The Canadian Economy Stumbles Out Of The Gate

Expectations were high that once the COVID restrictions were eased the economy would show a lot of power, growth would take off and the deep recession of 2020 would be a thing of the past. However, today’s release of the Canadian GDP numbers for the second quarter demonstrated that we are clearly not in a recovery mode, despite all the predictions of the bank economists.

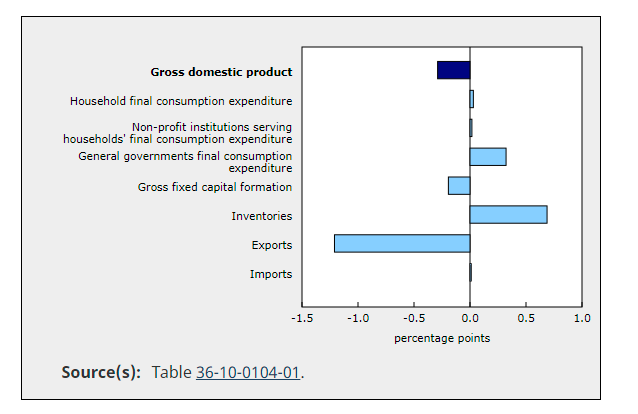

At a macro level, the economy declined at an annualized rate of 1.2%, in sharp contrast to an advance of 2-2.5% called forth by the leading forecasting groups. But macro numbers disguise more important developments at the industry and consumer levels. To begin with, household consumption barely contributed to overall demand, as consumers continue to save greater portions of their incomes. The household savings rate remains highly elevated at 14.2%. No longer can we cite the COVID restrictions and related shutdowns as reasons behind the surge in savings. Household incomes grew in response to higher employee compensations and continued transfer payments from the government. Despite this, households are very reluctant to spend and we should not rely on any quick turnaround in consumption, especially as we are in the beginning or in the midst of a fourth COVID-type wave.

The contraction in exports is even more of a concern given that the terms of trade were up by 4.2%. Commonly used to measure the importance of exports to an economy, the terms of trade are the ratio of export prices to import prices. Canada is the beneficiary of a nearly 18% increase in the price of exported crude oil and gas, far greater than the cost increase in our major imports. As Statistics Canada points out the “increased terms-of-trade contributed to higher real gross national income (+1.5%), which captures the real purchasing power of income earned by Canadian-owned production factors”( Energy and Terms of Trade). Looked at differently, without the run-up in oil prices, Canadian GDP decline would have been much greater.

Meanwhile, government expenditures and the accumulation in business inventories offset the declines in business investment and exports. The build-up in businesses inventories (in most cases unwanted) should not be regarded as a welcome development. Products sitting on the shelf add to the cost of business and business cycles are often related to swings in inventories. The build-up in inventories were led by durable retail goods, providing further evidence that the consumer continues to hold back.

Figure 1 Sources of GDP Growth

A final note on housing. Residential investment continues to be a major driver of economic activity. According to Statistics Canada, in the previous 12 months, housing investment was 17% higher than the average over the past 5 years. There appears to be no evidence of any significant slowdown as the residential capital stock now exceed the non-residential capital stock. In fact, Canadians took on more mortgage debt in the last quarter than in the first half of 2020 when housing demand was soaring.

What does the second-quarter results imply for the balance of the year? Early indications are that the 3rd quarter is off to a slow start. Preliminary estimates for GDP for the 3rd quarter are also barely above zero, despite further easing of health restrictions. The consumer remains very tight-fisted and business investment continues to underperform, making it less likely that earlier predictions of strong growth for the second half of 2021 will be borne out. Moreover, the banks are not extending loans, especially to the business sector, and without credit expansion, overall growth will continue to be tepid, at best (Business loans decline). Whoever is elected to form the next government later in September will need to provide additional support to aid the recovery process.

Why are "household savings so much on the rise? A rather obvious answer is the anticipation of needing them in the near future, when food prices, and other prices, inflate beyond imagination. Even in Canada thedirection of the Fed is obviously not right, and folks can see what is coming.