The Absurd Science

Language is often said to be a living thing. Common everyday usage can and does introduce new words and changes the meaning of existing ones. But this is a gradual evolution, and rarely does the process leap ahead into more drastic alterations.

Central bankers, however, are challenging such preconceptions. They write words that often have specific meanings in everyday custom but use them very differently than they had been before. Transitory is just one example, first introduced four years ago to try to dismiss why certain things weren’t those things; and then after about four years why those things still are those things. If transitory used to mean temporary, the way it is used today is nothing like that in this setting.

The Bank of Japan not be outdone issued its usual policy statement yesterday. Right at the top of its summary economic and price review, the central bank included the following grouping of formerly well-defined words (in Japanese, I presume, as well as English):

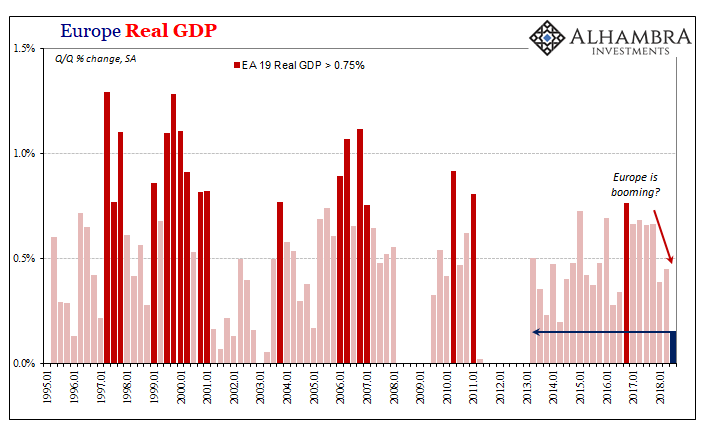

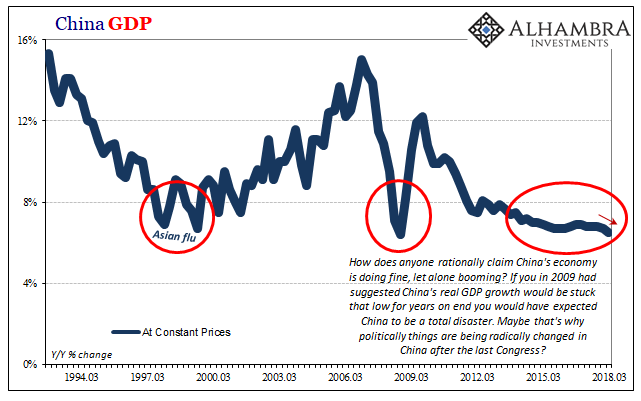

Japan’s economy is likely to continue growing at a pace above its potential in fiscal 2018, mainly against the background of highly accommodative financial conditions and the underpinnings through government spending, with overseas economies continuing to grow firmly on the whole.

“Growing”, “potential”, “highly accommodative”, and, of course, “overseas economies continuing to grow firmly on the whole”. These words have meaning, it’s just that they aren’t deployed that way here. It’s meaningless gibberish not constructed for actual scrutiny.

Where they do have meaning is in what to central bankers is an alternate reality; their mathematical models. These forecasts are taken as unquestionable gospel, even though time after time they amount to little more than the same noise. The Bank of Japan still believes that on some future date they’ll get it right, therefore everything has been right.

The words they wrote above are not true to their meaning today, they are written from that future date which never seems to show up.

The official inflation forecasts, for example, always start out years in advance at or near enough to the official inflation target (2%). This is the product of thousands upon thousands of simulations run through their regression-based statistical models. Inevitably, they don’t remain that way for very long.

In early 2014, the core CPI for Japan’s fiscal 2016 was forecast to be 2.1%. QQE, they were certain, was going to do the trick.

It was still that way for the October 2014 update even though at the same time the Bank of Japan felt compelled to augment QQE. That led them to raise their forecast for 2016 in early 2015 even though by then the whole world economy which Japan was counting on (“overseas economies continuing to grow firmly on the whole” wasn’t a phrase they just began using) had turned toward disaster.

The core CPI in fiscal 2016 would actually shrink, more familiar deflationary failure, rather than get anywhere close to the BoJ’s anticipated meeting of the definition for price stability. It was not the first such error. This is a constant miss, but the words describing the future are never changed – their meaning does because words have no meaning here.

At the outset of 2016, core inflation for fiscal 2018 was anticipated to be just shy of 2% and therefore close enough for success. Earlier this year, Haruhiko Kuroda was practically giddy that it seemed for him and his words their goal was finally within reach. In July, however, the forecast “central tendency” was dropped to just 1.1% as the world was shaken by “unexpected” (another meaningless word) crisis.

As of the latest update from yesterday, it’s down to just 0.9% for the current fiscal year.

For next year, somehow the Japanese central bank had managed in July to calculate an increased inflation rate. It upped its fiscal 2019 expectation to exactly 2% core CPI growth – only to now cut it dramatically to just 1.5% even though the words given at the outset of its policy piece.

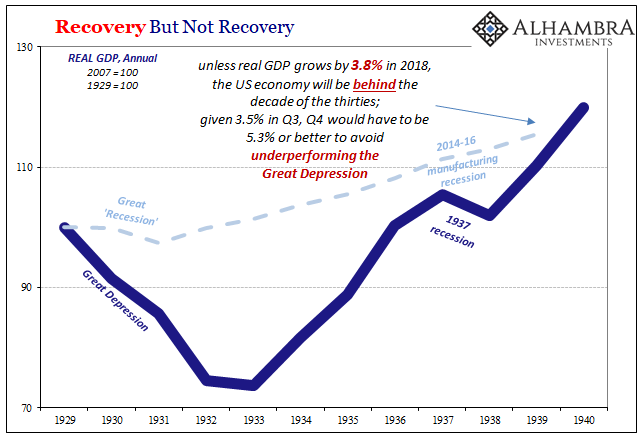

These same processes apply equally baffling in terms of GDP forecasts. If the global economy is on an upswing, for reasons well beyond their comprehension, math or otherwise, these reflation periods, the BoJ will expect Japan to be on one, too. If, rather when the next downturn materializes, these forecasts adjust (downward) even if the words and expectations further into the future never do.

The models the Bank of Japan employs are not some unique Japanese black box. They are one and the same for every central bank model in use around the world. Jay Powell’s “hawkishness” for the US economy, and therefore his words, are predicated on the same ridiculous and ultimately worthless mathematical constructions as those which have to unnerve Kuroda if only in private.

He may have his own unofficial dictionary, but I highly doubt after more than half a decade of QQE he’s happy about still flipping through it.

Powell and Federal Reserve officials use practically the same set of words as Kuroda and Bank of Japan officials always do, but who’s actually listening and following anymore? The media does, blindly, but markets not so much.

Overseas economies continuing to grow firmly on the whole. The only appropriately applied term that should come to anyone’s mind is absurd. Central bankers are always right, except they never are.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more

Quite an interesting report. But as for the predictions: Just like with any other publicly traded business, if the CEO and other top management ever predicted anything except glorious growth, they would be out the door and on the street before lunchtime. AND, in Japan it would be even worse, because if they ever admit to an error they would lose face, to them, a fate worse than anything else possible. So words get spoken while the meanings are tortured horribly. But that is what I wold expect from them.

Sadly the profession is about creating expectation rather than accuracy. Or another-words, they are supposed to lie in hope of someday making their lies reality. It is rather sad to watch.