“The Economic Consequences Of Trump’s War On Multilateralism”

That’s the title of my October 18th Global Hot Spots talk, sponsored by the Wisconsin Alumni Association (Fluno Center, 1:30-2:30).

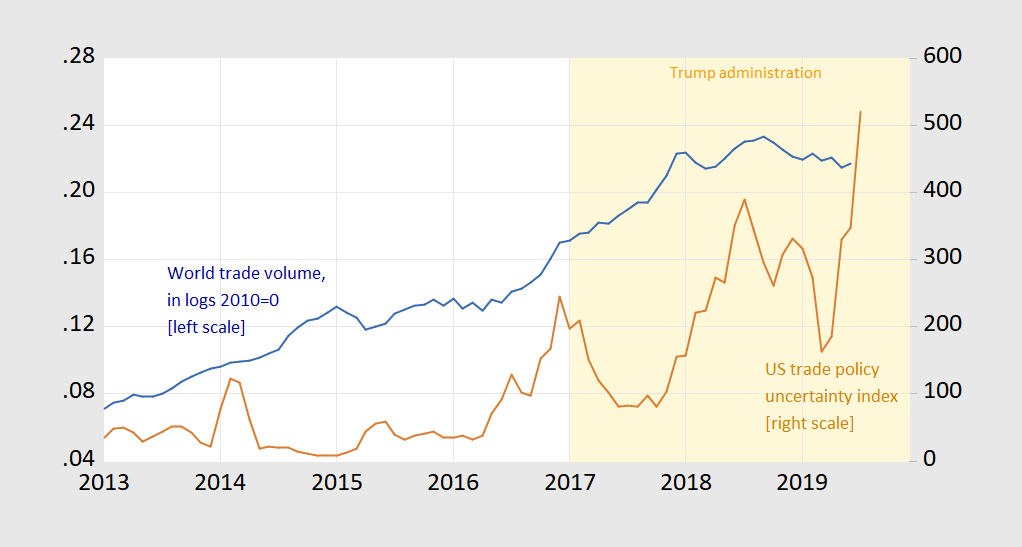

I was going to use this graph as my motivation:

Figure 1: Log trade volume index, 2010=0 (blue, left scale), and Trade Policy Uncertainty (right, brown). Both series three month centered moving averages. Light orange shading denotes Trump administration. Source: CPB Netherlands Bureau for Economic Policy Analysis, Baker, Bloom, Davis policyuncertainty.com, and author’s calculations.

Heightened trade policy uncertainty has been associated with a decelerating and then contraction of world trade volumes – certainly cause for worry.

However, with the news that the Trump administration is contemplating restricting capital flows to China, I fear I might have to devote some time to how Trumponomics might encompass the emplacement of capital controls on the US.

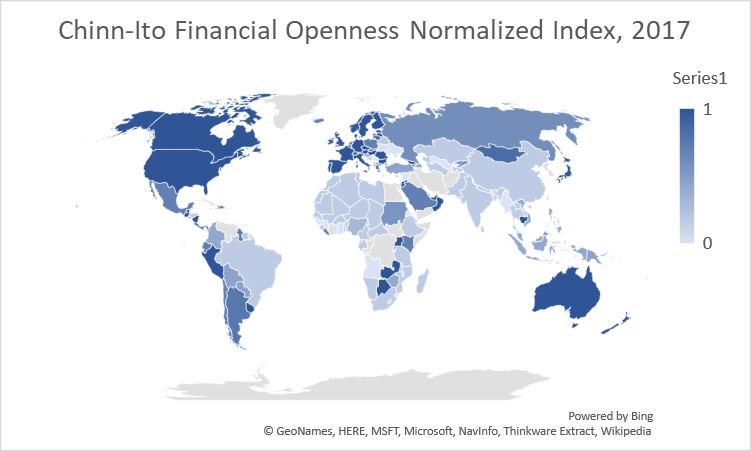

Consider a map of financial openness in 2017 (normalized index, 1 to 0. The darker, the more open, as measured by the Chinn-Ito de jure index.

Right now, the US is one of the most financially open economies in the world, which when combined with strong institutional development, has resulted in the US being a financial center. Restricting capital flows would result in making the US show up as “whiter” in the map above.

My view: willy-nilly attempts (after all, who thinks the current policy framework is coherent?) to punish China by closing the American economy will likely cause tremendous collateral damage.

Disclosure: None.