The Dirty Demon-etizing End Of A Reserve Era

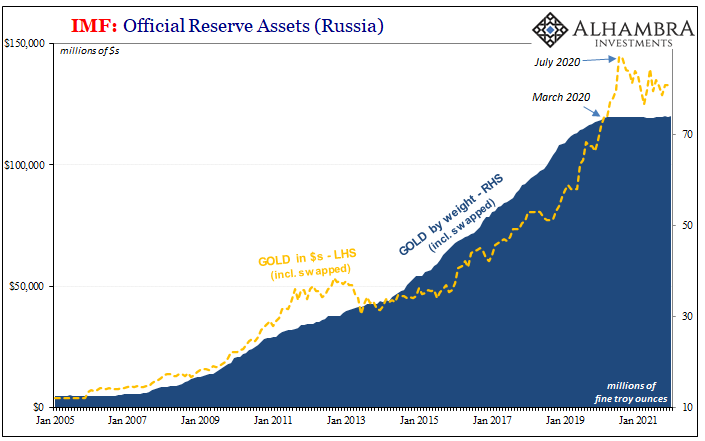

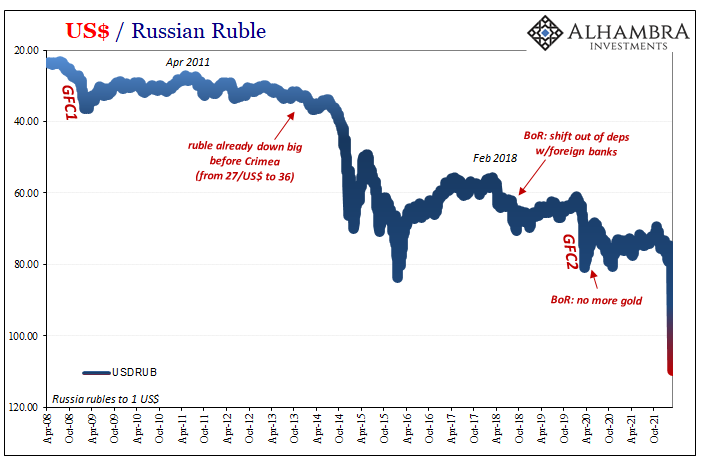

Late in March 2020, the Bank of Russia (BoR) abruptly announced it would no longer purchase gold. For years, Russia’s monetary authorities had been the metal’s biggest buyer, not just among official institutions but anywhere in the world. In fact, the country had been steadily accumulating bullion ever since October 2006; an effort that accelerated, not coincidentally, in April 2014 just two months after all that happened in and to Crimea.

Suddenly, April 1, 2020, Russia was no longer interested in gold. What changed?

BoR Governor Elvira Nabiullina blamed “volatility”, first in a cryptic statement released on March 30 accompanying the announcement, before reiterating the same at the press conference following the central bank’s April 24 Board of Directors meeting.

Volatility is basically a cute way of backhandedly confessing how gold had long ago been demonetized and therefore, in a liquidity pinch, it doesn’t help all that much. As a store of value, there’s tons of merit (pun intended). For an emergency situation, though, the ability to mediate exchange is hindered by ancient demonetization.

March 2020 would be among the more obvious examples of a global monetary shortage and its widespread, harmful ill-effects. The Head Economist for Russia’s Alfa Bank reiterated these golden drawbacks in linking them at the time with the real reasons behind BoR’s shocking shun of the Atomic #79:

To me, this decision seems quite obvious. Firstly, the Central Bank has about 20% of its reserves – investments in gold. After all, gold is a relatively illiquid investment that is sensitive to market prices. Now is the time in the markets when you have to worry about liquidity.

Since April 2020, the Russians had mostly refrained from additional gold purchases, “puzzling” most gold enthusiasts. It brings me no pleasure in reciting these facts and the reality of the global money world as it is, however Alfa’s Economist was exactly right in how this should have been obvious from the get-go. Gold in any reserve portfolio is a luxury, a nice, shiny rainy-day fund object for when flow of funding is steady and predictable.

So, why are the Russians, at the beginning of March 2022 announcing they’re ready to buy gold again after their nearly two-year absence?

What else are they going to do with their oil proceeds?

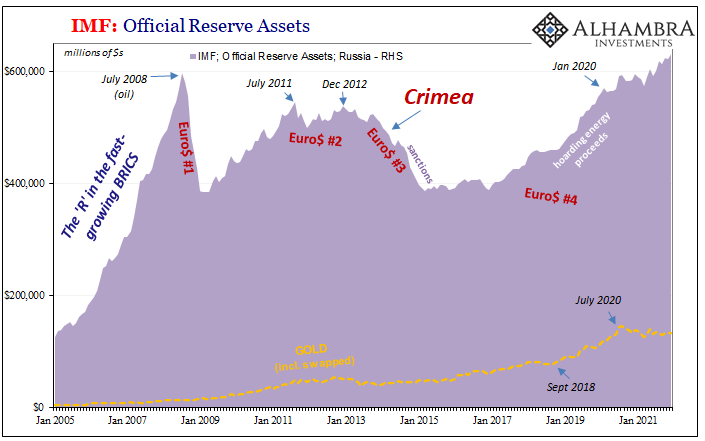

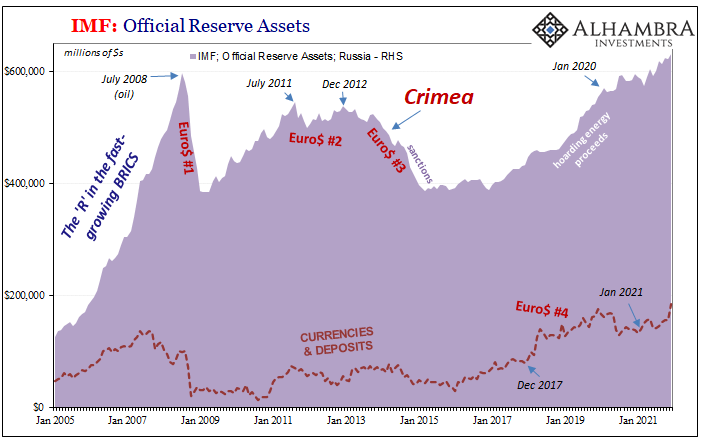

They won’t plow these back into the real economy – because they haven’t been for a suspiciously long time – as anyone should. On the contrary, ever since 2017 and 2018, officials have been hoarding reserves created by the gross energy surplus regardless of the nation’s internal economic condition; a situation that since the middle of 2019 has grown increasingly dire (August 2019 was no recession “scare”).

And not all types of reserves, either, a tightening subset. Thus, the gold pause.

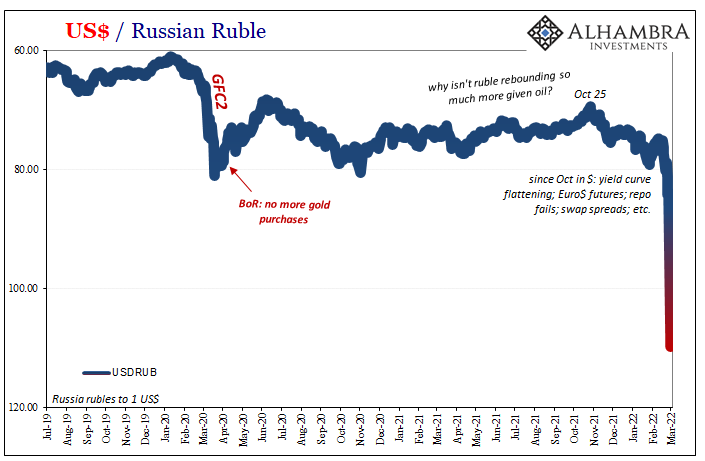

With the ruble in free-fall (a collapse which began before the latest “swiftly” adopted sanctions), maybe going back to making some gold purchases might help polish the local currency’s increasing lack of luster. Being backed by considerable energy wealth hasn’t done much for the currency, nor have those prior gold purchases, so it’s more of a shot in the dark than anything, attesting to Russia’s lack of options.

The Russian reserve situation has been turned far away from business-as-usual for a very long time. Like so many places around the world, the Russians have had to retool their management doctrines in the wake of the Global Financial Crisis…the first one.

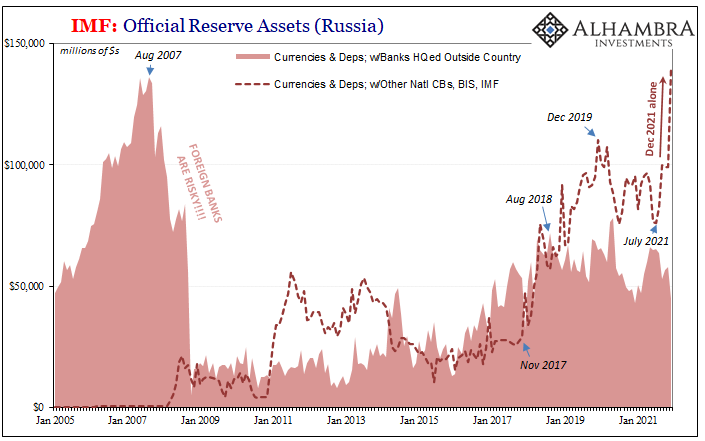

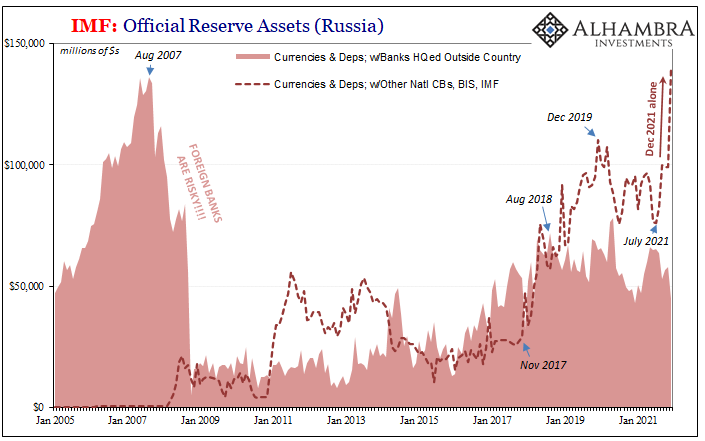

If you think Russia doesn’t trust Western banks because of politics, take a load of this:

As far as stores of value may go, neither banks nor financial securities have made Putin’s monetary minions feel very secure. What does that leave, aside from gold pre-GFC2?

It leaves mostly traditional deposits with foreign governments, perhaps the IMF (less likely) or BIS (only a bit more likely). You can bet that these deposits aren’t located at FRBNY.

I mentioned last week that over the last year, especially since last July, the Russians have once again rejiggered their reserve liquidity profile undoubtedly in advance of what Vladimir Putin has been planning. While the headline total is eye-popping, the world’s fourth largest stockpile of foreign assets, all is not as it may seem (just ask China, circa 2014). At $600+ billion, if it was indeed adequate there wouldn’t have been the need for making so many drastic changes.

Liquidity. Liquidity. Liquidity.

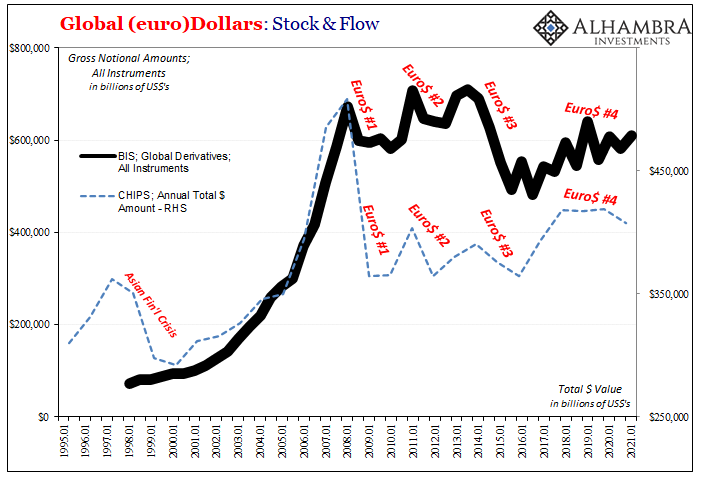

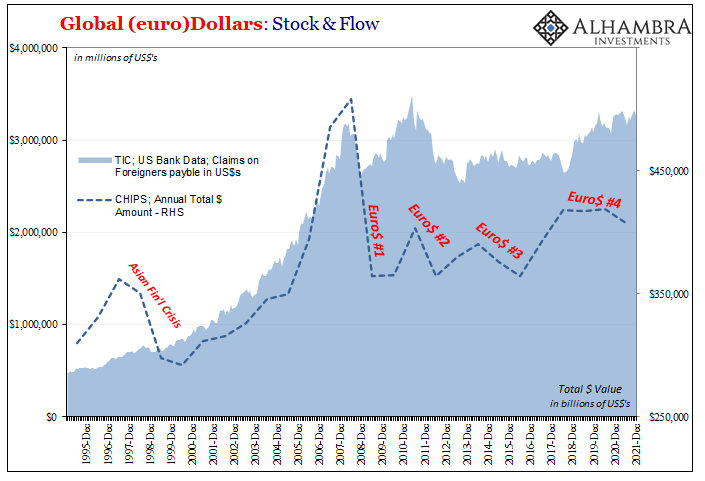

Going back to August 2018, Russia’s deposits with foreign banks have been declining. Why August 2018? Something about “dollar funding has evaporated” in the growing worldwide dollar deficit of Euro$ #4.

The Russians rotated instead into official deposits with other central banks (above), eliminating the credit/funding risk more thoroughly with their private overseas bank counterparties.

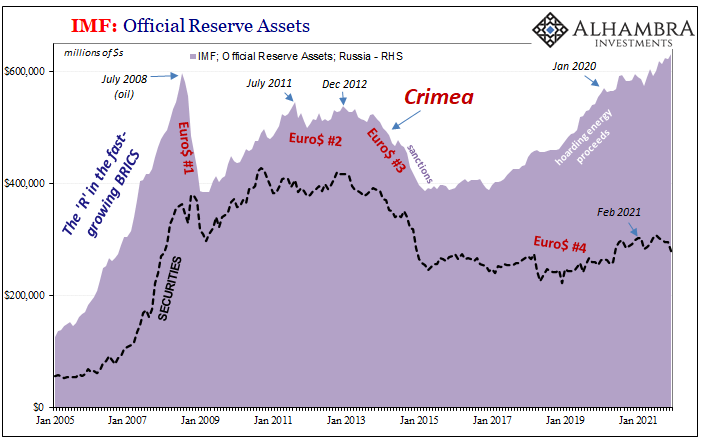

And then in December 2021, reserve managers made a hefty withdrawal from them (as noted here a few days ago when speculating about banking, lending, and collateral more globally), sold down some more securities, and rotated $40 billion more into deposits with surely the friendliest of foreign governments (what few are left).

What’s the overall theme here, separating the politics from the monetary mechanics? Deglobalization in light of GFC1’s rupture in the world’s reserve currency regime has left – again, just in terms of reserve money – Russia and others around the rest of the world with fewer and fewer workable options to manage increasing difficulties applied from all sides.

They’ve been backed into a monetary corner by a reserve system (eurodollar) that doesn’t work the same way the system once did, having become increasingly paranoid about this, and the incalculable economic consequences that have been wrought by all these simultaneously damaging downsides.

Let me reiterate (because you have to nowadays), I am not making any excuses whatsoever for the Russian invasion of Ukraine; quite the contrary.

Historically speaking, this is just what happens when it all falls apart. The oft-violent mess takes up as one era fades out, pouring into the vacuum of when the contours of the next age haven’t even taken shape. He’s fashionably late to the realization, but what former Speaker of the House Newt Gingrich said recently tragically fits the profile:

All of this means the end of the post-World War II system, which had successfully maintained the peace worldwide for some 77 years. And I think now that we’re going to see a much more violent world and a lot greater dangers, and we’re going to see the dictatorships being much more aggressive.

While the last part has become far too obvious to continue to ignore, all due respect to Mr. Gingrich but his timing is way, way off, by fourteen years and seven months. The end of the post-WWII era, which didn’t really get going until the mid-1950s (for “some” reason), was dated August 9, 2007.

You can even see it written right into Russia’s reserves profile. CHIPS, too.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

Good read, thanks.