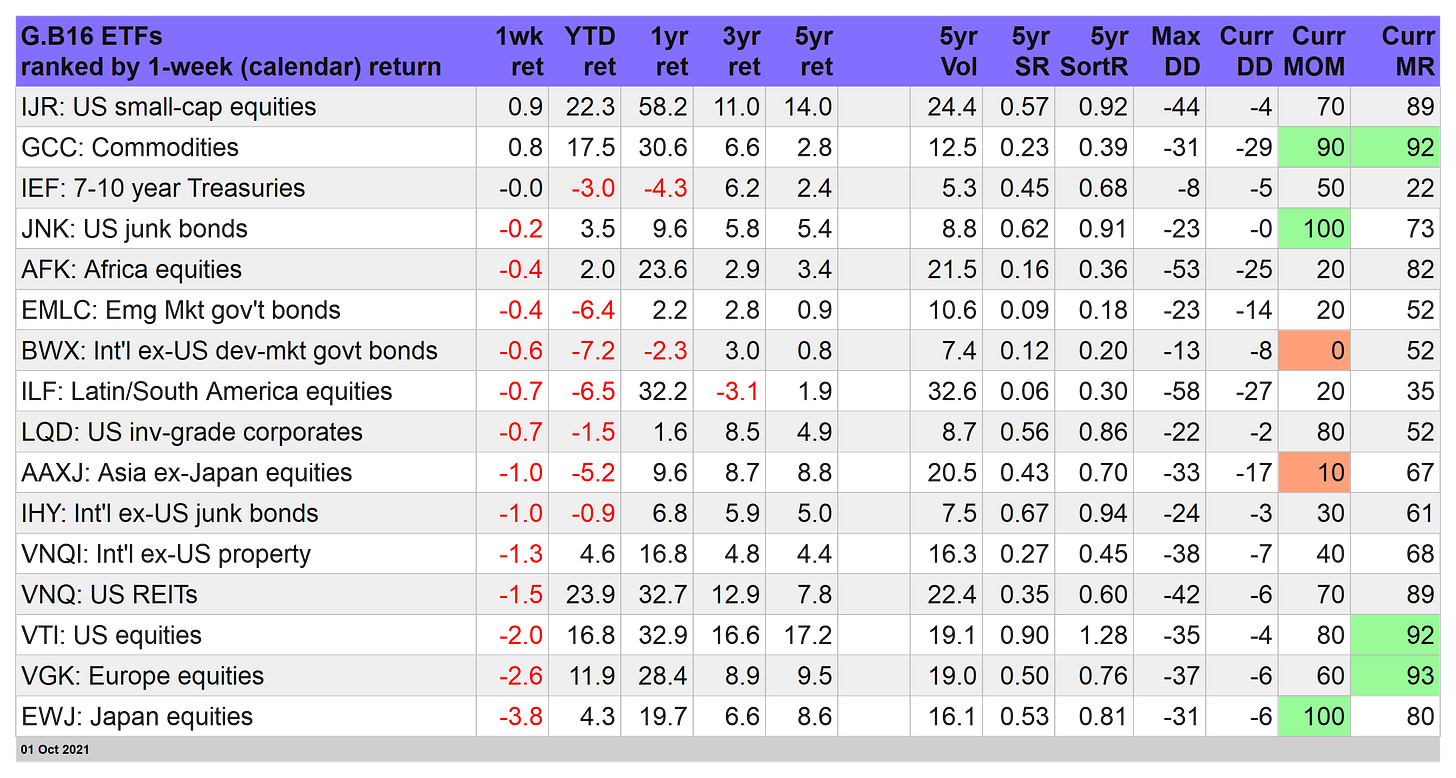

The ETF Portfolio Strategist - Saturday, Oct. 2

Small-cap stocks and commodities rallied this week. Otherwise, it was a bust for our world-spanning global ETF opportunity set for the trading week through Friday, Oct. 1.

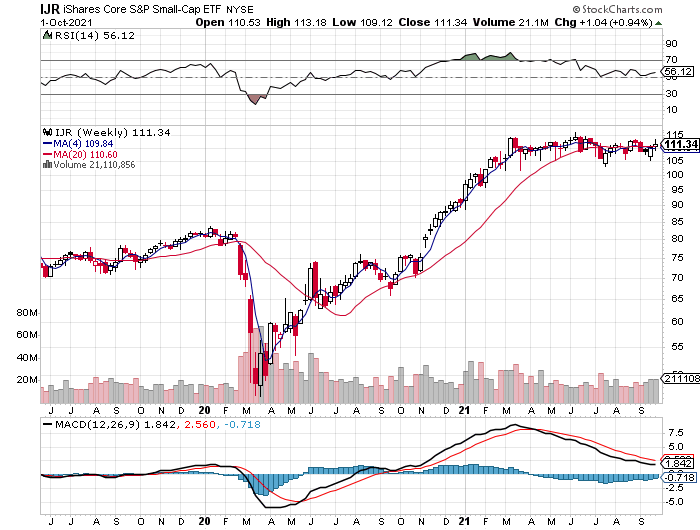

Despite a fresh round of political turmoil in Washington, small-cap shares continued to edge higher, rising 0.9% for the week. The gain marks the third straight weekly advance. Are small-caps pulling out of their recent funk? Possibly, although we’re still a bit skeptical since the rally as of late only lifts IJR to the upper range of its trading history for 2021 to date.

But the relative value with small-caps has caught the attention in some corners. Kiplinger’s this week advised that “small-caps are offering undeniable value,” citing Morningstar data that shows these stocks trading at a respectable discount via average price-earnings ratio vs. large stocks — 16 vs. 22.

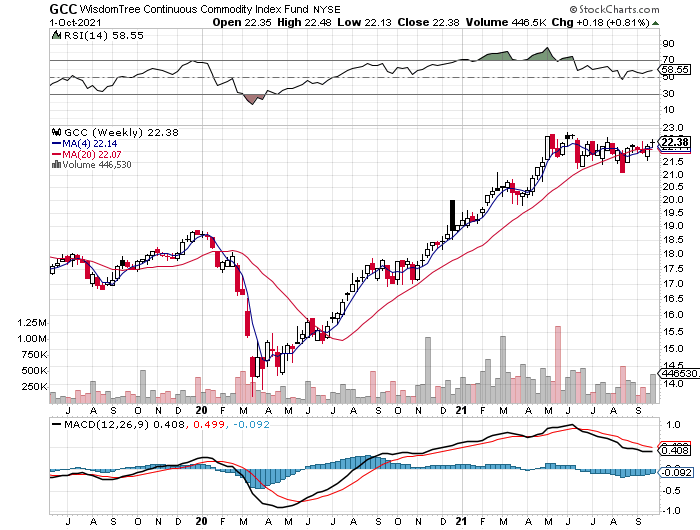

Meanwhile, commodities enjoyed another weekly gain. The equal-weighted WisdomTree Commodity ETF (GCC) rose 0.8%, closing the week near the highest level in two months. Bubbly news about inflation is keeping prices in this corner buoyant. One of the Federal Reserve’s favorite inflation measures — Personal Consumption Expenditures Index — accelerated in August, rising 4.3% year-over-year, the fastest pace in 30 years.

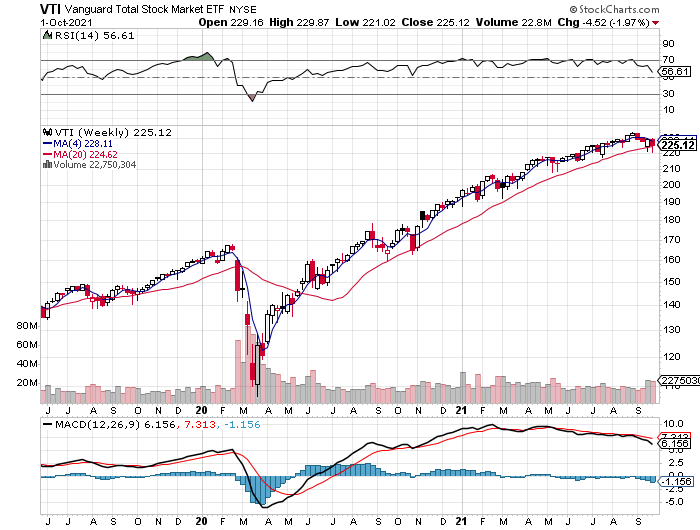

US stocks generally, on the other hand, are looking wobbly these days. Vanguard US Total Stock Market (VTI) slumped 2.0% this week. We’ve been here before, but the latest decline in recent weeks is the deepest and longest this year. Some of the weakness is probably driven by the uncertainty in Washington over the on-again/off-again infrastructure bill.

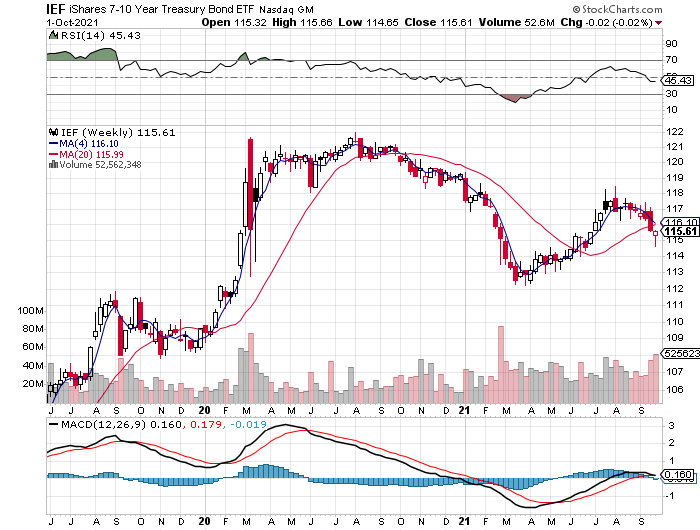

US bonds, on the other hand, look increasingly bearish. The iShares 7-10 Year Treasury Bond ETF (IEF) slumped for a sixth week. If inflation data stays hot, Treasury yields will likely rise further and IEF will remain on the defensive.

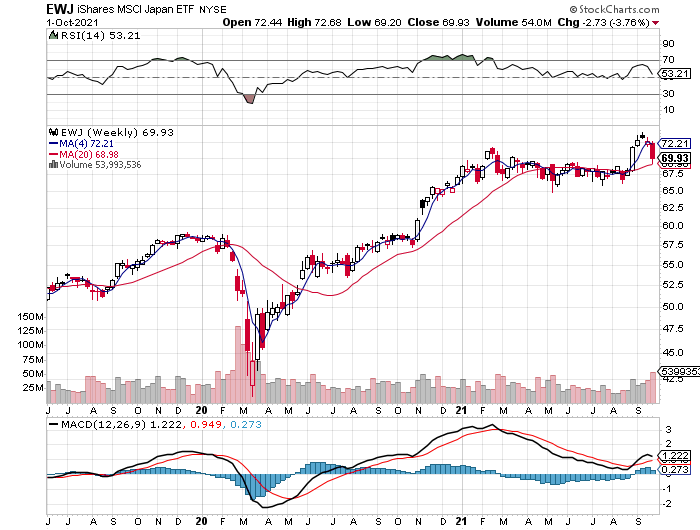

The biggest loser for our global opportunity set this week: equities in Japan. The iShares MSCI Japan ETF (EWJ) tumbled 3.8%. Some of the loss is related to challenging macro conditions for Japan, but political factors are playing a role.

Recall that EWJ surged a few weeks back Prime Minister Yoshihide Suga decided to step down, which triggered a sharp rally, presumably on expectations that his replacement would usher in a new period of pro-growth policies. But as I noted a month ago, “until it’s clear who’s going to run the show (and we’re a long way from clarity on that front), Friday’s jump looks like a speculative, short-term move.”

That was then. This week we learned that a party stalwart, Fumio Kishida, will become the new prime minister. But it’s fair to say that the market’s skeptical that the country is set to embark on a new run of economic dynamism.

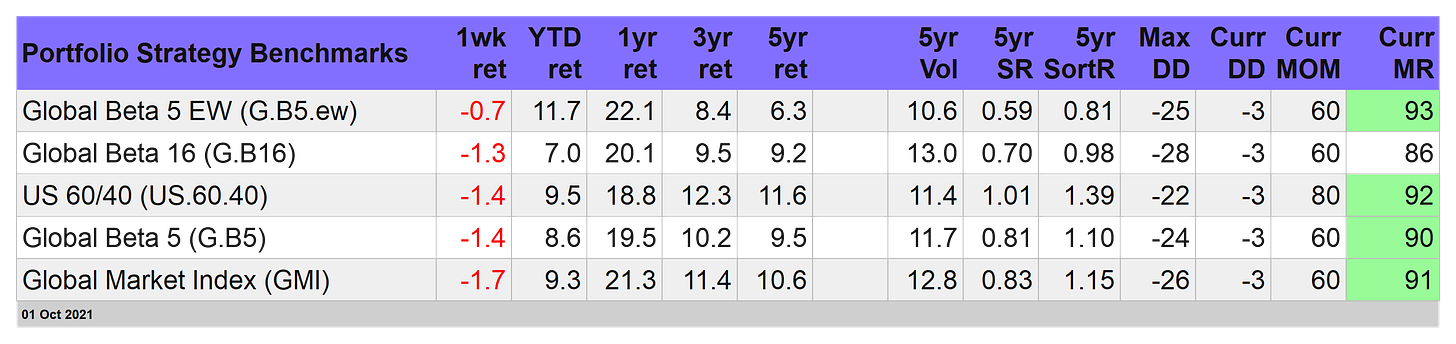

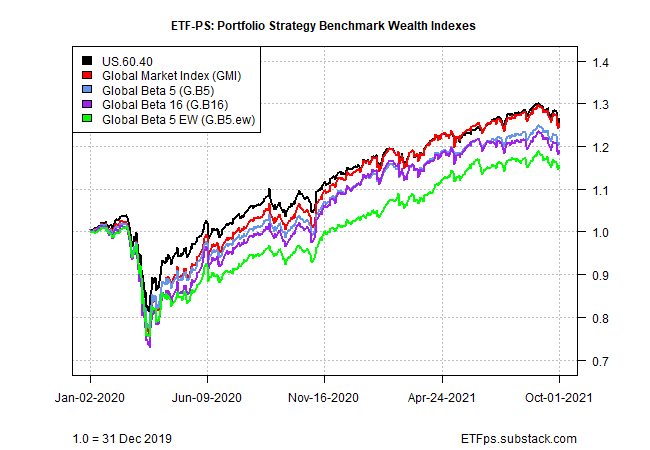

Across-The-Board Losses for Strategy Benchmarks

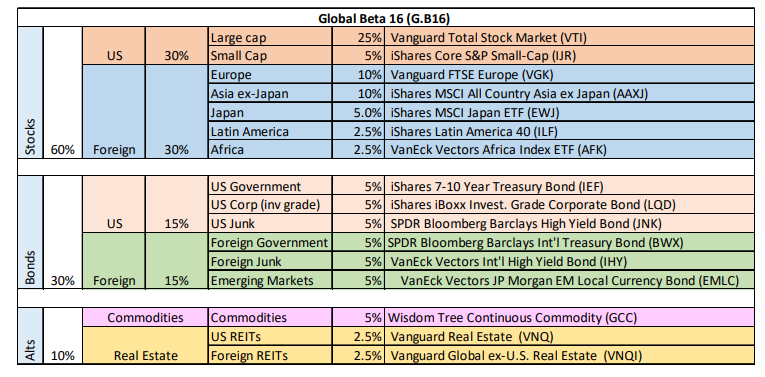

With red ink dominating most markets this week, there was no place to hide for our portfolio benchmarks. Losses ranged from 0.7% for the equal-weighted Global Beta 5 EW (G.B5.ew) to a much steeper 1.7% weekly decline for the more granular allocation of Global Market Index (GMI). When the dust cleared, G.B5.ew remained far in the lead year-to-date.

For details on all the strategies and metrics in the tables provided, see this ...

more