Spotlight On Promoter Concentration In The European ETF Industry

Image Source: Pixabay

Investors, market observers, and regulators always raise questions about the competitiveness of the European ETF industry since assets under management seem to be concentrated among a few ETF promoters. Generally speaking, I would agree with the statement that one needs to be concerned if a few players are dominating a market, but not when it comes to the European ETF industry.

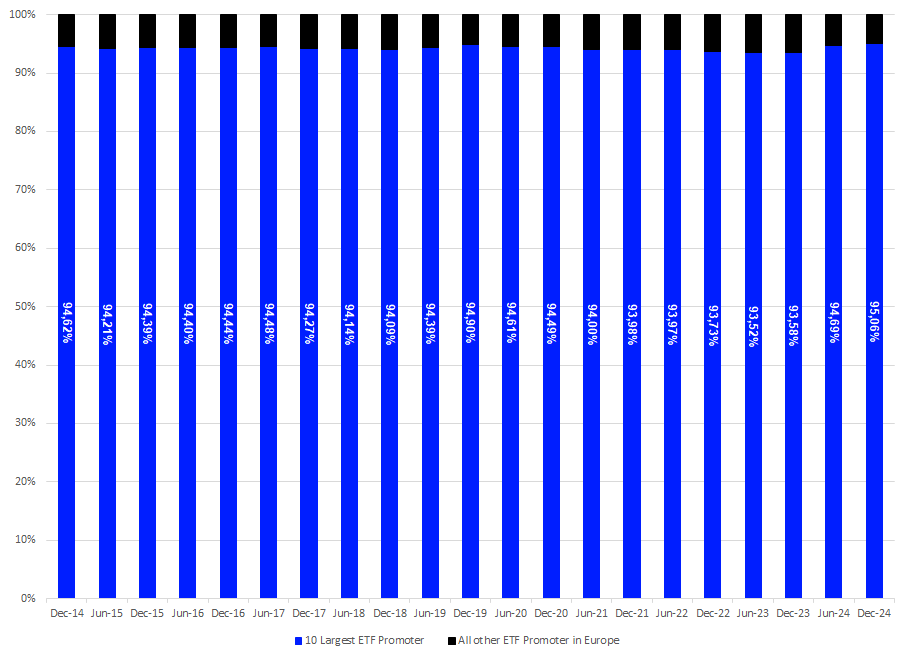

Graph 1 shows that the European ETF industry is highly concentrated at the promoter level since the 10-top promoters in Europe held between 93.52% (June 30, 2023) and 95.06% (December 31, 2024) of the overall assets under management in the analyzed period. The average market share of the 10 largest promoters in the European ETF industry was 94.28% over the analyzed time period.

While the 10-top promoters had their highest market share—as to be expected—at the end of the analyzed period, the lowest market share (93.52%) was marked on June 30, 2023. In general, it could be concluded that the concentration of the assets under management by promoter in the European ETF industry was falling at a slow pace between December 31, 2014, and June 30, 2023. Since then, the market share of the 10-top ETF promoters in Europe increased and reached a level which was even above the average market share (94.28%) of the 10 largest ETF promoters in Europe over the analyzed time period.

Meanwhile, the assets under management increased from €287.3 bn to €2,081.8 bn over the same period. In addition, it is noteworthy that the number of ETF promoters with at least one ETF registered for sale in Europe increased from 50 to 58 despite some mergers of promoters over the observation period.

Graph 1: Market Share (%) at the Promoter Level by Assets Under Management (December 31, 2014 – December 31, 2024)

(Click on image to enlarge)

Source: LSEG Lipper

This means that the market share of the 10 largest ETF promoters is increasing while the assets under management and the competition are growing. This development is not surprising, as the rising markets might have been in favor of the large promoters.

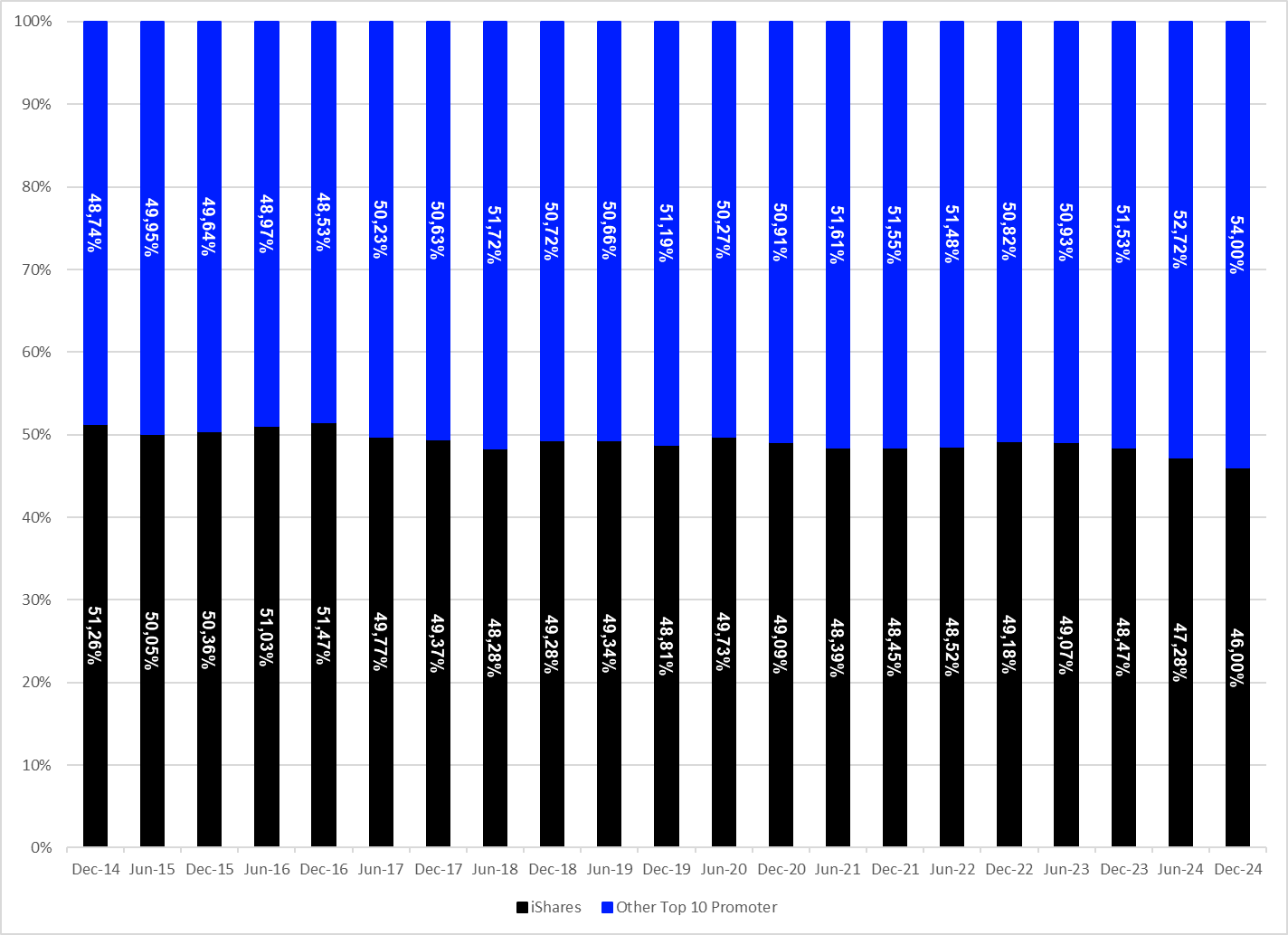

Graph 2 depicts iShares—the largest ETF promoter in Europe—accounts between December 31, 2013, and December 31, 2016, for more assets under management than the other nine of the 10 largest ETF promoters in Europe combined. June 2017 marked the first date at which iShares did not hold more assets under management than its top competitors combined and lost further ground up until December 2024. That said, the year 2024 marked a large loss in market share (-2.47%) for iShares, which means its competitors have been growing faster than the market leader by assets under management.

In fact, Invesco had the largest increase in market share (+0.75%) of the 10 largest ETF promoters in Europe, followed by SPDR (+0.72%) and Vanguard (+0.65%).

Despite the fact that the respective market share from iShares compared to the combined market share of the other nine promoters of the top 10 has declined over the analyzed time period, it has maintained a very dominant market position. In any other industry, such a high concentration would be concerning for regulators and clients, as this may lead to a monopoly or an oligopoly, which might bring prices up and/or product quality down.

Graph 2: Market Share (%) iShares vs the Combined Other Top Nine Promoters by Assets Under Management (December 31, 2014 – December 31, 2024)

(Click on image to enlarge)

Source: LSEG Lipper

In fact, the dominating position of iShares is so strong that it would require a merger of the next six largest promoters (as of December 31, 2024) to create a new rival for iShares as the most dominant player in the European ETF industry. Such a move, however, would create an even larger gap between the two-top ETF promoters and the rest of the European ETF industry, which would be even more concerning with regard to the competitiveness of the European ETF industry.

Rather than the aforementioned scenario, we see falling management fees and a very good quality of products when it comes to tracking underlying indices. In comparison to their actively managed peers, it needs to be said that the European ETF industry looks way more competitive than the European fund industry overall. This is because actively managed funds experienced increasing management fees, even as the concentration of assets under management is way lower than in the ETF space. That said, the ongoing discussion about the value added by active management and the high fees charged by the asset managers, in combination with the rise in popularity of ETFs, seems to drive down the overall costs in this market segment.

At the same time, the falling management fees for core market products are a concern for some market observers since they see the current fee levels for core products such as ETFs replicating the S&P 500 or the MSCI World as a barrier for entry for new ETF promoters in this segment.

Nevertheless, the high competitiveness of ETF promoters in Europe has led to a high product quality, driven by the expectations of professional fund selectors with regard to the quality of index tracking, service, management fees, and total expense ratios.

That said, one could argue that the competition in the industry drove prices down to a point where only asset managers with decently scaled products could earn money. Even worse, large ETF promoters could subsidize core products over a given time period to gain a competitive advantage over smaller promoters who might not be able to afford such a pricing policy. This is especially true for the so-called core markets, as these markets are by nature those markets which are attracting the most investor money. As a result, such behavior by the large ETF promoters can foster a further market concentration since new ETF promoters may rather launch niche products to avoid the competition with the market leaders in the core markets.

Nevertheless, new market participants are able to gather significant amounts of inflows at the ETF level, especially with innovative passive investment solutions for core and niche markets. That said, we are now seeing the rise of actively managed ETFs in Europe. Even as these products currently hold only a low percentage of the overall assets under management in the European ETF industry, there is a high number of promoters who are interested in the launch of active ETFs. Even as only the future will tell if these products will be successful in Europe, active ETFs are seen as one of the major drivers of the future growth of the European ETF industry.

Taking all this into consideration, it can be said that while the barriers to enter the market are not too high for new ETF promoters, it is common sense that the barriers to succeed are high. This means new ETF promoters need to have an in-depth understanding and a clear strategy to succeed in this environment.

With all this in mind, one needs to ask the question of whether all of the new market participants will be able to survive in the competitive market environment within the European ETF industry. With regard to this, it can be seen as a sign of the maturity of the market if an ETF promoter is absorbed by a competitor or is going out of business. One example for the latter can be seen in the case of circa 5000, a European ETF promoter which launched its ETF business (six equity ETFs) in June 2023 and left the industry in August 2024.

As I said before, I am not concerned about the current concentration of the European ETF industry since it is clear that there is strong competition between the different fund promoters. European investors can enjoy some advantages from this competition. I also see, however, that competition around management fees allows for some creativity at the promoter level because the majority of ETF promoters have implemented securities lending programs to earn additional income. The latest example is State Street Global Advisors, which introduced a securities lending program when it lowered the management fees for its S&P 500 products in 2023. Securities lending strategies are marketed as value-added strategies for investors because the promoters share the income from the securities lending with investors. Nevertheless, some of the revenue sharing models have come under scrutiny in the past, as they may have not been exactly in favor of the investor. From my point of view, however, it is questionable whether these kinds of strategies should be used within investment products that are sold to retail investors. This, however, is a topic which should be discussed in another article.

More By This Author:

S&P 500 Earnings Dashboard 24Q4 - Friday, March 28

Russell 2000 Earnings Dashboard 24Q4 - Thursday, March 27

What Is A Yield Curve And How Is It Used By Investors?

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more