diversification continues to lead portfolio strategy benchmarks.

Breakout for Commodities

WisdomTree Continuous Commodity Index (GCC) has been trending higher for much of the past year, and the good times kept rolling this week. GCC jumped 2.1%, closing on Friday (April 23) at its highest price in nearly six years.

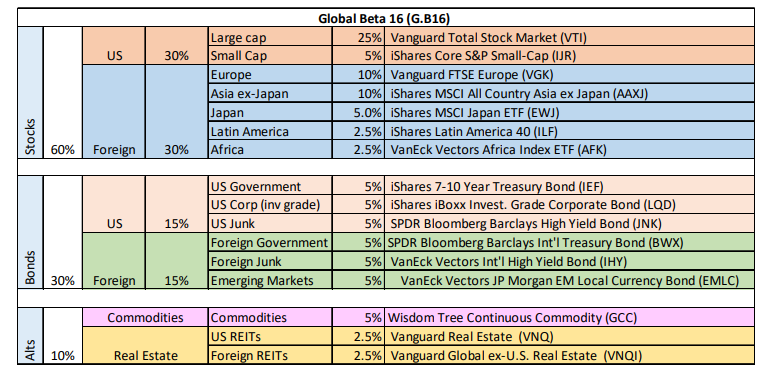

The equally weighted GCC also tops the weekly performance race for our 16-fund opportunity set (see table below). For the year so far, the ETF is up nearly 12%, the fourth-best performer for our primary funds representing the major asset classes.

A bullish driver of commodities prices lately has been expectations that inflation is on the rise. An added boost for commodities is that the US dollar remains weak. US Dollar Index closed Friday at its lowest level in over a month. The greenback and commodities tend to be negatively correlated, which favors the latter at the moment.

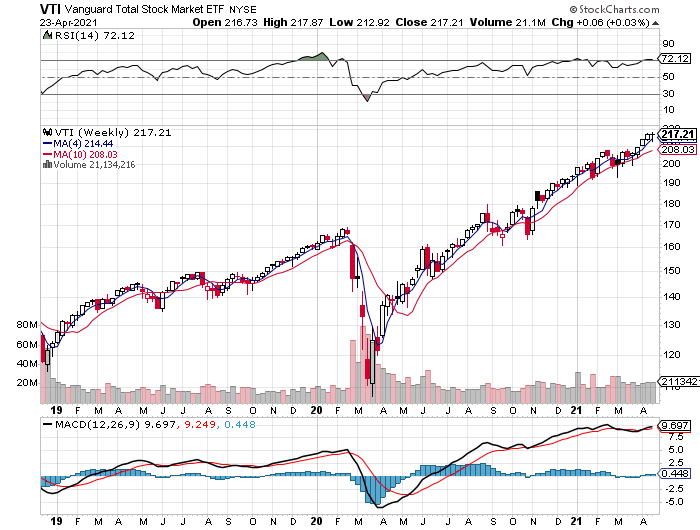

US equities broke their four-week winning streak, ending the week with no change, based on Vanguard Total US Stock Market (VTI). Analysts continue to argue that US shares are overvalued, perhaps to the point of entering bubble territory. Nonetheless, from a trending perspective, there’s no sign that the party’s about to end.

Meanwhile, the nascent recovery in Treasuries continues. Inflation risk may be rising, but so far it is having no impact on the rebound in iShares 7-10 Year Treasury Bond (IEF), which rose for a third straight week. For now, the bond market appears unpersuaded that higher inflation is sustainable beyond the next several months and a widely expected bounce due to “base effects.”

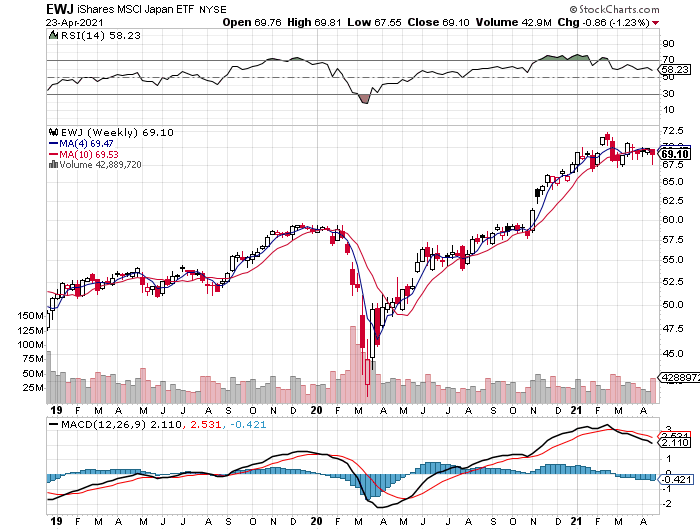

The weakest performer this week was Japan equities. The iShares MSCI Japan Fund (EWJ) continues to be caught in a tight trading range, although that didn’t stop it from losing 1.2% this week.

Broader Is Still Better For Global Beta

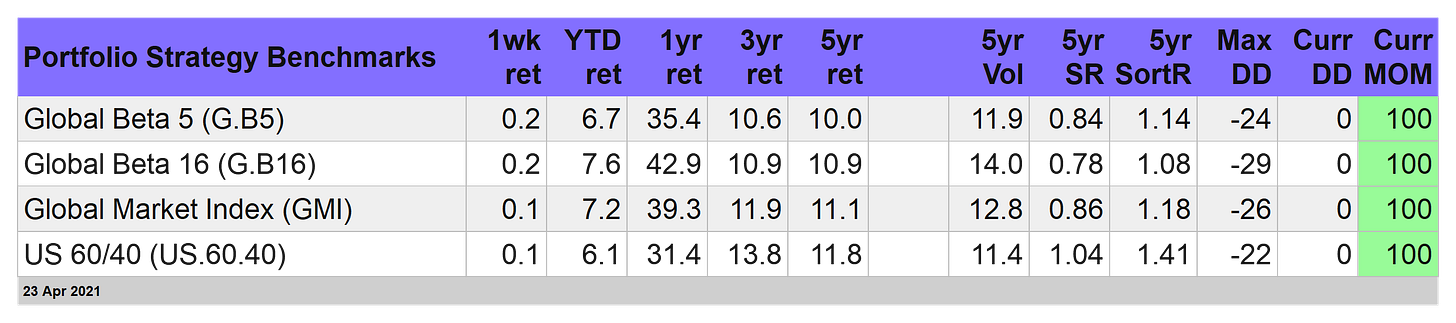

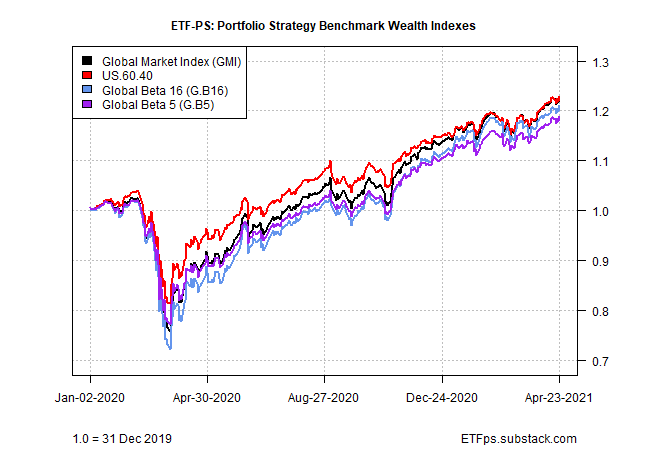

Our portfolio benchmark based on our 16-fund opportunity set (see table above and weights table below) continues to lead year-to-date. The 0.2% weekly advance for Global Beta 16 (G.B16) lifted the index to a strong 7.6% rally for 2021 so far. That’s modestly above the second-best strategy benchmark performer: Global Market Index (GMI), which holds a slightly different set of ETFs and is an unmanaged, market-weighted portfolio.

Meanwhile, the US-focused benchmark — the familiar 60/40 stock/bond mix (US.60.40) — continues to lag this year, posting a solid but last-place 6.1% year-to-date total return. As we noted last week, the recent revival in foreign assets (and other asset classes beyond US stocks and bonds) is delivering an unfamiliar challenge to America-centric investing: relatively weak results.

Are we at the dawn of an extended run of dominance for global asset allocation after a long relative performance drought? Unclear, but this week offered another reason to think that the dominance of all things US in asset-allocation land may be coming to an end for the foreseeable future.