Stock Markets Risk Wile E. Coyote Fall Despite Powell’s Rush To Support The S&P 500

How can companies and investors avoid losing money as the global economy goes into a China-led recession? That’s the key question as we enter 2019. We have reached a fork in the road:

- Since 2008, Western central bankers have focused on supporting stock markets

- But the bursting of China’s shadow banking bubble means this cannot continue for much longer

The central banks’ aim was set out in November 2010 by US Federal Reserve Chairman, Ben Bernanke:

“Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

And the current Chairman, Jay Powell, rushed to calm investors on Friday by confirming this policy:

“We will be prepared to adjust policy quickly and flexibly and use all of our tools to support the economy should that be appropriate.”

His words confirm he equates “the economy” with the stock market, as the chart shows:

- The Fed no longer sees its core mandate on jobs and prices as defining its role

- Instead it has become focused on making sure the S&P 500 moves steadily upwards

- Every time the S&P 500 flirts with breaking the lower “tramline”, the Fed rushes to its rescue

Like Wile E Coyote in the Road Runner cartoons, the Fed has used more and more absurdly complex strategies to try and keep the market going upwards. But now it is very close to finding itself over the cliff edge.

CORPORATE DEBT IS THE KEY RISK FOR 2019

The Fed should have realized long ago that markets cannot keep climbing forever. Instead, by printing $4 trillion of free cash, it has temporarily destroyed their key role of price discovery. As a result:

- Investors now have no idea if are paying too much for their purchases

- Companies don’t know if their new investments will actually make money

We are heading almost inevitably to another ‘Minsky Moment’ as I described in September 2008,:

“Earnings from the new investments prove too low to pay the interest due on the debt. Confidence in the ‘new paradigm’ disappears and, with it, market liquidity. Investors find themselves unable to sell the under-performing asset, and suddenly realize they have over-paid. In turn, this prompts a rush for the exits. Prices then begin to drop quite sharply, as ‘distress sales’ take place.”

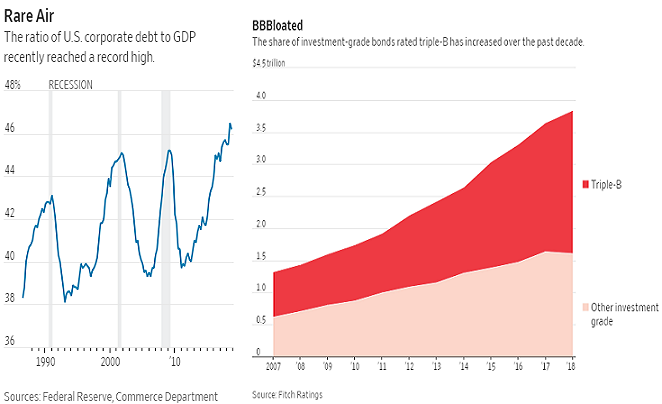

This time, however, the risk is in corporate debt, not US subprime lending. As the charts above show:

- The ratio of US corporate debt to GDP has reached an eye-watering 46%, higher than ever before

- Lending standards have collapsed with most investment debt in the lowest “Triple B” grade

Investors’ obviously loved Powell’s confirmation on Friday that he is determined to cover their backs. But they may start to remember over the weekend that the cause of Thursday’s collapse was Apple’s problems in China – about which, the Fed can actually do very little.

And while Apple won’t go bankrupt any time soon, weaker companies in its supply chain certainly face this risk – as do other companies dependent on sales in China. And as their sales volumes and profits start to fall, investors similarly risk finding that large numbers of companies with “Triple B” ratings have suddenly been re-rated as “Junk”:

- Bianco Research suggest that 14% of companies in the S&P 1500 are zombies, with their earnings unable to cover interest expenses

- The Bank of International Settlements has already warned that Western central banks stimulus lending means that >10% of US/EU firms currently “rely on rolling over loans as their interest bill exceeds their EBIT. They are most likely to fail as liquidity starts to dry up”.

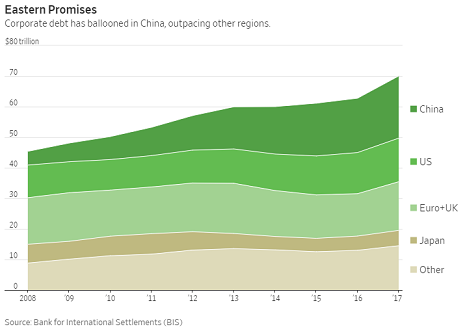

CHINA’S CORPORATE DEBT IS THE EPICENTER OF THE RISK

As the chart shows, China’s corporate debt is now the highest in the world. Yet it hardly existed before 2008, when China’s leadership panicked and began the largest stimulus program in history.

The “good news” is that China’s new leadership recognize the problem, as I discussed in November 2017, China’s central bank governor warns of ‘Minsky Moment’ risk. The “bad news” – for the Fed’s desire to support the stock market, and for companies dependent on Chinese demand – is that they are determined to tackle the risk, having warned:

“China’s financial sector is and will be in a period with high risks that are easily triggered. Under pressure from multiple factors at home and abroad, the risks are multiple, broad, hidden, complex, sudden, contagious, and hazardous. The structural unbalance is salient; law-breaking and disorders are rampant; latent risks are accumulating; [and the financial system’s] vulnerability is obviously increasing.”

Companies and investors need to take great care in 2019. China’s downturn means that markets are starting to rediscover their role of price discovery, despite the Fed’s efforts to keep waving its magic wand:

- Companies with too much debt will go bankrupt, leading to the Minsky Moment

- The domino effect of price wars and lower volumes will quickly hit other supply chains

- Time spent today in understanding this risk will prove time very well spent later this year

Once the tramline is broken, the Fed and the S&P 500 will find themselves in Wile E Coyote’s position in the famous Road Runner cartoons – with nowhere to go, but down.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more