The Bank Of Canada Reorients Its Balance Sheet Towards Long-Term Bonds

The Bank of Canada came late to the quantitative easing (QE) game, once it realized that the interest rates had to fall further if there is to be any hope of recovery from this deep recession. Today the BoC released its October Monetary Policy which set out the reasoning behind its recent changes in its QE program.

The BoC announced no change in its overnight interest rate target of 0.25%. Economists are debating where this is as low as it will get, unlike rates in Europe and Japan where the policy rates are negative. Recall the cliché—” never say never” when it comes to assessing where interest rates will drop below zero. BoC officials continue to ward off any discussion of negative rates, but they may not have the luxury of avoiding sub-zero rates given the large deflationary gap Canadians face. Simply put, the coronavirus is calling the shots when it comes to the path of future growth. And, the most recent surges in Europe and North America suggest the virus will continue to shape economic policy.

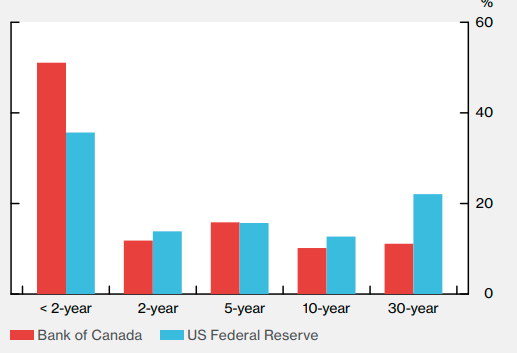

As for the role of QE, the BoC will continue to purchase Canadian bonds “calibrated to provide the monetary stimulus needed to support the recovery and achieve the inflation objective.” This rather opaque statement refers to shifting bond purchases towards the longer end of the yield curve--- 10 years and beyond. Initially, the BoC was purchasing short-dated bonds and bills. The Federal Reserve, by comparison, was more active in the 10-year and 30-year bond markets because those rates have the greatest impact on borrowing costs for businesses and households alike. Home mortgage rates feed off the 5-year bond rates and business investment decisions are influenced by the long-run cost of the capital. The BoC‘s participation in the long end of the yield curve will reduce much of the term premium, ultimately lowering longer-term interest rates. With Canadas 30-year bond trading at 1.2%, it is quite conceivable that we see a long bond well under 1%.

Govt Securities Held by Maturity a Percentage of Total Govt Securities

Currently, the BoC holds about 30% of all Canadian government bonds and some have argued that is too much given the size of the market. The Federal Reserve holds about 22% of all US Treasuries. If this is the standard to go by, then BoC is not far out of line. Nonetheless, the BoC has announced that it will terminate two short-term bond-buying programs immediately, and will reduce its weekly purchases from $5 billion to $4 billion.

While the purchase of more long-date bonds is a necessary condition, it may not be sufficient to stimulate growth. When the BoC buys bonds from financial institutions and large funds, there is no certainty that they will lend the money to where it is most needed. Money can only be created within the banking sector. Unless the banks make additional credit available to the broader economy, no new economic activity can be created. You can lead a horse to water, but you cannot make it drink. The BoC knows this only too well.

There is no criteria to judge whether a central bank holds too much of public debt. The Bank of Japan owns more than 80% of its govt debt. If the debt is serviced, is liquid and can be rolled over readily then ownership is not an issue. Whether individuals or their central bank own the debt is an ideological debate, not a practicable matter in the financials. The issue of debt goes only to the faith that it is serviceable and redeemable

.

It’s purported that the BoC will own about half of the Canadian sovereign bond market by the end of next year. Perhaps they’re aiming to adjust this by reducing its buying spree, however, it remains to be seen whether economic recovery indeed happens by 2022 as is being protected!

Typo: protected = projected

Half the bond market? Half? Wow.

There was a report by National Bank stating this to be the case:

“ Thanks to its QE program, the bank will own around 40% of outstanding federal bonds by the end of 2020 and could be closer to 50% at this time next year.”

Link: www.advisor.ca/.../bank-of-canada-is-overdoing-it-on-qe-report-says/

Wow, thanks for the link.