Tesla And Volkswagen: Report From A Country With 64% BEV Adoption

First, I think some caveats are in order.

Those who leap unthinkingly into the belief that EVs, either with both gas and electric power (Hybrid Electric Vehicles, or HEVs) or fully-electric BEVs, will create a no-carbon-release nirvana are 100% wrong.

What Norway is seeking, and likely to achieve, is zero "emissions" - from the automobiles themselves.

It still takes some kind of fuel to power the massive machinery needed to extract the various elements and minerals that are needed to build the specific components and batteries that store the electricity in the car.

It still takes some type of fuel to power the manufacturing plants that assemble the cars, trucks, and buses that will become BEVs, and it takes some kind of fuel to deliver these vehicles to those who would buy them, whether on the same continent or across the seas.

In addition, we need to remember that while Norway is a fair-sized country, larger than Germany, Italy, Poland or the UK, its population is just over 5.4 million. What can be accomplished in a smaller population with a full democracy (Norway is listed as #1 by the Economist Intelligence Unit of all the world's nations) and with a highly educated and literate electorate is not always attainable in larger nations.

Finally, Norway derives more than 98% of its electricity from hydroelectric power generation. This gives Norway a massive advantage in being the front-runner in conversion to a less carbon-centric nation. Electricity generated by Norway's massive waterfalls and raging rivers can be used to power the machinery that extracts EV metals. It can also be used to power the manufacturing plants that convert raw materials into batteries and other components.

These advantages are not duplicable, at least not completely, in any other nation, especially one as large and diverse as the United States. But their pioneering efforts provide an example that, at least in part, can be practiced elsewhere to good advantage.

With these caveats in mind, let's take a look at how Norway is accomplishing this EV transition.

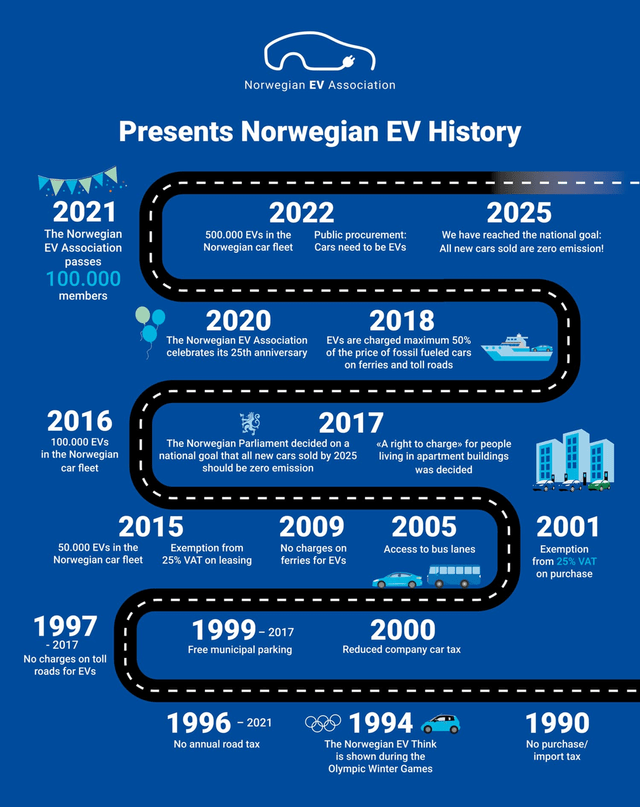

A Little Dash of History

Beginning 32 years ago, in 1990, Norway abolished purchase and importation taxes for EVs. Six years later, they removed any road/infrastructure taxes for EVs. In 1997, they removed all toll charges for EV autos, and in 1997, they removed all municipal parking fees.

("Municipalities" in Norway don't mean cities; they are more like US counties. They are the smallest unit of local governance, responsible for primary education, outpatient health services, senior citizen services, unemployment and other social services, zoning, economic development, and municipal roads.)

These small incentives were then expanded, starting in 2005, to allow EVs to use the almost-never-crowded bus lanes, the removal of any VAT tax, and free travel on all Norwegian ferries. If you have been to Vestlandet, the Norwegian western coastal region, you will recall that what might take a leisurely hour's car ferry ride across a massive fjord would take seven or eight hours to go scores of miles inland just to find a bridge to get to the other side.

Finally, this year, the Norwegian parliament mandated that all government vehicles of any type must be zero emission (either hydrogen or BEV.)

By virtue of using the above incentives, Norway is on track to reach its goals of:

- 100% of passenger car sales to be electric or hydrogen by 2025 (this assumes technological maturity permit it)

- 100% of new heavy vans should be zero emission by 2030

- 75% of new long-distance buses should be zero emission by 2030

- 50% of new trucks should be zero emission by 2030

You will notice there is no ban on gas-powered vehicles or any type of hybrid electric. This gives people like me a sigh of relief. I love classic gas-driven, noisy, oil-dripping cars. I used to do a little racing and gymkhanas and such. I love the feeling of, and the sound of, a perfectly-timed downshift, an apex perfectly targeted and the roar coming out of those corners. I also love the styling and the uniqueness of many such cars.

Norway is not banning these cars - or your beloved old Pinto or Gremlin. (Really? Why?) They will still license these. They just won't import new cars if they are not zero emission. Over time, that will mean 90%, then 95, then 96, etc. percent of cars on the road will be ZEV (Zero Emission Vehicles.)

graphic (Norwegian EV Policy website)

Which Automobile Brands are the Big Dogs in Norway?

Until recent times, the answer would have been Tesla, Tesla, and Tesla. Tesla (Nasdaq: TSLA) held a strong "first-mover" advantage from the time of its first production model way back (!) in 2008. Thousands of Norwegians became early adopters. While mostly quite pleased with their cars, these consumers now have ample opportunity, however, to select from a dozen different makes and many more models.

In 2020, for the first time, Tesla fell to 2nd place in number of BEVs sold. the Audi e-Tron, one of Volkswagen's (OTCPK: VWAGY) primary brands, took first place.

In 2021, Tesla regained the lead for most sales in Norway, with Volkswagen #2. They were followed by Toyota (TM), Volvo, BMW (OTCPK: BMWYY), Audi (OTC: AUDVF), Skoda, and, for the first time an American BEV manufacturer, Ford (F). FYI, China's NIO (NIO) now has a sales presence in Norway, as well.

Through the first 6 months of 2022, the preliminary numbers indicate that Tesla and the various VW brands are still the Top Dogs. (VW's other passenger car brands include Audi, Porsche, Skoda, Bentley, Bugatti, Lamborghini, and SEAT. They also own Ducati, MAN, and others. More on the "SEAT" brand below!)

Will Tesla stay #1 in 2022? Will VW or one of its other brands (or all of them together) accede to this small throne? Who knows? In my opinion, there are now so many US, Japanese, Chinese, and European competitors all vying for a large piece of this small pie that the dilutive effect will be the real winner.

What we have already gained from the current slugfest between Tesla and VW is an early indication of customer satisfaction. We must be cognizant of the fact that, for many who have switched from gas to electric, their satisfaction is skewed by that fact alone -- they prefer electric -- probably more than by brand satisfaction.

In other words, the savings from operating their new EVs leave them so ecstatic about their car that it almost does not matter which brand they selected. With 98% of Norway's electricity coming from cheaper hydroelectric power, the savings over gasoline models are huge. One friend told me his previous car cost him nearly $3,000 USD a year in fuel -- this last year, his first with an e-car, the same number of miles cost him $500.

The bottom line at least until now is clear: in this test environment, Tesla and VW are likely to be the ones to watch. Ford is coming on strong elsewhere and may surprise by doing so in Norway, as well, especially among rural residents that want a functional pickup truck. I'm not sure... Ford's F150 Lightning and competitor Rivian's (RIVN) more expensive R1T are likely to do well in the US, but in nations where the roads are smaller and the parking is tighter - like in much of the world - these may not do as well. Fortunately for Ford, they have many more models to choose from that will find willing buyers.

Tesla is a fine company making good cars, but their cheapest model (the Model 3 Rear-Wheel Drive) starts at a base price of $46,990 and goes as high as $64,000 with various customizations.

I don't know if Tesla will have the ability or willingness to compete on price with deeper-pocketed companies. And since this is an investment site, to make an intelligent "investment" decision we need to review not market cap or enterprise value, but those values relative to the price we pay.

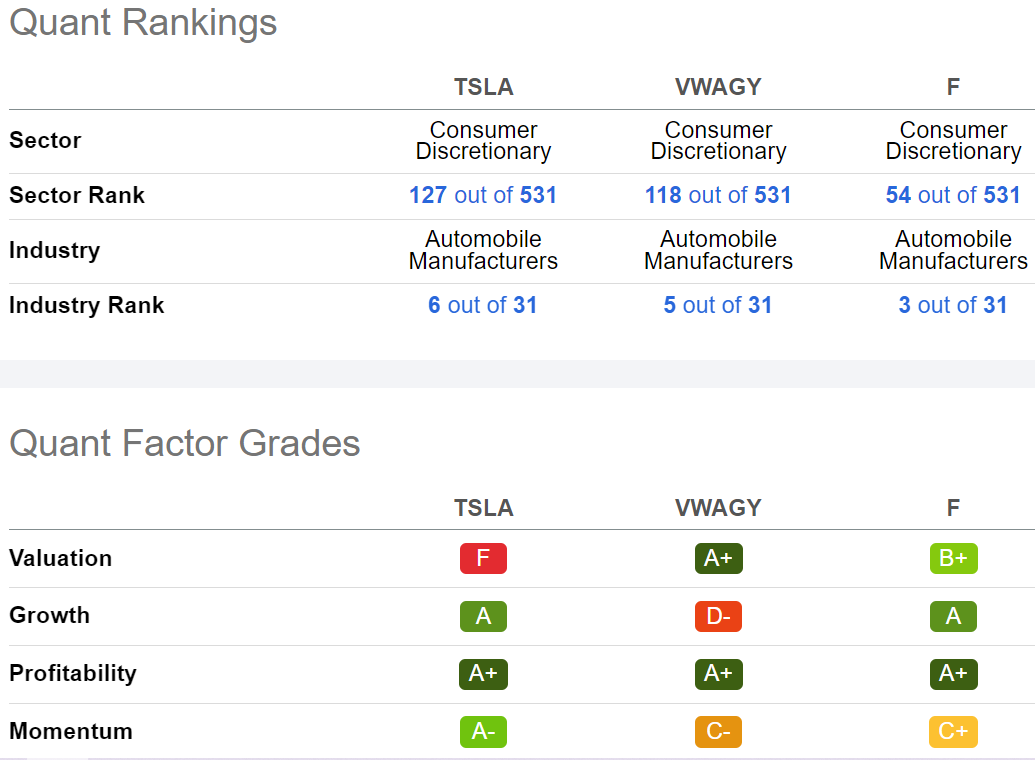

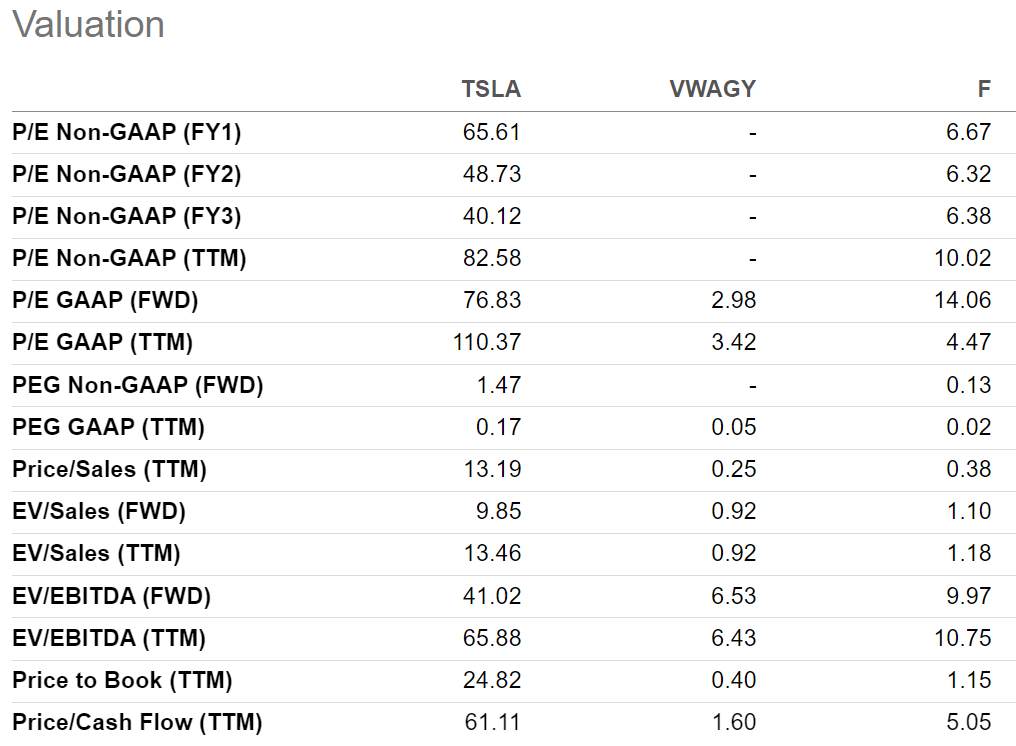

Condensing these into the fewest graphs possible, here are SA's Quant rankings for these three firms:

(Click on image to enlarge)

Seeking Alpha

All three get A+ for profitability, a very good thing in these times. Tesla has the best momentum and is tied with Ford for the best growth. Only VW gets an A+ for valuation. As a value investor, that intrigues me. I think the "Growth" ranking for VW overlooks its current momentum in EVs.

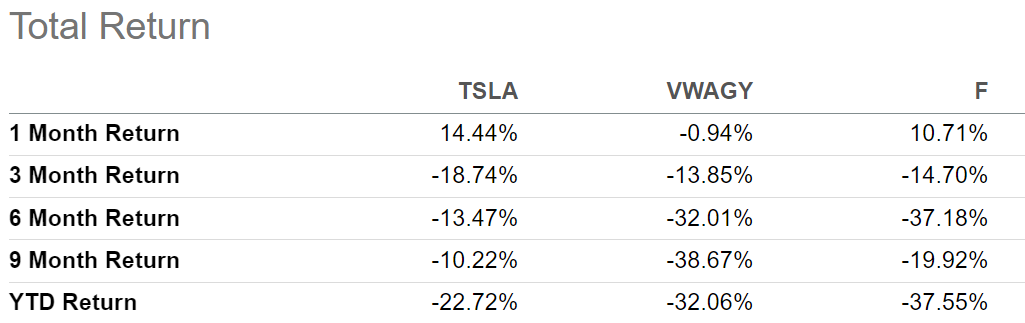

(Click on image to enlarge)

SA

Total return this year is dreadful for all three. Prior to 2022, Tesla clearly held the edge in returns.

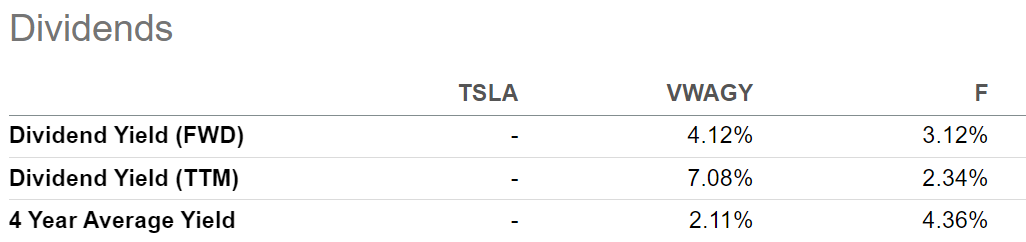

(Click on image to enlarge)

SA

I don't buy companies for the dividend. Still, a dividend is nice to have, and it does mitigate the fact that none of them have moved much this year. For those who want current income, only VW and Ford provide them. In my experience with Tesla stock fans, growth is the reason they buy, so no loss there to a real Tesla share fan.

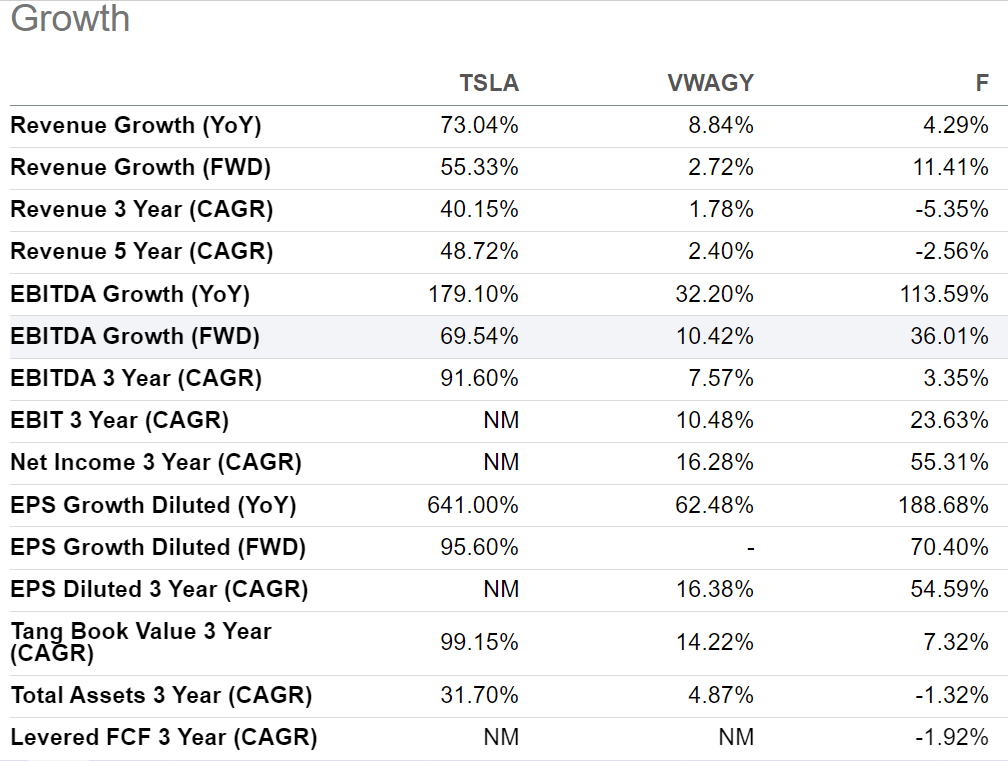

(Click on image to enlarge)

SA

(Don't mind the gaps in Non-GAAP. VW had ample earnings, but the EU reports differently than the US in this area.)

Looking at every single valuation metric holds no surprises. "If" all were to grow at the same rate going forward -- not that they will -- TSLA looks awful while Ford and VW look like serious bargains. Since both value and growth metrics are historical except for the forward guesstimates (noted above as FWD,) if I did not know the reputations of these companies, I would find it difficult to buy the one selling at a P/E of 110, a Price/Sales of 13, a Price/Book of 24, and a Price/Cash Flow of 61.

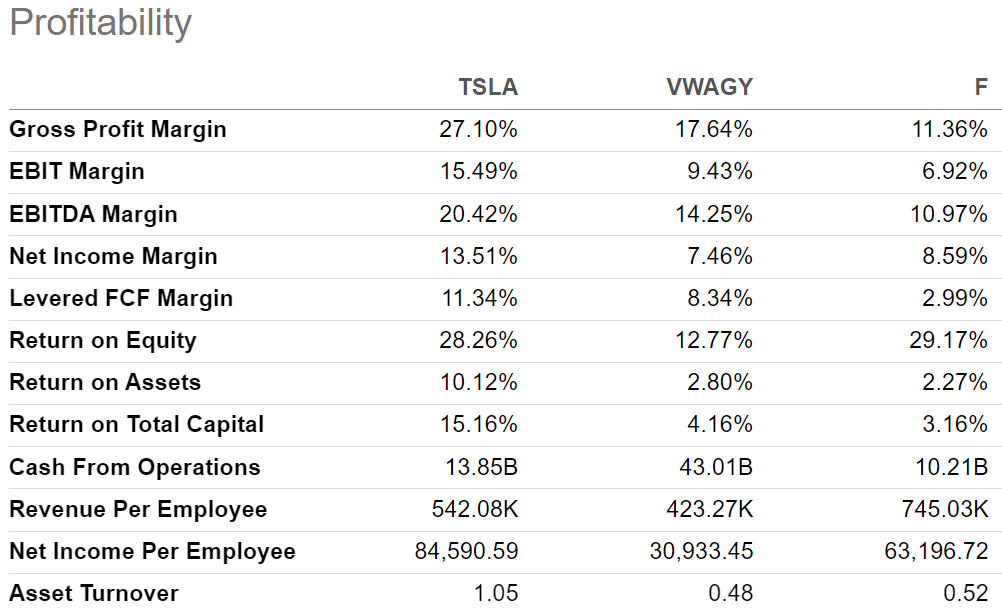

I will only show two more corporate metrics. In both of them, Tesla shines the brightest by far.

(Click on image to enlarge)

SA

(Click on image to enlarge)

SA

In both areas, Tesla shines. However, even if Tesla keeps its lead in the above metrics but unit sales fall as new competitors ramp up more production and more sales, the needle on share price will likely favor VW as well as the other deep-pocketed firms offering many different models.

If you believe Tesla's growth will continue at its current torrid pace, then you will likely prefer Tesla as your investment. If you have the funds, you might consider TSLA as your primary for growth and VWAGY as your more staid, but less volatile, partner trade. I don't think either, using current projections, will disappoint. For me, looking at the broad sweep of newer options for buyers, I am going with more staid. I will find my excitement in the myriad tech bargains out there right now. My bottom line after reviewing the key metrics? From an investment standpoint, I am personally a buyer of both Volkswagen and Ford.

You may read my analysis of VW at the Seeking Alpha site. You will find a sampling of my EV and Battery Revolution articles there as well. But first, a very brief report on:

My First Experience With a BEV

All I specified on my made-from-the-US Hertz reservation was an EV with at least a 250-mile range. I have driven in Norway many times and the distances to some of my favorite places are far, far away! I read that Norway has nearly 20,000 charging stations, but I still wanted the reserve charge for rural driving.

Hertz provided me with something called a Cupra Born. Huh? Say what? I had never even heard of such a car.

I quickly looked it up to see where the heck it is made and by what company. It turns out it is made by VW's subsidiary SEAT, the Spanish car company. SEAT has established Cupra as its "sporty" version of a different SUV and now makes these cars at a separate manufacturing facility from its other cars.

cupraofficial.com (Company website)

The new CUPRA Born 100% electric car | CUPRA (cupraofficial.com)

That "other car" is the Volkswagen ID.3. Both share the same MEB platform, both weigh within a pound of each other, and both share roughly the same performance characteristics. But the Cupra looks way better. You get German craftsmanship and performance with Spanish styling. A rakish, more aggressive front end, an upgraded interior, and a back end that is more posh, all conspire to make you prefer this one.

The only other difference? My Cupra had a 12" touch screen vs. the 10" on the ID.3 and had 20-inch wheels.

It also had all the stuff I don't want: collision avoidance, auto-slow when detecting a posted speed sign, and all that boring stuff that is designed for the car to drive you. Fortunately, every bit of it could be over-ridden with a mere touch of the accelerator, steering wheel or brakes. Let the next generation of drivers be driven around in a nanny's perambulator. I, and my wife who also drove the Cupra, want to drive, not ride.

And drive it did. Clean cornering, fast pick-up without a nanosecond's hesitation, and good clean braking. Passing was a breeze, stopping on a dime easily done. However...

Now, we come to charging these things. It is true Norway has some 20,000 charging stations. It is true they are everywhere. The tiniest little nothing couldn't-even-call-it-a-town has at least one charging station. We were up at a small hotel in Fjaerland. Go ahead, look it up if you can. But it was near the Glacier Museum (fabulous, brilliant, not to be missed, and with a harrowing video that is AAA+.) Even there we found two charging stations.

So, what is the problem? There are a dozen companies competing for your charging business. Every one of them requires an "app." You could not just stick a credit card in the slot like at a gas station. Oh no, you had to use that company's app. I had to sign up for four separate companies just to be able to figure we could reasonably find one of those brands wherever we were.

On the other hand, they were Norway-helpful. If you called their 800 number when having problems of any kind, they were able to accept the credit card you had on file with them just by identifying yourself with your app password. They could turn on the juice from hundreds of miles away and did so for us more than once.

Caveat Emptor, America: frequently-spaced charging stations that accept credit cards from everybody regardless of one's "appiness" will be essential to make this EV revolution work. Still, we need to fix the charging uniformity for payment issue before we go any further.

More By This Author:

The Real Story On Inflation: How It Affects Your PortfolioMercer International: This 'Strong Paper' Stock Is On A Roll

The Market 'Could' Get Worse, But Signs Of Recovery Are Here: HDV And QQQ

Disclosure: I/we have a beneficial long position in the shares of VWAGY, F either through stock ownership, options, or other derivatives.

Disclaimer: I do not know your personal financial ...

more