The Canadian Banks Find Reasons Not To Give Out Loans

Image Source: Pexels

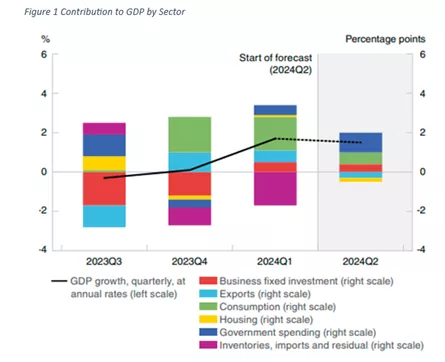

Seemly, the poor outlook for the Canadian economy has gone largely unnoticed this summer, perhaps from benign neglect as millions of Canadians take time to enjoy the short-lived summer months. Nonetheless, a deteriorating set of economic variables continues to reveal an economy, if not in recession, at best on the brink of contracting. In its most recent monetary report, The Bank of Canada acknowledges that growth will barely be in positive territory for the balance of the year. Moreover, without the large contribution from government expenditures, the economy is surely in decline (Figure 1) The report stressed that with population growth reaching 3%, the highest among the G-7 nations, GDP per person is expected to contract by 1.5%. The Bank clearly identifies the culprit in the form of a significant reduction in personal consumption, as debt service eats away at discretionary expenditures. Concurrently, residential construction remains very weak and it’s expected to decline at rate of 2.5% in the most recent quarter.

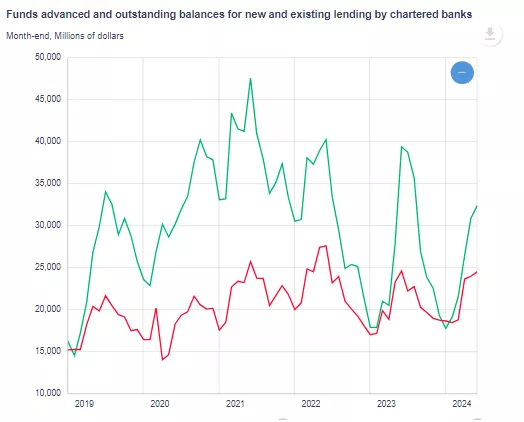

There is the potential for a vicious cycle to take hold. The economy weakens, and commercial banks reduce loans to consumers, further weakening the economy. The Canadian banks continue to struggle with higher-than-normal loan loss provisions and underperforming profitability. Credit growth is virtually non-existent as the banks shore up capital ratios and deal with delinquent borrowers. As the dominant participant in the mortgage market, the banks are unwilling to advance new funds to prospective home buyers, signalling that the banks are essentially turning away far more business than they accept. The housing industry is now suffering from a decline in new construction loans in the face of weakening demand from buyers who no longer qualify for mortgages. At the same time, the banks are standing their ground on advances for personal credit, again putting further pressure on the consumer.

Figure 2 Canadian Banks Mortgage Loans Advanced (green) and Personal Loans Advanced (red)

Enter the Bank of Canada which is primarily concerned with inflation. It has signalled, by the most recent rate cuts, that it recognizes that the battle against inflation has largely been won. The investment industry expects rate cuts to continue next month and for the balance of the year. The real issue concerns whether the Bank of Canada acts quickly to bring rates down to starve off further economic decline. Central bankers are a cautionary lot and slow to respond to rapidly changing conditions. It is one thing to reduce the cost of borrowing, yet another more important matter to make funds available, even at a lower rate. The Bank of Canada can lead the horse (commercial banks) to water, but it cannot easily make it drink (lend money). At this moment, the commercial banks are not favourably inclined to expand credit and that is not encouraging.

More By This Author:

Faced With Declining Employment Levels The Bank Of Canada Needs To Act QuicklyCentral Bankers Are Always On Their Back Foot

What Underlies The Pessimism Regarding The Outlook In Canada